WASHINGTON - A year after major changes to the Bankruptcy Code took effect, bankers and outside experts are continuing to debate whether the reforms did financial institutions any good.

Several industry representatives argue that a sharp decline in overall filings for bankruptcy protection this year, and preliminary data indicating that chargeoffs are falling, prove that the reform law that went into effect Oct. 17, 2005, was worth it.

Banks are "better off, because fewer customers are entering bankruptcy and fewer loans are being written off," said Wayne Abernathy, the executive director of financial institutions policy at the American Bankers Association.

But others say that it is too early to tell, and that critical figures, such as the rate of delinquencies and recoveries from debtors, are not yet in. Some also argue that stories of abuse in the bankruptcy system were overdramatized, and that the reform law has not made more debtors able to repay their loans.

A provision requiring well-heeled debtors to repay some of their debt "hasn't worked, … because there weren't many people who could pay their debts in the first place," said Henry Sommer, the president of the National Association of Consumer Bankruptcy Attorneys.

The Bankruptcy Abuse Prevention and Consumer Protection Act instituted several changes to the system, including increased filing fees, mandatory credit counseling, and a requirement that debtors with substantial income pay at least some of their debt.

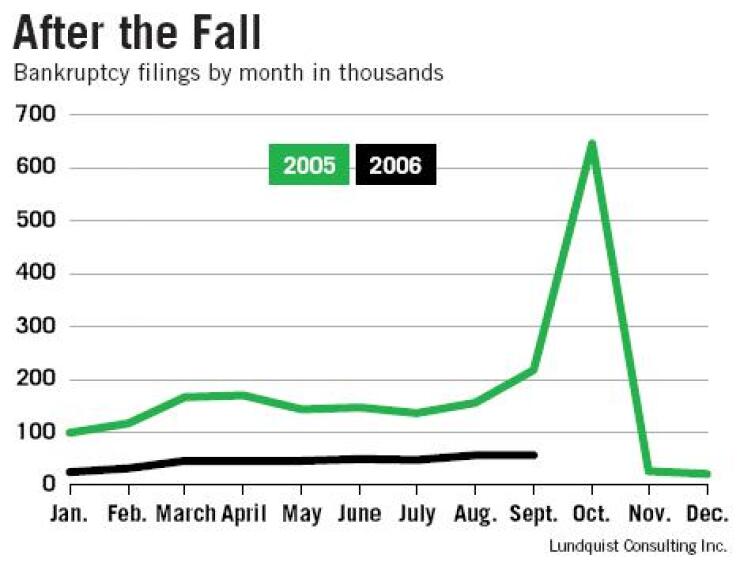

Available data on the law's effect is incomplete, but it is clear that filings have declined dramatically in the past year. As of Oct. 8 the number of petitions for bankruptcy protection filed this year was 79.7% less than the number filed last year, according to Lundquist Consulting Inc., a California company that compiles bankruptcy data.

However, the 2005 total of nearly 2.1 million was abnormally high and included 600,000 Chapter 7 petitions filed during the two weeks before the law was enacted.

There are also indications that the number of filings is beginning to rebound. The number of petitions filed during the week that ended Oct. 8 nearly tripled from the number filed during the week that ended Jan. 8, according to Lundquist Consulting's data.

Though Mr. Abernathy argued that the drop in filings alone proves that the changes worked, others say it misses the point.

"The question about the bankruptcy law in the first place was not whether filings would decline," said Stuart Feldstein, the president and co-founder of SMR Research. "The question was whether that would be made up for by an increase in nonbankruptcy chargeoffs."

Preliminary data indicates that bankers, especially credit card issuers, have enjoyed lower chargeoff rates as bankruptcy filings have dropped off. But analysts said they expect chargeoffs to begin increasing as delinquency rates and bankruptcy petitions slowly rise.

Even staunch supporters of the reforms question whether the drop in filings translates into financial gains for banks.

"A lot depends on how much shows up in other delinquency areas," said Jeff Tassey, the principal of the lobbying firm Tassey & Associates, who was a key figure in helping to pass the reform law. "A decline in filings is a good thing. How much of it shows up on the other side is unknown."

Critics also question whether the law, which was one of the industry's top political goals, has done anything to alter the underlying causes of bankruptcy.

"The laws changed, but people went into bankruptcy because of job loss or divorce, and those problems haven't gone away," said Nina Parker, a longtime consumer bankruptcy lawyer in Winchester, Mass. "They've made the requirements more difficult, but they didn't fix the problem."

Sam Gerdano, the executive director of the American Bankruptcy Institute, said he senses disappointment about the changes, which he attributes to big promises from lawmakers that could never be kept.

"The bill, at its worst, was oversold as some magic pill that would return untold dollars in the pockets of creditors," he said. "But those dollars aren't there, because as an economic matter, [debtors are] too far gone."

One benefit that Mr. Gerdano said was oversold was the elimination of fraudulent bankruptcies and "bankruptcies of convenience." He estimates that only 2% to 3% of consumer bankruptcy filings were fraudulent before the legislation was enacted. "In 98 out of 100 cases, there's nothing there."

Still, supporters of the law insist that banks are better positioned, because they do not have to worry about questionable bankruptcies.

"Now they have a system they know is much more fair and honest," Mr. Tassey said.

Another area of contention remains a provision that requires potential debtors to seek credit counseling before filing for protection from creditors. The idea was that the counseling could provide alternatives for consumers who could work out individual agreements with creditors while ensuring that the truly destitute could still seek court protection.

But critics have charged that credit counseling has failed because consumers seeking protection have such high levels of debt that they have no other options, essentially making the provision another hurdle to jump before filing.

For example, the National Foundation for Credit Counseling released data Monday showing that virtually every consumer who sought counseling through one if the group's 115 members proceeded with a bankruptcy filing.

But bankers defend counseling as a way to ensure that the doors to bankruptcy courts remain open for consumers in dire shape.

"The intent of the law was not for the certified credit counselors to prevent consumers from filing bankruptcy but to ensure that bankruptcy is a last result," said Steve Bartlett, the president and chief executive of the Financial Services Roundtable.

While both sides debate the law's impact, an emerging concern is whether it will remain intact if Democrats gain a majority in the House or Senate. Mr. Gerdano said that the counseling provision and higher filing fees would be prime targets.

"I would expect it to be revisited. I would be shocked if ... [Democrats] didn't reopen at least part of it," he said.