-

Some large issuers posted continuing signs of improvement in credit card performance in monthly reports for July.

August 17 -

Given the glimmers of improvement in second-quarter results, credit card lenders are hoping for an endless spring.

July 24 -

By plunking down $1 billion to keep and expand its cobranding contract with Delta Air Lines Inc., American Express Co. is following through on a promise to continue making strategic investments despite funding and credit challenges.

December 10 -

The pessimism seeping from banking companies' third-quarter earnings reports this month has lowered market expectations for American Express Co., which is scheduled to release its results after the market closes Monday.

October 17 -

Since 2003, American Express Co.'s portfolio of card receivables has grown almost three times as fast as the industry.

June 26

If credit card loan performance is indeed turning around, it appears to be doing so the fastest at American Express Co., giving the company an opportunity to ramp up business.

Amex is looking to plow much of the money it expects to save from reduced credit costs into marketing and rewards programs, areas where it has cut back during the recession. By doing so, the company would move past a bruising phase that tarnished its reputation as a high-end issuer with impeccable credit quality.

Risks still abound for Amex. Employment and other economic conditions are uncertain, as is the ultimate impact of broad new rules on credit card practices that are being phased in.

But Amex said aggressive spending on marketing and rewards — which increased threefold from 2001 to $7.9 billion in 2007, or at a compound annual rate of nearly 19% — has driven substantial gains in its market share and put it in a better position to emerge from this recession than the last one. Back then, it also made a quick recovery, its chargeoff rate dropping back from a peak prior to improvements in unemployment (and in the rest of the card industry).

"To the extent that growth in loans helped them gain additional spending market share, then it will be beneficial over the longer term," said Bradley Ball, an analyst with Ladenburg Thalmann & Co. Inc. "They've got to work through the cyclical challenge of deteriorating credit, but the market share gains on the spending side should be sustainable."

Sanjay Sakhrani, an analyst at KBW Inc.'s Keefe, Bruyette & Woods Inc., said Amex's ability to remain profitable throughout the downturn and to increase marketing and rewards spending now give it a unique ability to take market share from competitors.

Heavy loan growth from 2005 to 2007 "probably contributed to some disproportionate degradation relative to the industry" during the downturn, Sakhrani said. (Newer accounts tend to go bad at a higher rate than those held by customers with older relationships with an issuer.) But now the impact "may be wearing off," he said.

The $117 billion-asset New York company said it plans to steer a "significant" amount of the money it expects to be freed up from lower credit costs in the second half toward expenditures on things like marketing and promotions, rolling back $1.5 billion of cuts it had planned for this year.

In a meeting with analysts and investors this month, Kenneth Chenault, Amex's chief executive, said the company "may opt to flow some of" the benefit from reduced credit costs "through to the bottom line," if it determines the economic environment makes acquiring new business less attractive.

But, he said, "I have a bias in investing in growth where we have it and we can generate those returns."

Even in the depth of the downturn, Amex continued to put resources into ventures it hoped would produce long-term payoffs.

In December, the company prepurchased $1 billion of Delta SkyMiles points as a part of a deal to renew its cobranding contract with Delta Air Lines Inc., its largest cobrand relationship.

Chenault said that in the first half, Amex had substantially exceeded its forecast for acquiring customers of the former Northwest Airlines Corp., which Delta bought last year and had a cobrand relationship with U.S. Bancorp.

At the meeting, Amex's president, Alfred Kelly, said the new Northwest accountholders "had terrific credit profiles, and they got very, very high initial lines so that we can get their spending capacity right out of the chute."

A buildup in new business would mark another point of inflection for the industry, which has tightened credit standards and been on the defensive in recent months.

