-

Two online payday loan operations in the Kansas City area have been shut down after the CFPB and FTC charged them with bilking more than $36 million from consumers.

September 17 -

The state is asking Google, Comcast and other companies to stop running ads for companies that can't lend legally to its residents. Bankers are also being urged to be on the alert for illegal loans to their customers.

April 23 -

Internet-based, short-term lenders have various routes for setting up business, but most of their options expose them to potential legal challenges.

October 1

Online payday lenders often portray themselves as financial-industry pioneers, but like a lot of corners of the Internet, this one has some dirty secrets.

If a consumer signs up online for a loan, there is a good chance that the lender will automatically roll over the principal, trapping even prudent, well-intentioned borrowers in a cycle of debt.

Borrowers' personal information may get sold again and again, and if they fall behind on payments, they may face illegal threats of arrest.

And it is not just lenders who use the cover of the Internet to engage in questionable conduct. A sizable percentage of online borrowers seem to have no intention of ever repaying their loans.

The Pew Charitable Trusts has conducted the most thorough assessment to date of the online payday loan business, and its findings, released Thursday, are scathing. The report, which relied on a nationwide survey of borrowers, focus groups and data obtained from numerous sources, concludes that fraud and abuse are widespread in the Internet market.

"It's clear that basically the kind of self-policing of online lenders has not worked," said Alex Horowitz, research manager at Pew.

Pew, which has released three previous reports about payday lending, is a sharp critic of both online and storefront lenders. But the most recent report focuses on ways in which online lenders are different from brick-and-mortar stores.

Among Pew's findings: nine out of 10 Better Business Bureau complaints about payday lenders involve online operators, even though online loans only make up about one-third of the total market; 30% of online borrowers report being threatened by a lender or debt collector; and online payday loans typically have annual percentage rates of 650%.

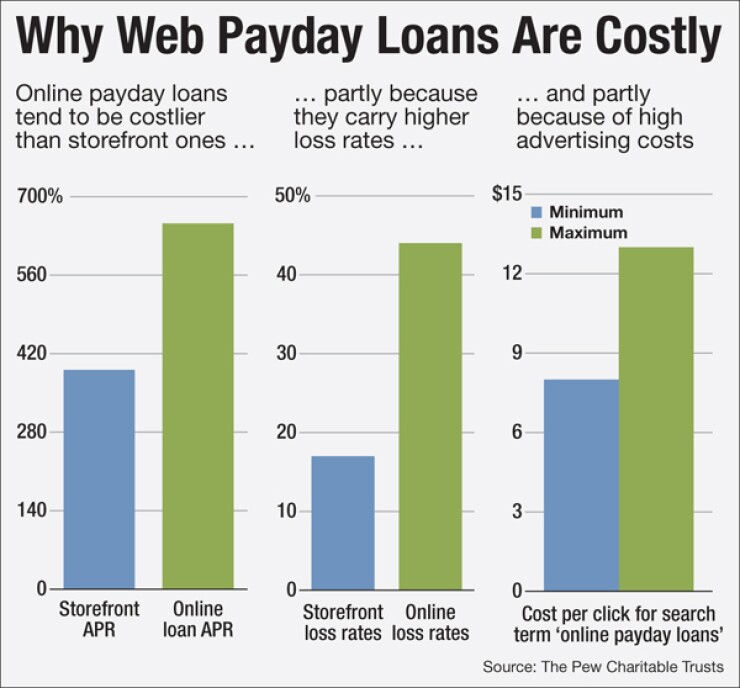

The report illustrates just how different the business models are for online and storefront lending. For storefront companies, the biggest costs typically involve rent, employee salaries and other overhead. Online lenders have few of those costs, but their loss rates are sky-high the report estimates that chargeoffs represent 44% of revenue in the online industry, compared with 17% in the storefront world.

"With a store, it's a real person who came in, provided references usually, left a post-dated check, and lives and works nearby," Horowitz said. "Online, none of that's the case, and there's no relationship either. So there's a lot more risk for fraud."

Other reasons that online payday loans are so expensive include the high cost of acquiring borrowers. The lenders rely heavily on lead generators, which typically have to pay search engine companies from around $5 to $13 every time a consumer clicks on one of their ads, according to the report.

In one state, Vermont, Google, Microsoft and Yahoo have agreed to disable advertising for any lender that is identified as violating the state's strict interest rate cap. Pew officials said they do not have a position on whether search engine companies should bear any responsibility.

The largest lead generator, MoneyMutual, which runs TV ads featuring former talk-show host Montel Williams, spent roughly $211 million on advertising over a 12-month span, the report found.

As a result of all the advertising, customer leads are expensive to buy. Pew found that a lead used to cost as much as $125, though prices have since fallen.

The lead generators collect sensitive information from prospective borrowers, including Social Security numbers and bank account numbers, and then sell it to multiple lenders. The first buyer, which pays the highest price, gets a brief exclusivity period, but soon the consumer may get bombarded with multiple offers.

In order to make their money back, online lenders need their borrowers to roll over their loans multiple times. Pew found that one in three online borrowers has taken out a loan that was set up so that they would pay only a fee on their next payday, and the entire loan principal would be automatically rolled over. "To pay more, most of these borrowers had to make a request by phone," the report states.

Pew also says that 32% of online borrowers report experiencing an unauthorized withdrawal, and 39% report that their personal or financial information was sold without their knowledge.

The online payday lending industry can be divided into two groups: those companies that have licenses in every state where their borrowers reside, and those that do not. That second group of companies includes firms associated with Indian tribes and offshore lenders, many of which have faced lawsuits by states that accuse them of illegal lending.

Pew says that the problems detailed in its report seem to be confined mostly to the second group of lenders. "Aggressive and illegal actions are concentrated among the approximately 70% of lenders that are not licensed by all the state where they lend and among fraudulent debt collectors," the report states.

"Licensed lenders do have some state supervision," Horowitz added, "and that makes a difference."

Pew notes that many of the problems it found are violations of a set of best practices developed by the Online Lenders Alliance, a trade group that represents lenders and lead generators.

Lisa McGreevy, the trade group's president, said that the group's member companies strive to implement its best practices, but she would not say whether members have all fully implemented them.

"Self-policing actually does work," McGreevy said, pointing out that a number of Kansas City area-based online lenders that were recently charged with violations of the law are not members of the Online Lenders Alliance. "We have a demonstrated record of changing behavior through our best practices."

At the same time, McGreevy said that her organization's member companies are expecting to be covered by forthcoming payday lending regulations from the Consumer Financial Protection Bureau. "We're prepared for it," she said. "We not opposed to regulation at all. In fact, you know, we welcome it."

"These are the lenders of the future. So our people are compliant, they want to play by the rules," she added. "When we find out that there are abuses, or issues that come up in the industry, we have a very robust complaint system."

Pew is calling on the CFPB to enact regulations that would apply to both storefront and online payday lenders, and would ensure that the borrower has the ability to repay the loan as structured. It did not put forth any policy recommendations specifically for online lenders.

Pew also said it is pleased with recent rule changes by Nacha, the bank-owned group that governs the automated clearing house network, which will make it harder for fraudulent merchants to access consumers' bank accounts.

Nacha president Jan Estep said that the rate of instances where a transaction is returned because a merchant made an unauthorized debit from the consumer's bank account is only 3 in 10,000, but added: "I think these rules are intended to make sure that we can rapidly identify outliers."

Estep said the rule changes will be phased in during 2015 and 2016.