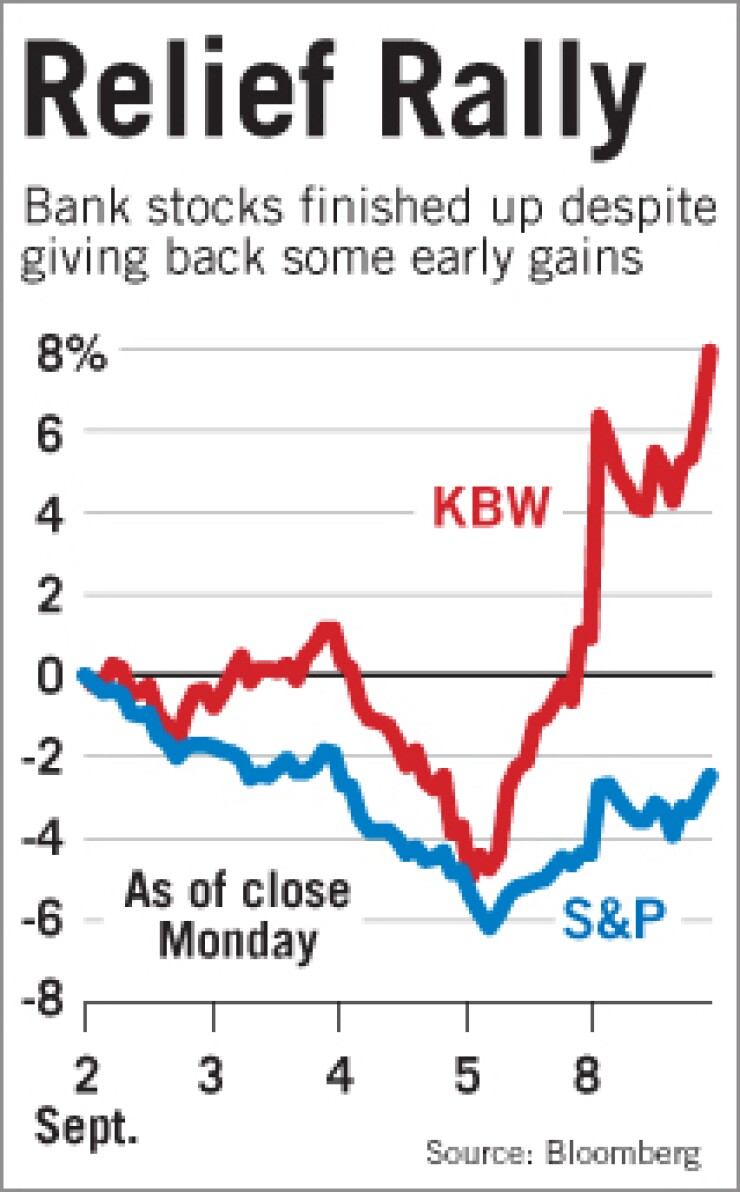

Bank stocks roared out of the gate Monday on news that the government had seized Fannie Mae and Freddie Mac and held on despite giving back some gains.

The KBW Bank Index closed up nearly 7% after posting gains in a range of 3% to 14% at various points during an intensely volatile day.

The Dow Jones industrial average gained 2.6%, while the Standard & Poor's 500 rose more than 2%.

Anthony Conroy, the head trader at Bank of New York Mellon Corp.'s ConvergEx Group, said the government's move "takes a lot of uncertainty out of the market. That's what everybody's been waiting for."

Analysts at Fox-Pitt Kelton Cochran Caronia Waller wrote in a research note that the government's action on Sunday provides some clarity about a range of banking companies' exposure to Fannie and Freddie. However, the intervention also makes it more likely that third-quarter writedowns in the sector will be larger than previously estimated given the elimination of dividends and the potential for complete loss for the preferred shareholders, the analysts wrote.

Those with the largest exposure to the government-sponsored enterprises' preferred securities as a percentage of common equity included Sovereign Bancorp of Philadelphia, Westamerica Bancorp. of San Rafael, Calif., and Astoria Financial Corp. of Lake Success, N.Y., the Fox-Pitt analysts said.

Jeff Davis, an analyst at First Horizon National Corp.'s FTN Midwest Securities Research, said the pain may be more acute at smaller banking companies. (See story

Sovereign's shares fell 6.6% Monday, Westamerica's rose 4.4%, and Astoria's rose 8.6%.

Fannie's shares fell 89.6% and Freddie's fell 82.7%.

Decliners included Washington Mutual Inc., which fell 3.5%.

Early Monday, the Seattle thrift company said that it had ousted its chief executive, Kerry Killinger, and that is operating under a memorandum of understanding with the Office of Thrift Supervision. The company named Alan H. Fishman, a former Sovereign executive, to the role. Several observers suggested that Mr. Fishman will be called upon to remake Wamu's executive ranks and possibly guide it to an eventual sale. (See story

Shares of Downey Financial Corp., a thrift in Newport Beach, Calif., which on Friday unveiled a memorandum of understanding with the OTS, fell more than 30%.

Gainers included Zions Bancorp., which benefited from several pieces of news.

On Friday the Salt Lake City company said it would assume $800 million of deposits from the failed Silver State Bank in Henderson, Nev. On Monday, Zions, which has struggled to raise capital in recent months, said it plans to raise up to $250 million in additional capital by working with Merrill Lynch & Co. Inc.

James Abbott, an analyst at Friedman, Billings, Ramsey & Co. Inc., wrote in a research note Monday that Zions and others whose stock has been shorted on concerns over their residential construction portfolios may be the biggest beneficiaries of the government's takeover of the GSEs. "For a bank such as Zions that has been very proactive and conservative on appraising, re-appraising and re-margining its residential construction loans and may have been closer to the peak" nonperforming assets "than most, we believe the Fannie Mae/Freddie Mac news is even more positive than for the average bank," Mr. Abbott wrote.