Prosperity Bancshares in Houston is becoming more hopeful about its M&A prospects.

The $21.4 billion-asset company has historically been a prolific acquirer, scooping up nine banks since 2012. While the company ended a self-imposed deal hiatus last year, it has struggled to line up the next acquisition due to the downturn in the energy sector.

But its fortunes could be changing.

Prosperity in the last year has talked with a number of banks about a possible deal, David Zalman, the company's president and chief executive, said during a recent conference call, adding that it is "just a matter of time" before something is announced.

An increase in deal chatter would be welcome news, both for Prosperity's investors and for those who have been eager to see more consolidation in Texas, industry observers said.

"If you have a bullish theory on Prosperity, then M&A has to be central to that," said Joseph Fenech, an analyst at Hovde Group. "Fundamentally, the recovery phase from the impact of the slowdown earlier this year is pretty much complete. Stock prices are starting to reflect that."

Only 13 banks in Texas

Prosperity's last bank purchase — of

Regulation tied to crossing over $10 billion of assets — including mandatory stress testing and caps on interchange fees — was "like someone taking a bat to the eyes," Zalman said in an interview. For instance, the number of bank employees working on regulatory issues jumped from 15 to more than 125.

Though the regulators didn't tell Prosperity it needed to take a break from M&A, Zalman said he "got the impression" that getting another deal approved "would be harder," so management took a break to focus on internal improvements.

The downturn in energy prices didn't stop Prosperity from looking for its next deal but potential sellers, who were worried that lower earnings could translate into lower premiums, were reluctant to talk. "It didn't affect our willingness to buy but maybe sellers didn't want to sell during [the energy] downturn," he said.

Prosperity has also run into issues where potential sellers were trading at higher comparative multiples, making it harder to place a bid that would benefit existing shareholders, Zalman said. Still, he is confident the bank will be able to make something work.

"I still think you'll see strong consolidation in years to come," Zalman said. "It may not happen right now, but you'll continue to [M&A] because of the regulatory burden and pressure on return on equity. I think there's also a lot of fatigue with executives managing these banks."

Completing acquisitions is an important part of Prosperity's business model since it generally has slower organic growth than other banks of its size, industry experts said. The company excels at integrating banks and managing expenses, said Brett Rabatin, an analyst at Piper Jaffray.

"For the last year, there's been too wide of a bid-ask spread between buyers and sellers," Rabatin said. "Buyers, including Prosperity, are in a better position to pay with more certainty around their earnings streams, and stock prices have moved up."

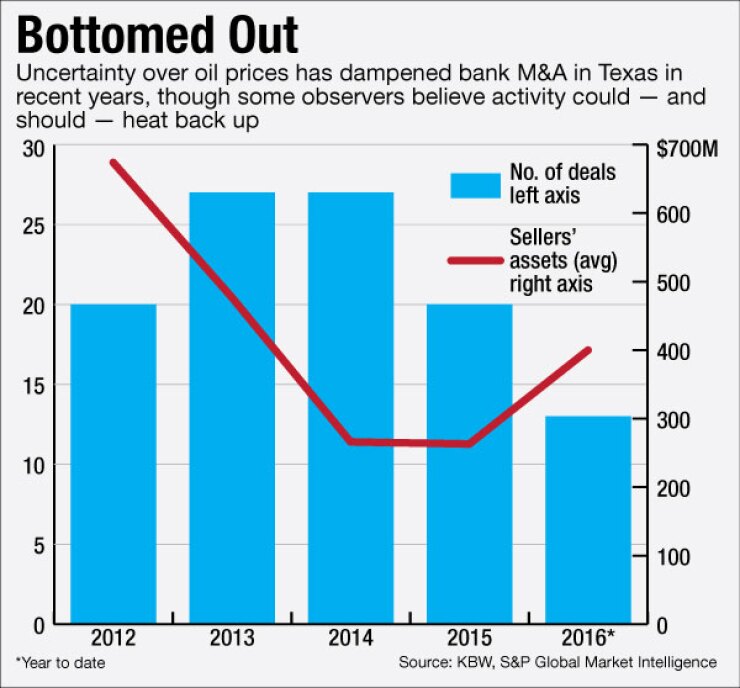

The price of oil has stabilized and stock prices for energy lenders have rebounded, causing some hope that M&A in Texas could return next year. Management teams are also feeling better about credit quality in general, said Brian Johnson, a managing partner in the financial institutions group at Commerce Street Capital.

"There are a lot more active discussions going on," Johnson said. Higher stock prices allow potential buyers "to offer a higher price, and that helps to bridge the bid-ask spread."

Most recent sellers in Texas have been small institutions, but the average asset size could rise as larger publicly traded banks like Prosperity return to acquisitions, Johnson said.

Future sellers could also include privately held banks with investors looking for liquidity, Rabatin said.

Besides Prosperity, potential acquirers in Texas include Hilltop Holdings in Dallas, First Financial Bankshares in Abilene, Independent Bank Group in McKinney and LegacyTexas Financial Group in Plano.

The $12.4 billion-asset Hilltop is "actively seeking acquisition opportunities," Jeremy Ford, its president and co-CEO, said in a statement. He added that the company is looking "to partner with other community banks that share our relationship-based philosophy and have an established customer base."

The $5.4 billion-asset Independent declined to comment, while the $8.1 billion-asset Legacy and the $6.6 billion-asset First Financial did not return requests for comment.

Zalman said he believes M&A in Texas will bounce back next year as sellers become more realistic about the prices they can fetch — and as conditions continue to improve.

"You talk to people and find out what's happening in the market," Zalman said. "Earnings should [become] more normalized. Hopefully nonperforming loans are reducing and the economy should be picking up."