Atlantic Capital Bank in Atlanta is not a typical start-up.

Though most new banks target small-business owners that their organizers say are being ignored by larger banks, the three-week-old Atlantic Capital is aiming to compete directly with big banks for middle-market customers.

Led by a former top Wachovia Corp. executive, organizers raised a whopping $125 million in capital, believed to be the most ever for a start-up, and the bank's lending limit of $25 million for secured loans is well above the limit of the typical new bank.

Doug Williams, its president and chief executive, said his plan is to build assets to about $1.5 billion in three to five years and then take the bank public. To reach these goals, he said, its lenders must stay focused on the bank's target market: companies with $5 million to $250 million of revenues.

"When you plan to grow at the pace we plan to grow at, it is very important that we … stay disciplined and focused on the business segment we want to participate in," said Mr. Williams, who held various senior posts at Wachovia, including head of corporate finance, before leaving the company early last year to organize Atlantic Capital.

Observers say that Atlantic Capital's business plan appears sound but that reaching its targets will not be a cakewalk.

Though commercial loan demand remains strong in the Atlanta area, observers said that the market already has a number of well-established middle-market lenders, including Wachovia, SunTrust Banks Inc., and BB&T Corp.

Atlanta has also been a hotbed for start-ups in recent years, and though Atlantic Capital does not see these banks as competitors, one investment banker wondered whether too much capital is chasing too few deals.

"It's a funny thing for me to say, because I am in the bank start-up business, but I think we are overbanked," said Lee Bradley, managing director of Samco Capital Markets Inc. in Atlanta. Atlantic Capital "raised a lot of money, but they have to go out on the field and perform, and I just don't think it's going to be as easy as they think it is."

Mr. Williams, 49, is counting on an experienced team of lenders, as well as the bank's ability to make loan decisions quickly, to help establish it as a competitor to be reckoned with. He has recruited both lenders and top executives from Wachovia, SunTrust, and other big banks, and Atlantic Capital's chairman, Walter M. "Sonny" Deriso Jr., is a former Synovus Financial Corp. vice chairman. Mr. Williams said that at least 60% of the portfolio would be made up of corporate loans, 25% to 30% commercial real estate loans, and 10% loans to wealthy individuals.

"This is not a community bank strategy," Mr. Williams said. "This is a corporate bank strategy. Because this is a different model and a different type of banker, we exceeded expectations across the board, raising more capital, and hired the people we wanted to hire."

Former Wachovia executives Mr. Williams has hired include Rich Oglesby, Atlantic Capital's chief risk officer; Carol Tiarsmith, its chief financial officer; and John Coffin, a senior lender and executive vice president in the banking group.

Mr. Williams also recruited Clell Deavers, a longtime SunTrust lender, to be a senior vice president focused on corporate banking.

Mr. Deavers left SunTrust in September, after 14 years in its corporate and investment banking areas. He has also worked at the former Morgan Guaranty Trust Co. for six years and Industrial Bank of Japan for five. Atlantic Capital's business model and its team of veteran bankers attracted him, he said.

"Banking at large banks, where I spent my career before this time, became such a rigid experience for bankers and our clients," Mr. Deavers said. "This business model we've implemented offers the best of both worlds — the top-notch products and significant lending power associated with big banks and the high level of customer service found at community banks."

Still, the $186 billion-asset SunTrust is the dominant banking company in Georgia, and a spokesman there said the company "is in a strong competitive position" in middle-market lending.

Chris Marinac, the managing principal and director of research at FIG Partners LLC in Atlanta, said Atlantic Capital's lofty goals are reachable, because it is not focusing on the slowing real estate construction market — as most start-ups have — and a number of its top lenders have at least 20 years of corporate finance experience.

"This is a monster de novo, no question about it," Mr. Marinac said. "But they have really good people, and people are really important."

Gray Medlin, the managing director of Carson Medlin Co. Investment Bankers in Raleigh, said he believes that recent acquisitions of community banking companies in Atlanta with $1 billion of assets have actually left a "void" for middle-market lending. BB&T bought the $2.5 billion-asset Main Street Banks Inc. in September, and Royal Bank of Canada bought the $1.8 billion-asset Flag Financial Corp. in December.

