Eventually banking companies will be able to ease off on reserving and send more of their revenue to the bottom line.

However, the challenge facing bankers in the second half of 2009 and early 2010 will be pinpointing the right time, balancing the expectations of investors and regulators.

Bankers face pressure to maintain reserves while charging off bad credits aggressively but also to press forward on restoring robust profitability.

"While issues in residential housing are declining, we still don't know what will happen in commercial real estate and consumer portfolios," said Robert Patten, an analyst at Regions Financial Corp.'s Morgan Keegan & Co. Inc.

"So the emphasis is still on banks' building reserves to deal with issues, until the economy and job losses begin to stabilize," he said.

At the same time, observers are anticipating a peak in loss provisioning, said Gary Townsend, the chief executive of Hill-Townsend Capital LLC. "The burning issue from the standpoint of profitability and growth of earnings is whether provision expense will decline from here."

Experts debate how high reserving will go.

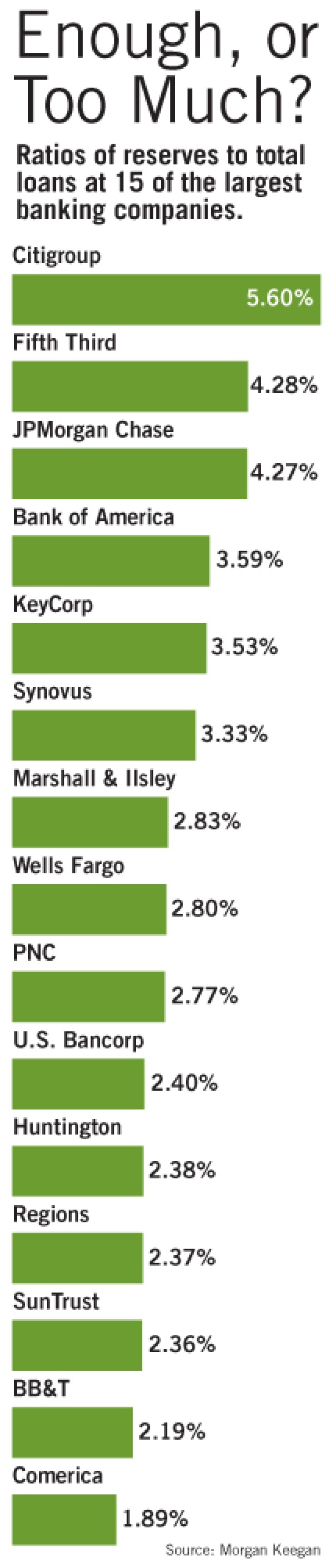

The median ratio of loan-loss reserves to total loans for the top 50 banking companies by assets was 2.26% in the second quarter, according to Patten. This was up from 1.83% in the first quarter and 1.34% a year earlier.

Reserve ratios were healthy, he said, but as nonperformers continue to rise, banks will probably increase their provisions to cover additional losses as they charge off more loans.

The median ratio of nonperformers plus 90-day delinquencies to total loans for the top 50 banking companies was 2.24% in the second quarter, Patten said, and the median ratio of chargeoffs to average loans was 1.84%.

Christopher Whalen, the managing director at Lord, Whalen LLC's Institutional Risk Analytics, said that all of the large banking companies are trying to raise their loan-loss reserve ratios to at least 3% of total loans and that most should consider reserving even more as losses peak in coming quarters.

"Loss rates by the end of the year will hopefully peak," he said, "but they'll be quite amazing."

Whalen estimated that chargeoffs could average 4.5% of total loans, well above the peak of about 3% during the downturn in 1991.

"Because loss rates are going to be so much higher than in past cycles, you're going to have to see" reserve levels "pulled up to accommodate that," he said.

However, Patten contended that most banks really do not need to reserve much more than 3% of total loans because their pre-provision earning power is strong enough to handle increased costs.

"Margins are improving, deposit growth is robust, the cost of funds is low, the yield curve is steep — and banks' improved earnings can help them cover the expense of their distorted credit costs," Patten said.

Bank of America Corp.'s second-quarter reserve and chargeoff ratios were 3.59% and 3.44%, respectively.

B of A's chief executive, Kenneth Lewis, said in the company's July 17 earnings call that chargeoffs would continue to trend upward for the remainder of the year, as late-stage delinquencies build up and economic pressures continue.

However, the pace should be slower than in the second quarter, so B of A will continue to reserve but probably not at the same levels as in the year's first six months.

Likewise, Doyle Arnold, the chief financial officer at Zions Bancorp., said that provision and chargeoff levels at the Salt Lake City company would remain elevated in the third quarter, though probably less than the second-quarter reserve and chargeoff ratios of 3.01% and 3.3%, respectively.

"I know you would like me to be more precise than that," Arnold told analysts in the company's July 20 earnings call.

"But quite frankly, we have countervailing indicators in the credit quality. It is very difficult to predict how it is going to model out in the next couple of quarters," he said.