Capital One Financial is backing off slightly from the booming auto market, with its chief executive citing “aggressive” actions from credit unions and other lenders that are keeping their pricing roughly flat even as interest rates rise.

The McLean, Virginia-based lender is not undertaking a “huge pullback” from the auto sector or its relationships with dealers, CEO Richard Fairbank told analysts on a quarterly earnings call after the markets closed Thursday. But profit margins have gotten tighter in auto lending, prompting Capital One to “trim around the edges,” Fairbank said.

“The auto opportunity continues to be a significant one for Capital One,” Fairbank said, adding that the company will “continue to be pretty tight around the edges” until pricing becomes more attractive.

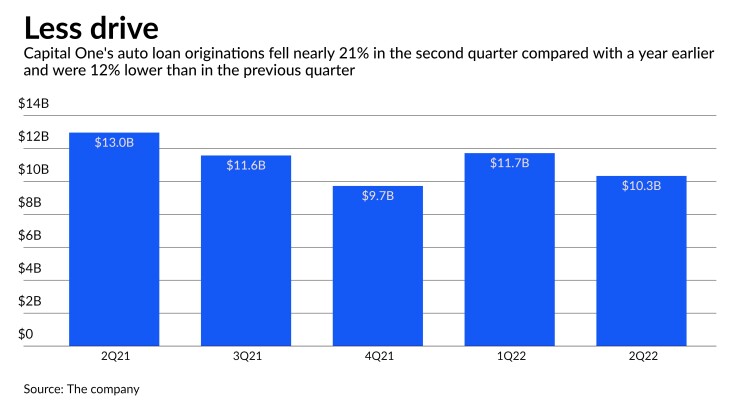

Capital One made about $10.3 billion in auto loans during the second quarter, down 12% from $11.7 billion in the first three months of the year. Auto originations were 20% below the nearly $13 billion in loans Capital One made in the second quarter of 2021.

Fairbank said big banks and most auto lenders have “moved up their pricing very consistently and responsibly” to adjust to the Federal Reserve’s interest rate hikes, which have pushed up the cost of funding for the industry.

A few large players, however, have kept their pricing “well behind” the Fed rate hikes, Fairbank said. Credit unions also have a different business model and “have really not moved at all” in their pricing, Fairbank said, giving them a large increase in market share. Fairbank did not specify which companies were keeping their pricing flat.

Capital One’s caution lines up with that of Providence, Rhode Island-based Citizens Financial Group, whose CEO says it is focusing less on auto in

Yet Ally Financial said this week it sees

The Detroit-based lender has been a major beneficiary of the auto market’s growth during the pandemic. Looking ahead, company executives expect demand to be particularly strong among higher-income customers who have little sensitivity to higher car prices and rising interest rates.

Capital One’s lower appetite for auto loans stands in contrast to its leaning into consumer credit cards.

The company, which last year

Spending bonuses for new cardholders drove up marketing expenditures, as

Fairbank said the company is already seeing benefits from its decadelong push toward “heavy spenders,” whose higher purchase volumes drive up interchange fee revenues and whose strong repayment behaviors limit any credit deterioration.

“Our 10-year quest to build our heavy spender franchise has brought with it significantly increased levels of marketing, but the sustained revenue, credit resilience and capital benefits of this enduring franchise are compelling, and they’re growing,” Fairbank told analysts.

The heavier marketing expenditures did not seem to concern analysts. “We appreciate the willingness of management to invest in both marketing and technology to capture opportunities and drive future growth,” RBC Capital Markets analyst Jon Arfstrom wrote in a note to clients.

Credit Suisse analyst Moshe Orenbuch, meanwhile, wrote that he was “modestly positive” on the bank’s performance and highlighted the success Capital One “has had so far with building its transactor franchise.”

The consumer card focus also comes as

Fairbank alluded to the economic environment, saying there is “more uncertainty at the moment” and that is “not lost on us.” But he said the company always underwrites its loans assuming a tougher economic environment so its credit book can remain resilient.

Capital One has been doing “some trimming around the edges” in credit cards as well, but it continues to “feel good about and lean into” the opportunities it sees with its target customers.

“I think your net impression should be that while we have a very watchful eye on the economy and obsess about it every day,” Fairbank said, the company systematically underwrites “to a worsening scenario.”

Overall, the company reported nearly $2 billion in net income during the quarter, down 43% from $3.5 billion a year earlier. The decline was partly due to a $1.1 billion provision for potential credit losses, compared with a nearly $1.2 billion release during the second quarter of 2021.