-

By offering comprehensive business card features, banks and credit unions are positioned to meet the unique requirements of small business credit card account holders and compete with the largest financial institutions.

April 24 -

Small-business loan volume is on the rise at big banks.

June 1 -

Unpredictable card terms and conditions make it hard for small-business owners to budget. If they can't allocate funds with confidence, they're less likely to hire employees, hurting the economy.

September 7

American Express Co. (AXP) has long led the pack in the small-business credit card segment. But with consumer card loans growing only sluggishly industrywide, the battle for business accounts has now been joined.

In particular, JPMorgan Chase (JPM) and Capital One (COF) have bolstered their initiatives to enroll small-business owners, according to analysts who follow the industry. And in the face of a more competitive landscape, American Express has redoubled its own efforts.

The card industry's courting of businesses is happening with

"In a world where consumer credit is not growing that fast, obviously issuers are looking for any additional growth they can find," says Scott Valentin, an analyst at FBR Capital Markets. "If consumer credit cards were growing at a more rapid pace, I think there'd be less emphasis on small business."

"The next million accounts are tough to get, even for the big banks," adds Robert Hammer, a card industry consultant.

There is no industrywide data on the business credit card market, or its growth curve, because many card issuers do not disclose publicly their breakdown between consumer and business accounts.

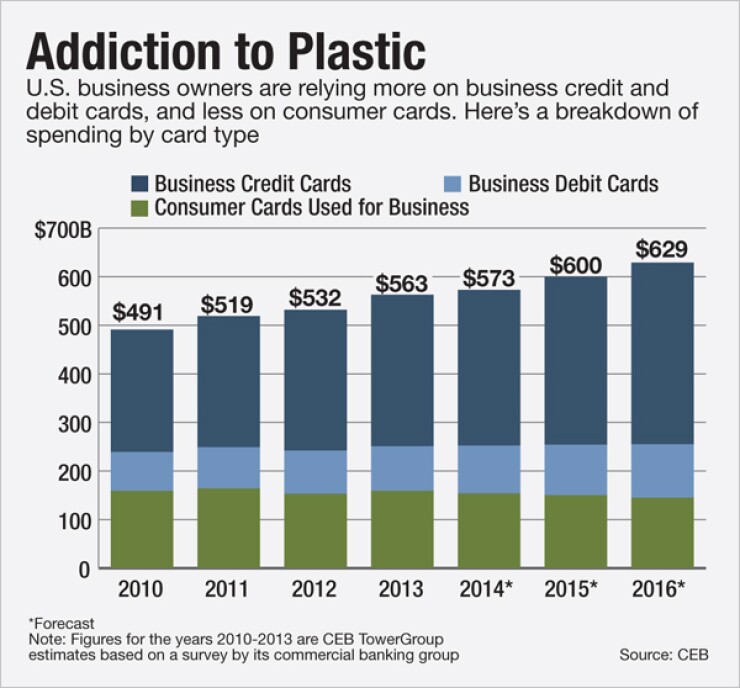

But the consulting firm CEB TowerGroup estimates that spending on business credit cards totaled $312 billion in 2013. By 2016, the firm projects that spending in the segment will increase by 20%.

"It's a good space for growth for major issuers," says Brian Riley, research director at CEB TowerGroup.

The small-business card segment includes both credit cards, which allow for revolving debt, and charge cards, which do not. Charge cards don't have preset spending limits; instead, transactions get approved on a case-by-case basis. Business owners frequently use charge cards for larger purchases that they couldn't make with a credit card.

As of April, American Express had 12 business cards in the market, more than any other issuer, according to CEB TowerGroup. Bank of America (BAC) ranked second with 11 business cards. Other issuers that offered at least five cards were U.S. Bancorp (USB), Capital One, JPMorgan and Barclays.

Historically, many small-business owners have relied on consumer credit cards to keep their firms afloat, and a good deal of today's competition is about stealing some of that spending from other card issuers, according to analysts.

For example, if a business owner currently uses four personal credit cards, each from a different issuer, and each with a $10,000 credit limit, she might get offered the opportunity to shift all of that spending onto a single business card with a $40,000 credit limit.

Loss rates on business credit cards have generally been low, according to analysts. And charge cards, which usually require the borrower to pay in full each month, allow issuers to keep a tight rein on their credit risk.

There are also regulatory reasons for card issuers to be shifting their focus to business accounts. In 2010, Congress placed a host of restrictions on the industry for example, barring issuers from retroactively raising interest rates on existing debt, and from hiking rates based on a default of another loan. But those practices are only banned with respect to consumer credit cards.

"All those are still available to issuers on the small-business side," Valentin says.

In recent months, JPMorgan has been aggressively pitching its Chase Ink credit and charge cards to small business owners.

"One of the best reasons for having a small-business card is, first and foremost, to start to separate your personal and your business expenses," says Laura Miller, president of Ink at JPMorgan Chase. "It also helps you to build your credit as a small business, versus as an individual."

Ink cards come with a mobile app called Jot, which serves as an expense management tool, and offers JPMorgan an additional selling point to small businesses.

When the Ink card is used to make a purchase, the accountholder receives an alert. The business owner can then sort the purchase into a category such as office supplies or travel, and load the purchase into the firm's accounting software.

For card issuers, business card accounts offer certain risk-management challenges in comparison with consumer accounts. "Small business is more complex," Miller acknowledges.

She says that there's competition among issuers for small business accounts, but she also suggests that various issuers have an opportunity to grow their portfolios, given the large number of small businesses that still rely on checks. "I think there's a lot out there that's not even on plastic today," she says.

Manish Gupta, executive vice president of the small-business card line at American Express, echoes that point. He points to data from the consulting firm McKinsey, which found that last year only 9% of spending by small businesses, excluding payroll expenses, was on a plastic card.

"I do believe that the small-business opportunity is very significant," Gupta says. "I would feel comfortable to say that it is probably larger than any other area," he adds in response to a question about the growth potential of small-business cards compared with consumer cards, while making clear that he's expressing his own personal view.

Amex is taking a variety of steps to defend its lead in the business card segment. For example, the company is offering certain free services, such as an

With respect to expense management, the New York-based company recently launched a

"We do have competition. But what we've been focused on from the beginning is really staying ahead of the game," Gupta says. "A lot of the competitors want to copy us and follow us. And that's OK."