No one can accuse First Internet Bancorp CEO David Becker of being timid.

He wants the $3.7 billion-asset online-only bank to become one of the nation’s top Small Business Administration lenders — quickly.

The Fishers, Ind., company is set to complete its acquisition of the small-business lending division of First Colorado National Bank in the third quarter, and Becker has sketched an aggressive plan for building on the unit's $39 million of high-yield loans, $112 million servicing portfolio and experienced team of lenders.

“It’s kind of ambitious to think we can originate $100 million of loans by year-end, but I think that’s still a possibility,” Becker, 65, who founded First Internet in 1998, said in a recent interview. “I can definitely see in the next 24 to 36 months we can build it up to the potential of being a $200 million-a-year operation.”

John Rodis, an analyst who covers First Internet for Janney Montgomery Scott, is predicting a bump in earnings per share in the low- to mid-single-digit range as a result of its expanded SBA program.

Few could blame Becker for wanting to make up for lost time. He began wooing the $68 million-asset First Colorado’s team, which has offices in Chicago and Indianapolis, nearly eight years ago.

SBA lending "has always been on the horizon for me as something I wanted the bank to do,” Becker said. So First Internet considered a number of other options to break into the business, but “for a myriad of different reasons they didn’t seem to connect.”

The signs kept pointing back to First Colorado.

“We haven’t just been waiting, we’ve been looking at other opportunities, but from virtually the first time I met these guys it just seemed it was a great connection,” Becker said. “Being right in our backyard, kind of the Chicago-Indianapolis market, was phenomenally attractive. Just watching and getting to know them over the last seven or eight years, it’s really a good opportunity for us and a great foundation.”

First Colorado CEO Stan Park did not respond to a request for comment about the deal, including why he was willing to part with the division.

According to Federal Deposit Insurance Corp. data, First Colorado had net income of $1.7 million in 2018 and $282,000 in the first quarter of this year. Gain on sales of loans made an outsize contribution to the bottom line: $504,000 in the first quarter and $3.1 million last year.

First Internet’s expansion drive coincides with a tumultuous year for SBA. The agency was

However, concerns about the budget and another potential shutdown do not appear to have dampened bankers' enthusiasm much. Through mid-June, volume in 7(a) and 504, the SBA’s largest guarantee programs, was $19.3 billion — down from the elevated levels the agency enjoyed in fiscal years 2017 and 2018, but in line with fiscal 2016.

Earlier this month, ConnectOne Bancorp in Englewood Cliffs, N.J.,

“A marketplace that matches borrowers with lenders seems to be the place we needed to be,” CEO Frank Sorrentino said in a recent interview. “It gives us the opportunity to create and get going with an SBA lending unit.”

Last year the $138 billion-asset KeyCorp

Banks like First Internet and ConnectOne deserve credit for being proactive and "thinking outside the box," said Chris Marinac, research director at Janney Montgomery Scott.

A robust online presence will become increasingly important as younger generations, who prefer digital channels, open small businesses, Marinac said. An online platform could allow banks to charge a premium because it is "easier and faster and comes with less of an underwriting box."

At the same time, banks have to take care not to lower credit standards. "The key is underwriting and being selective," Marinac said.

"In our experience, First Internet has turned down many transactions," Marinac added. "They've been selective. They're not just doing every deal that comes along."

First Internet’s multiple nationwide business lines, which include public finance and mortgage lending, should provide some cushion in case of another SBA shutdown, according to Becker.

“It doesn’t scare us,” Becker said. “We’ve grown accustomed to being able to pivot and change on a moment’s notice. … If there is a slowdown for a 30-, 60- or 90-day period, we’re in a position to weather that.”

Last fall, as the First Colorado deal began taking shape, First Internet embarked on a soft launch, hiring a handful of SBA lenders to operate in its core Central Indiana market.

“We started hiring some people locally,” Becker said, “kind of pulling things together in September and October last year, getting people on board, building the infrastructure.”

The results have exceeded expectations, Becker said. In little more than nine months, First Indiana has booked more than $10 million in loans, with “another serious $10 million-plus in the pipeline.”

“I would have assumed that, as we’ve done with our other business lines, commercial real estate, municipal lending etc., we would have a [modest] market in Indiana, but to really get scale and volume we’d have to build a national footprint,” he said.

Once the First Colorado team is in place, First Internet plans a nationwide SBA expansion on multiple tracks.

That includes plans to leverage its

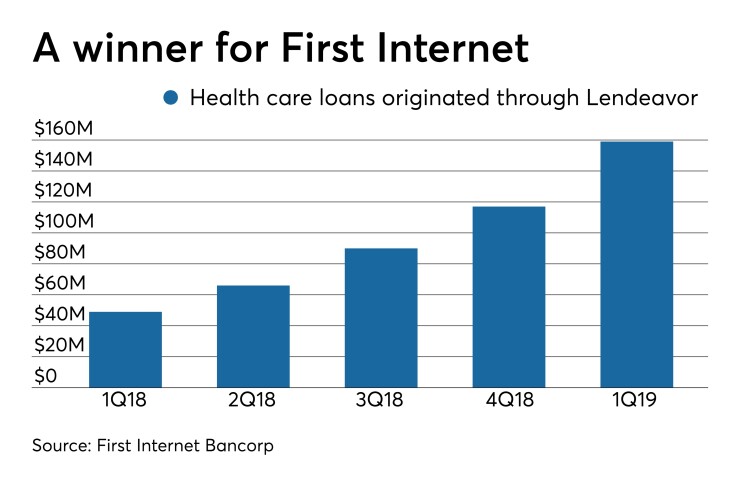

Working with Lendeavor, First Internet has built a $159 million health care portfolio, focused on dental and veterinary practices, but it has not been able to offer those clients SBA-backed loans. According to Becker, that has resulted in a market gap, with the bank unable to serve many up-and-coming entrepreneurs whose finances do not yet meet the standard for a conventional loan.

“SBA will enable us to broaden the set of clients we can serve with Lendeavor,” Becker said.

Rodis said that for First Internet's health care push "depends on the execution," but that there is no reason it shouldn't be able to reach more borrowers.

"It certainly makes sense," he added.

Lendeavor CEO Daniel Titcomb did not respond to a request for comment.

First Internet plans to sell much of its increased SBA production on the secondary market, which should lead to an increase in noninterest income. In the quarter ending March 31, fee income totaled $2.4 million, or 6% of total revenue.

“Our only real fee income today is money we’re making off mortgage sales,” Becker said. “Given the seasonality of mortgages, this will kind of smooth out that noninterest track for us.”