"In addition to that, numerous de novos in Atlanta over the last five or 10 years were bought before they were ever big enough to be able to supply" loans to middle-market customers, Mr. Medlin said.

Atlantic Capital is likely to reach the $1 billion-asset threshold faster than the average start-up because it has raised so much capital.

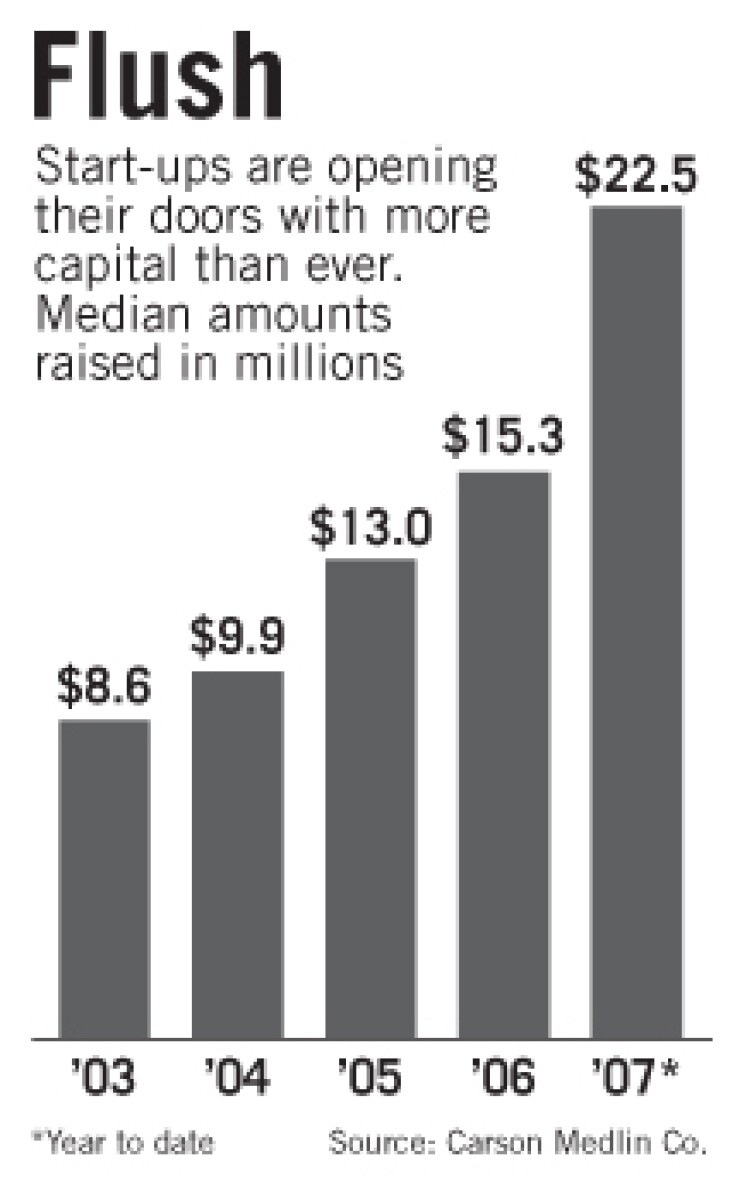

Though start-ups are coming out of the gates with more capital than ever — a median of $22.8 million for banks formed so far this year, according to Carson Medlin, up from $8.6 million four years ago — Atlantic Capital is in a league of its own. The only others in recent years to come close were American Momentum Bank in Tampa and Square 1 Bank of Durham, N.C., each of which raised about $100 million. (American Momentum opened in October, and Square 1 opened in 2005.)

But though its size may have helped Atlantic Capital attract talent, it made the organizing process more challenging. Stephen Dunlevie, the managing partner at Womble, Carlyle, Sandridge & Rice PLLC in Atlanta, the bank's lead legal counsel, said regulators spent more time than usual scrutinizing the business plan and the ownership structure and making sure it had the proper controls in place for safely deploying its capital.

"It is probably the most complex de novo that I have ever been involved in," said Mr. Dunlevie, who has been forming start-ups for 20 years.

He said that though a typical start-up might need two lawyers, Atlantic Capital had dozens working on its application.

"We were literally getting approvals on things as late as Monday, May 14," he said. The bank opened May 15.