Big banks' investment in online small-business banking - several have added services in just the last few weeks - seems to have given them an edge over small ones in customer satisfaction.

"Small-business is big business in banking right now," said Margaret M. Bradshaw, the national director of small-business banking for Comerica Inc. of Detroit. "There are still many untapped needs of small businesses on the financial side."

Comerica said last week that it has begun to offer a MasterCard small-business credit card with flexible billing options.

Earlier this month it launched an online payment system through which small businesses can transfer funds between accounts, originate automated clearing house transactions, initiate domestic and international wire transfers, and make federal, state, and local tax payments.

Ms. Bradshaw said Comerica also plans to introduce new loan and deposit offerings for small businesses this year.

In recent weeks Sovereign Bancorp Inc., Wells Fargo & Co., and Bank of America Corp. have also unveiled new products and services aimed at the small business market.

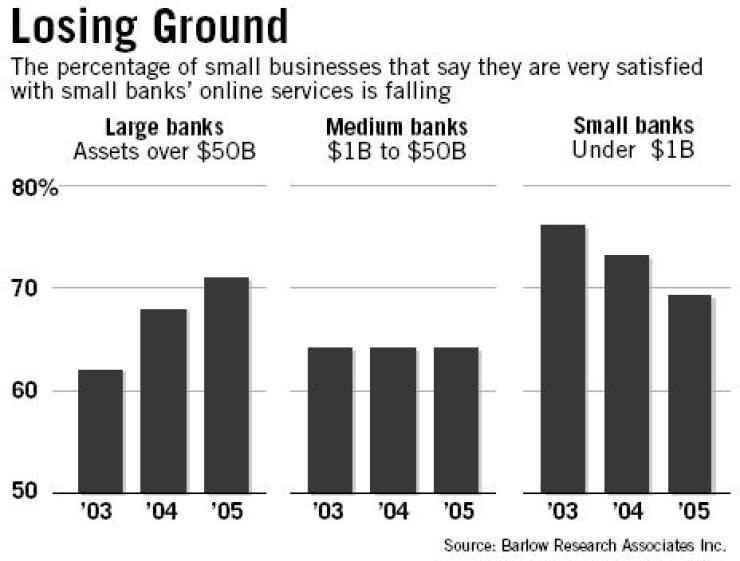

Big banks now top small ones - a reversal from just three years ago - in satisfaction with their online small-business offerings, a Minneapolis consulting firm says.

In a 2003 survey, 76% of small -business customers were "very satisfied" with the online services of small banks (assets under $1 billion), according to Barlow Research Associates Inc., but the figure was only 62% for big banks (with assets of $50 billion or more).

Last year, though, small banks came in at 69% and big banks at 71%, Barlow Research said. (Midsize banks' score was flat, at 64%.)

Linda O'Connell, who manages Barlow Research's small-business banking program, said the results reflect business owners' growing comfort with using online banking services and suggest that banks need to offer new services aimed at specific market segments, such as small businesses.

"It's time for everyone to differentiate themselves," Ms. O'Connell said. The functionality of online small-business banking has "kind of reached a plateau," she said.

On Monday, Sovereign added a suite of online small-business services with a raft of new functions.

They include remote capture of check images, automated alerts, electronic statements, and Onsite Official Check, which enables users to print the equivalent of cashier's checks at their offices.

Marshall P. Soura, an executive vice president at the Philadelphia thrift company and the managing director of its global solutions group, said Onsite Official Check uses specially modified magnetic ink character recognition printers and blank check stock supplied by Sovereign. The service is meant for companies that must issue numerous checks, such as mortgage companies, auto dealers, and insurance companies, he said.

"We have a way to allow them to print these official checks right there in their office with all the security of a wire transfer," Mr. Soura said. The service identifies authorized users, verifies available balances, and delivers an immediate electronic confirmation.

Wells Fargo is focusing on payroll. Last week the San Francisco banking company announced Employer Direct Pay, a new direct-deposit system for small businesses that process their payrolls in-house. (Wells has offered an online payroll service at least since 2001.)

Business owners and other authorized signers can use the system to set up direct deposit of employees' net pay without outsourcing the payroll function. They can also use it to reimburse employees, pay commissions, and make one-time or recurring payments to contractors or agents.

The patent-pending system was tested for a few months, with one client paying one employee.

Mark Baumli, the head of Wells' business Internet services, said the electronic payroll system is aimed at companies that may be unfamiliar with using the ACH network. "We've designed out the complexity," he said. "This is designed for ease of use."

While its competitors focus on business payments, Bank of America announced last week that it had added an invoicing capability to its online business banking system so companies can send their customers electronic or paper invoices, using preformatted electronic templates.

The invoicing feature is an extra-cost add-on to B of A's Online Business Suite, said Joe Helweg, the small-business e-commerce executive at the Charlotte banking company. The basic suite, which costs $15 a month, includes accounts-payable and account-management functions and is itself considered a step up from B of A's free small-business banking service.

Online Business Suite is designed for companies that have "more sophisticated needs but are not on a commercial level," Mr. Helweg said.