Brokers in the bank channel reported the lowest job satisfaction among all the industry channels covered by Fidelity Investments' National Financial unit in a survey, indicating a need for banks to improve broker recruitment and retention, a National Financial executive said.

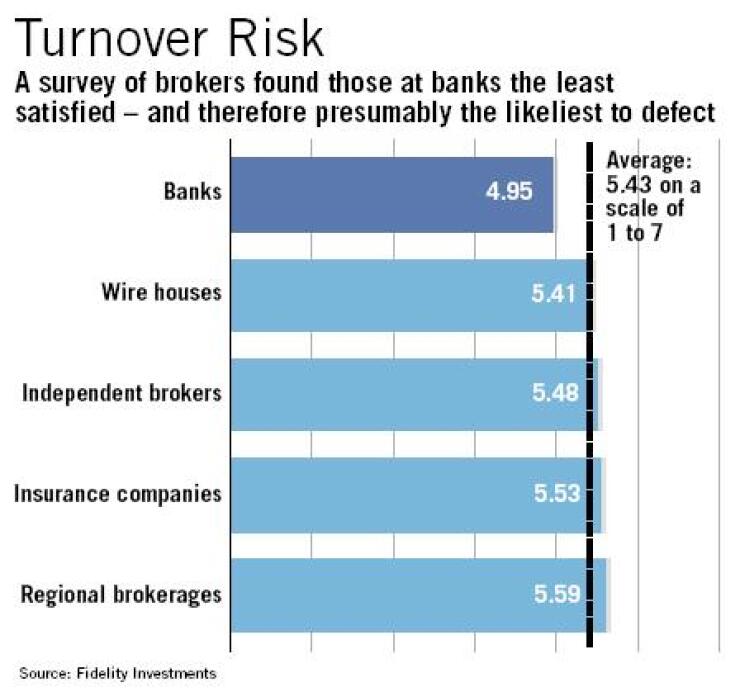

The average broker job satisfaction across five categories of financial company is 5.4 on a scale of one to seven, according to Sandy Metraux, a senior vice president at the Fidelity unit, but bank brokers rated 4.9 in the survey, which was done in May and released last week.

Though 4.9 denotes relatively high job satisfaction, the result suggests that banks have room for improvement in attracting and retaining brokers, Ms. Metraux said.

"Dealers should be pleased with the results of the survey, but they shouldn't get complacent," said Norman Malo, the president and CEO of National Financial, which provides clearing services.

The growth in fee-based brokerage business has benefited Vanguard Group, which has seen its broker distribution network expand as a result, said Martha Papariello, a principal in the company's client relationship group.

"Financial advisers of all types are doing more fee-based business, … they're doing business in a way that makes Vanguard a much more logical consideration," Ms. Papariello said. Vanguard offers educational tools for brokers who sell its products, including its Center for Retirement Research, which provides papers and executive summaries on retirement-related research.

Thirteen percent of brokers across all channels said they were likely to switch to a new firm within the next 12 months, according to the survey.

They registered least satisfaction with marketing support, professional development, and compensation, Ms. Metraux said. They also said these criteria were among the most important to them in measuring job satisfaction.

Also affecting satisfaction was having insufficient income for personal and family goals and insufficient time and ability to travel.

Banks and other companies that employ brokers need to know how they stack up relative to competitors and act to solidify or expand their distribution forces, Ms. Metraux said.

On the marketing support and professional development issues, companies can supply tools for generating sales leads and offer brokers access to more complex investment options, such as hedge funds, she said. High-net-worth clients often ask brokers for information about alternative investments, she added.

"Brokers are saying, 'How can you help me build my business?' " Ms. Metraux said.

Bank of America Corp. offers extensive training support for its roughly 2,000 financial advisers, said spokesman John Yiannacopoulos. Its program for brokers includes sales training and capital markets classes.

The company also creates advancement opportunities for associates with strong track records, he said. It has a three-year training program for associates that schools them in Bank of America products, capital markets, and sales techniques.

The bank also has "very competitive" transition packages to lure brokers from rival firms, Mr. Yiannacopoulos said. He declined to offer details on the compensation packages.

On the compensation side, asset-based brokerage business is going strong, but brokers are likely to favor a combination of fee-based and transaction-based compensation packages, Mr. Malo said.

"They want a combination of effects to maximize income," Ms. Metraux added.

The survey, which Mr. Malo said was the first of its kind, measured brokers' satisfaction with their employers and profession. National Financial questioned more than 700 U.S. brokers in a random sampling of regional brokerages, banks, insurance companies, independent brokers, and wire houses. The survey included brokers within and outside of Fidelity's network.

Research House, an independent research company, did the survey this May, asking 13 questions touching on satisfaction with employer, career, and work-life balance.

Thirty-two percent of the respondents were independent brokers, 30% wire house employees, 19% at insurance companies, 9% at regional brokerages, and 9% at banks. Fifty-nine percent of the brokers surveyed worked for companies with 1,000 or more brokers, and the same percentage had 11 years or more of experience in the business.