Want unlimited access to top ideas and insights?

Banks that scrambled to grant forbearance to stressed borrowers are now trying to gauge the underlying condition of deferred loans.

Many lenders, especially those that complied with the Current Expected Credit Losses standard, recorded large loan-loss

Forbearance, while it can go on for months, doesn’t last forever, leaving bankers and industry observers to speculate on how many deferred loans will be

An obscured view of credit quality also makes it more challenging for banks to price for risk and establish terms and conditions for new loans, industry observers said.

“The pandemic requires banks to grant forbearance, which in turn creates a short-term muddy windshield on banks’ real credit quality,” said Christopher Marinac, an analyst at Janney Montgomery Scott.

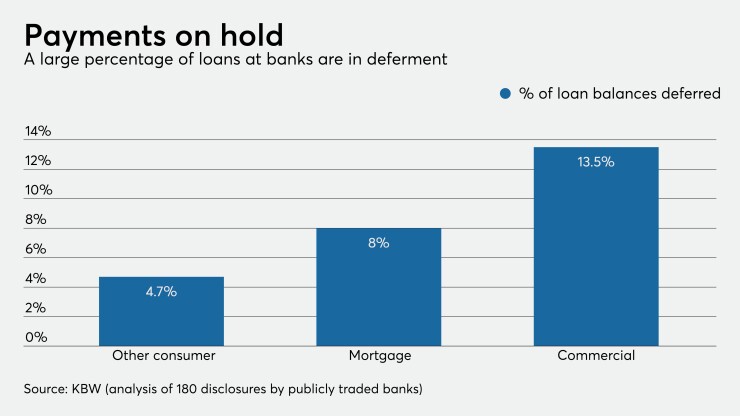

Nearly 14% of commercial loans and 8% of mortgages were in deferment on March 31, according to Keefe, Bruyette & Woods’ analysis of roughly 180 publicly traded banks with total loans of $5.5 trillion. About 5% of other consumer loans were deferred.

Deferrals make up a much higher percentage of total loans than nonperforming assets, suggesting that borrowers are struggling, but not to the point that their issues are showing up in credit quality metrics.

“There’s an underreporting of the true credit picture since so many deferrals exist,” Marinac said.

At Amerant Bancorp in Coral Gables, Fla., deferrals — granted and requested — represented nearly a fifth of total loans on March 31, but only 0.59% of its loans were classified as nonperforming.

Though it has strong collateral requirements and conservative loan-to-value ratios, about 30% of Amerant’s loans are tied to industries such as retail, hospitality, dining, entertainment and child care. Bankers are talking to clients while trying to gauge their long-term prospects.

“Given the relief requests granted, the executive management team has increased its oversight and monitoring of credit and liquidity risk and is working hard to understand and quantify the potential magnitude of the current pandemic on our business,” Amerant CEO Millar Wilson said during the $8 billion-asset company’s earnings call.

Deferrals also account for nearly a fifth of all loans at First Defiance Financial in Defiance, Ohio, while nonperformers account for just 0.79% of the overall portfolio. Many of the deferrals are for six months, and executives expressed hope that by the fall the economy will recover, allowing borrowers to resume payments.

“Coming out the end of that tunnel, those loans will be the same quality rating as long as some business activity that supports those loans comes back,” CEO Donald Hileman said during the $6.5 billion-asset company’s quarterly call.

Like Hileman, many bankers and investors are hopeful that pressure on the economy eases in coming months and that the second quarter will mark a trough to the current credit cycle. If that proves true, loans that were deferred could bounce back and elevated first-quarter provisions would largely cover any losses.

But that is the optimistic view.

“What if this goes on much longer — or pulls up for a while and then comes back [down] later?” said Mike Matousek, a trader at U.S. Global Investors. He noted that a prolonged malaise increases the probability of substantial loan losses despite lenders' mitigation efforts.

Consumer losses historically start in credit cards, then cascade into auto loans and mortgages, following the order that people prioritize debt payments, Matousek said.

Large credit card issuers are already pulling back as they try to gain a handle on their exposure.

Nearly 50 million U.S. credit card customers said their credit limits were cut or their cards closed in recent weeks, according to a LendingTree survey. One in four Americans said their issuer had changed their card terms since the onset of the pandemic.

Discover Financial said it enrolled almost 500,000 accounts into its skip-a-payment programs, though it also warned that deferrals may prove inadequate to blunt the pandemic’s impacts.

“Due to the nature and novelty of the crisis, our credit and economic models may not be able to adequately predict or forecast credit losses,” Discover warned in a statement to Bloomberg. “The pace of recovery is uncertain and unpredictable.”

History may prove an unreliable guide for commercial loans, given the virus’s unprecedented impact on foot traffic. But concern is mounting that almost all sectors could struggle if an economic recovery stalls in the second half of 2020. Banks’ commercial loan portfolios could face even more strain.

In addition to pulling back in areas such as credit cards, lenders will likely be reluctant to pursue new originations — beyond federal programs such as the

The latest Federal Reserve

“Overall the survey painted to us a picture of an industry in which standards have tightened across the board,” the research team at Piper Sandler said in a recent note to clients.

The shock “happened so fast — there was no slow decline in liquidity or the normal metrics banks use to forecast credit issues,” said Dallas Wells, senior vice president of strategic innovation at PrecisionLender, a division of Q2 Holdings that provides pricing and portfolio management advice to banks and other lenders.

“A significant portion of the portfolio hit the wall at once,” Wells added. “Under those circumstances it is almost impossible to price for risk because there are no indicators for how to do this stuff.”