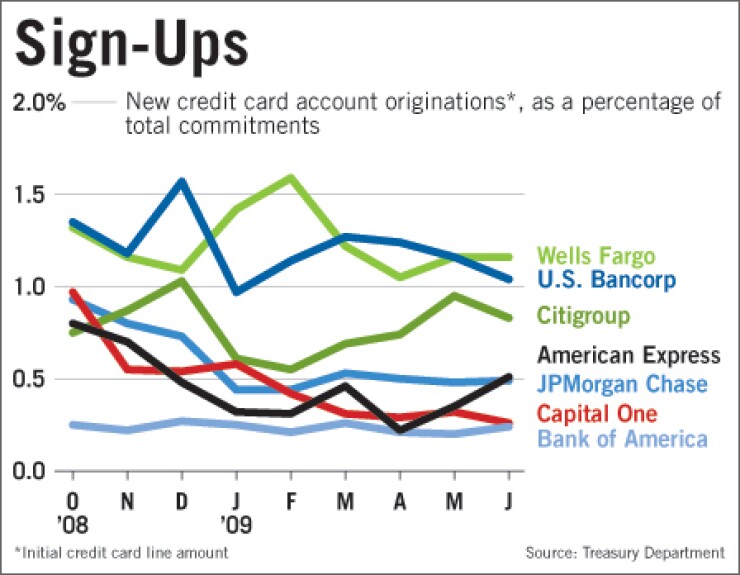

According to Treasury Department data on beneficiaries of the Troubled Asset Relief Program, initial lines extended under new account originations at Amex, as a percentage of total used and unused lines, hit 0.51% in July, up from a low of 0.22% in April, but down from 0.8% in October, the first month in the series.

Amex attributed the dip in April primarily to the timing of its acquisition campaigns. New accounts have also been roughly flat or have declined at Amex's four largest competitors over the same time period.

"There's always that risk" that new lending will slam into another dip in consumer health, but "investing for future growth is smart and necessary," Ball said. "This management team is … very tuned into the market opportunities, and so I think the odds are pretty good that they'll time their re-entry pretty well."

Amex's U.S. credit card receivables declined 16.5% from the year prior to $54 billion at June 30, a substantially bigger drop than any of its largest competitors. (Total revolving credit declined 5% to $911 billion, according to the Federal Reserve Board.)

The company attributed the fall primarily to lower spending volume (revenue from spending volume is the company's focus), pushed along by factors including that its customers pay down a larger proportion of receivables each month than at other issuers.

Amex said it expects the portfolio to grow again once spending rebounds, and that restraint among wealthy cardholders — what Kelly called the "trade down phenomena" where, for instance, "they're still flying, but instead of first class they go in business class" — will ease.

"Yes, the reality is some of them are going to save more than they did before this economic downturn," Kelly said. "But I expect a lot of this average ticket decline we're seeing to come back up over time."

Vijay D'Silva, a director and co-head of the payments practice at McKinsey & Co. Inc., noted that acquisitions of new accounts never really stopped across the sector.

"Acquisitions are always the lifeblood of the industry," he said.

But activity has been "ratcheted down" as lenders sought to reduce risks and became "much more conservative about the kinds of accounts they were originating. You would expect that to continue."

Citing widespread expectations that employment conditions will continue to be weak, D'Silva said "there's still a fair bit of caution among most issuers before they open up their credit spigot, which I'm not sure is going to happen in the near term."

In contrast to mortgages, for instance, "growth in credit cards has never been hugely spiky," he said.

Scarcity of capital translates into tighter credit policies, "but not so much in terms of curbing growth overall."

Amex's chargeoff rate jumped 700 basis points from the third quarter of 2007 — the last full quarter before the recession as demarcated by the National Bureau of Economic Research — to 10% in the second quarter. That put the company's loss rate above those of Capital One Financial Corp., which posted a 538 basis point increase in chargeoffs to 9.2%, and JPMorgan Chase & Co., where losses jumped 533 basis points to 9% excluding the receivables it acquired when it bought Washington Mutual Inc.'s banking operations last year. (At Bank of America Corp., the chargeoff rate increased 706 basis points to 11.7% and at Citigroup Inc. it increased 740 basis points to 11.9%.)

But the improvement Amex posted in July outpaced its biggest competitors, and the company has forecast that its chargeoff rate will retreat in the second half of this year from the peak reached in the second quarter.

According to data compiled by Barclays PLC, the chargeoff rate for receivables backing Amex's credit card bonds fell the most in July from June among the six largest issuers — 133 basis points to 9.76%.

(JPMorgan Chase's credit card bonds showed the most improvement on the delinquency front — accounts 30 days or more overdue fell 30 basis points to 4.16%, compared with 18 basis points to 4.39% for Amex.)

At the investor meeting, Daniel Henry, the company's chief financial officer, acknowleged that Amex had lost its prerecession advantage of lower chargeoffs. This happened, he said, because of its exposure to small businesses, which produce higher credit losses than consumers; the concentration of rich people, its core clientele, in Florida and California, which have been hit hard by the housing crash; and growth prior to the downturn.

But Amex is "starting to separate from our competitors" once again, he said.