Though it remains the largest electronic funds transfer network over all, First Data Corp.'s Star has slipped to No. 2 in point of sale debit transactions, behind Visa U.S.A.'s Interlink.

According to a report issued last week by ATM&Debit News (a sister publication of American Banker), Interlink's March point of sale volume rose 110.2% from a year earlier, to 238.62 million transactions, while Star's dropped 7.7%, to 224.98 million.

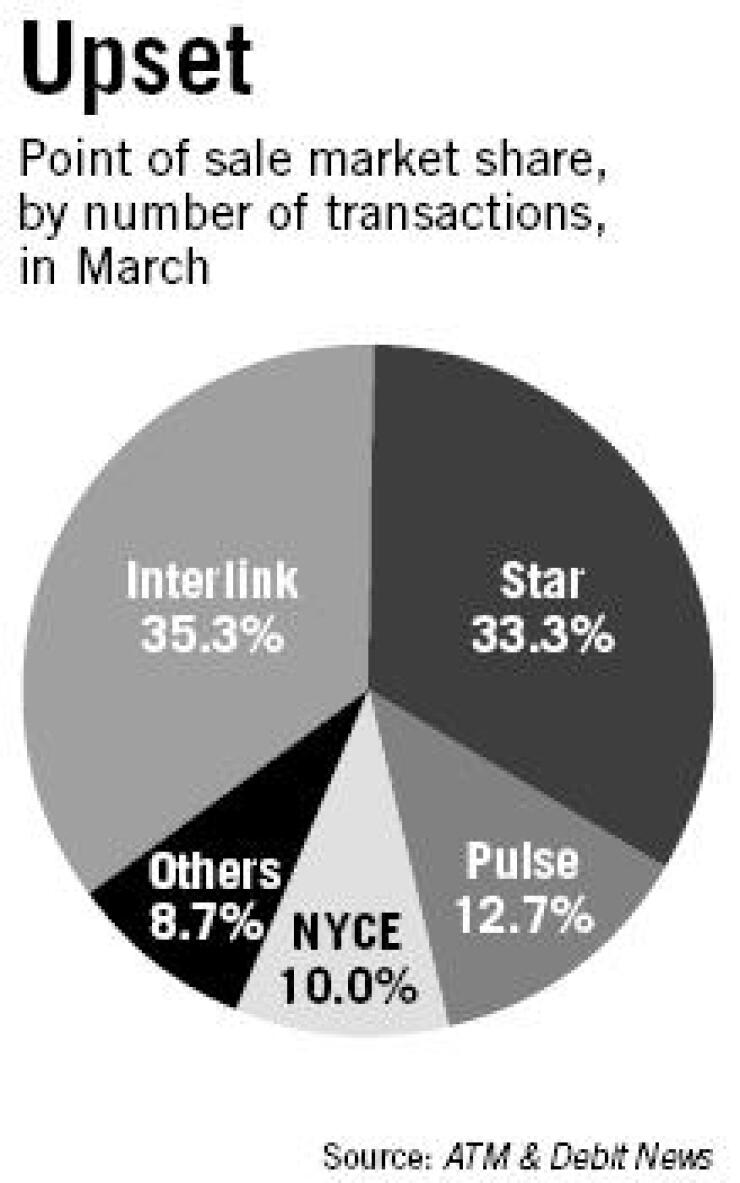

The total U.S. point of sale debit volume in March was 676.2 million transactions. Interlink's share jumped to 35.3%, from 19.7% in March of last year. Star's share shrank to 33.3%, from 46.6%.

Star retained the top overall position among EFT networks in part because it handles automated teller machine transactions, as well as merchant ones. Interlink processes only merchant transactions; another Visa network, Plus, processes ATM transactions.

According to the report, Star's total March EFT volume was 293.7 million transactions, compared to Interlink's 238.6 million. Star handled 68.7 million ATM transactions in March, and Visa said that Plus handled about 49.8 million transactions that month.

Tony Hayes, a vice president with Dove Consulting, a Boston division of Hitachi Consulting Corp., said that the figures reflect the two companies' different growth strategies: First Data has focused on buying networks, while Visa has used financial incentives to persuade banks to switch networks.

During the 1990s, Star became the country's No. 1 debit network by buying several networks. Concord EFS Inc. purchased Star in 2001, and First Data acquired Concord last year for $7 billion.

Mr. Hayes said that in the past several years Visa has been "calling on Star's biggest customers, and saying to these large banks, 'You should leave Star and move to Interlink, and to incent you to do that, here's a big fat check,' and they basically defected."

According to Mr. Hayes, "the moral of the story is … [that] invariably, if you win the loyalty of the individual banks, that would appear to be a stronger foundation."

Stacey Pinkerd, the senior vice president of consumer debit products for Visa, said Friday that he had expected Interlink's market share to increase this year, but "ending up as the number one network was a pleasant surprise."

He attributed Interlink's growth to a variety of factors. "I think it would be too simplistic to think that some kind of one-time payment would be sufficient to make financial institutions make long-term commitments to networks. They do that based upon a value proposition that the network provides to their overall business."

In an interview last week, Mary Walker, a First Data spokeswoman, did not dispute the numbers. However, they reflect "a snapshot in time - one month," he said. "There are a lot of variables that can go into it from month to month."

Robert Dodd, an analyst for Regions Financial Corp.'s Morgan Keegan & Co., said he was not surprised by the shift in POS debit. Several big customers have switched from Star to Interlink in recent years, he said, including Wachovia Corp., Wells Fargo & Co., U.S. Bancorp, Synovus Financial Corp., and Commerce Bancorp Inc.

"We did expect Star to lose some market share, but perhaps not this fast," he wrote in an e-mail last week. "The loss of market share by Star is one of the factors dragging FDC's growth this year."

Mr. Hayes said First Data has been moving to retain, and win back, its bank customers with better financial deals. Bank of America Corp., the first large Star banking customer to defect to Interlink, in 2001, shifted its ATM transactions back to Star in 2002, and its POS transactions last year.