Capital One Financial recorded a healthy increase in deposits last quarter, which led to higher interest expenses and offered a contrast with banks that are seeing deposit outflows.

The McLean, Virginia-based company reported $333 billion in deposits during the fourth quarter, a 7% increase from a year earlier, partly due to a high-yield savings account that has quickly been paying better rates to savers amid supersized interest rate hikes from the Federal Reserve.

The Fed

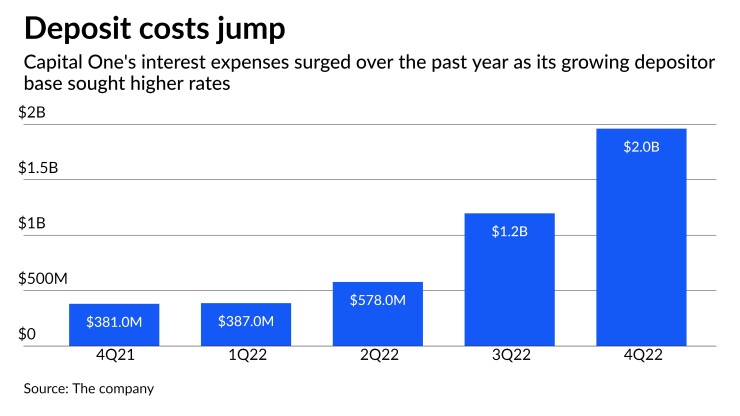

But Capital One executives said Tuesday they nonetheless expect deposit costs will keep rising. While the Fed's rate increases last year allowed Capital One to rapidly pass along higher rates to borrowers, executives said the impact of higher deposit rates on the bank's expenses is a bit more gradual.

"As we get into the latter part of this rate cycle, lagged deposit rates really have a bigger impact than the asset yields that reprice more quickly," Chief Financial Officer Andrew Young told analysts on the $455 billion-asset bank's earnings call.

The bank collected $9.2 billion in interest income during the fourth quarter, up 34% from the $6.8 billion it reported a year earlier. But its interest expenses also jumped sharply in the second half of the year, rising to nearly $2 billion last quarter compared with $381 million a year earlier.

Rising deposit costs will be a "modest headwind" to the bank's net interest margin, which measures the difference between the interest it collects on loans and the interest it pays to depositors, Young said. But he added that Capital One may see some upside from credit card users carrying larger balances, which would allow the company to collect more interest.

The bank's net interest margin climbed slightly during the fourth quarter to 6.84%, up from 6.8% one quarter earlier. But the four-basis-point increase was far more muted than the quarterly rise of 26 basis points it recorded during the third quarter.

Interest expenses will "be pressured as deposit repricing ramps up" in order to fund the stronger growth that Capital One will likely see in its lending businesses, UBS analyst Erika Najarian wrote in a research note. But revenues from higher loan totals will offset that pressure, she added.

Capital One has been spending heavily on marketing as company executives look to add new card customers and highlight the firm's digital-first banking tools. Last quarter, the company recorded more than $1.1 billion in marketing expenses, part of a

The growth in deposits shows "some of the success we're having" in marketing, CEO Richard Fairbank said during the company's earnings call, contrasting Capital One's growth with other banks where deposits are shrinking.

Fairbank did not indicate that the bank is eyeing a pullback in its marketing expenses. He said Capital One sees opportunities for "resilient growth" despite worries of a looming recession.

"We continue to feel good about the marketing. We like the traction that we're getting," Fairbank said. "And we have, of course, a very vigilant eye on the economic environment that we're moving into."