Most bankers agree that online lending applications can attract customers and drive up volume, but few actually offer such services.

"Customers don't have two hours to walk into a bank and meet with a loan officer. They want to apply online at their own convenience," said Dan Welbaum, vice president and chief marketing officer at Mortgagebot LLC.

Bank and credit union executives do understand this and think online lending will increase dramatically in the next three years, according to a report that the Mequon, Wis., company, which sells electronic loan-application technology, is expected to release Wednesday.

In a survey conducted by an independent research group but paid for by Mortgagebot, 71% of bank executives said they will have to offer some kind of interactive, online mortgage application at some point in the future; half said they are evaluating whether to adopt some type of interactive application system by 2012.

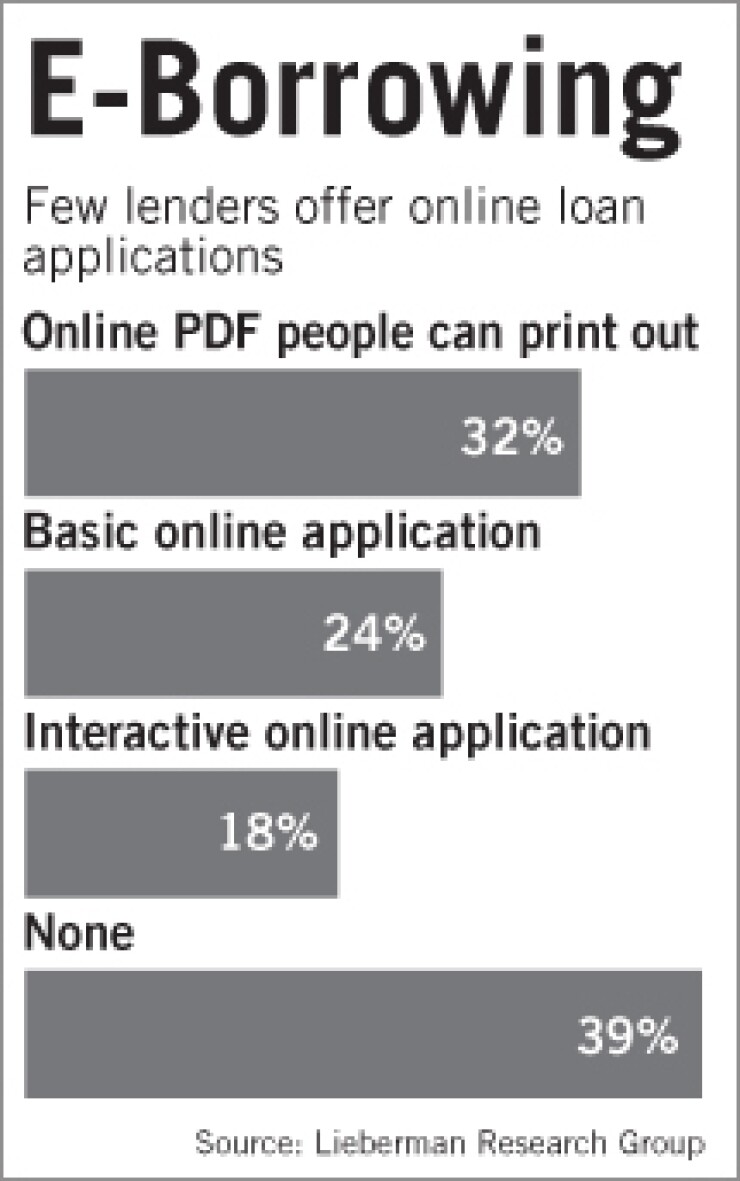

However, only 18% are now able to accept mortgage applications online. And 40% of banks and credit unions currently have no capability to accept online mortgage applications at all, and another 42% offer only a basic form that borrowers must download and print — the lenders must reenter the data manually later.

Bill Emerson, chief executive of Quicken Loans Inc. in Livonia, Mich., said that while most bank lenders say they want to adopt online lending, "a fully integrated online application is pretty much nonexistent out there."

An integrated online mortgage application should be easy to understand and simple to fill out. Ideally, it should let people "sign" the documents online and provide status updates all the way through the closing, he said.

One of the main barriers is that mortgages still must be "wet signed," and few counties and municipalities will accept an electronic signature on a mortgage because they do not have the technology infrastructure, he said.

"What we're really talking about here is the future," Emerson said. Electronic application systems are "where the business is going. Most people say they want to work online, but they haven't invested in the technology."

David Colwell, an executive vice president at Loan-Score Decisioning Systems, an Irvine, Calif., pricing and automated underwriting provider, said that originating a loan online can cost about $800 less than through traditional methods, such as a loan officer.

Online lending can also function as a customer retention tool, he said. "The more products they hold, the less likely the customer will leave you."

Building an online application system still is no guarantee prospective borrowers will notice the lender. Lenders often have to team up with a lead aggregator to drive borrowers to their website, said Kevin Marconi, the chief operating officer at United Fidelity Funding, a wholesale and retail lender in Kansas City, Mo. "Without one, you cannot have success of the other," he said. "The lead aggregator and affiliated lead relationships are the driving force to get the borrowers to the online site."

Marconi said he is testing an online mortgage portal by having his 13-year-old son and 73-year-old grandmother determine its ease-of-use.

"If the two of them can do it, then anyone can use it," he said.

Despite the slow adoption of online lending by some banks, online application volume is expected to triple by 2013 with volume growing from just 4% this year, to 13% of total volume, the survey found. Lenders still expect loan officers to be the dominant channel, accepting 57% of all mortgage applications by 2013, down from 67% this year, the survey found. Employees who work at bank branches are expected to originate roughly 13% of mortgage applications by 2013, on par with this year.

Lenders in every region (except the South) now accept 9% of mortgage applications online, compared with 20% of credit unions that accept online applications.

The survey also found that credit unions, which tend to rely less on loan officers, expect their online applications to grow to 31% of total volume by 2013.

Not since Deloitte Consulting LLP released a survey in mid 2008 showing consumers' willingness to apply for a mortgage online has the chasm seemed so large between what customers want and what institutions are offering.

Currently 71% of banks do not offer a "smart" online application but plan to do so in the future. Another 15% are undecided about implementing such technology, and 14% have no intention of doing so, the survey found.

Interactive applications allow borrowers to get pricing information, obtain conditional approval and receive full disclosures from the lender online in minutes. The technology typically walks borrowers through data and tailors questions for each applicant.

Banks and credit unions that have not adopted online lending technology cited concerns about protecting the security of borrowers, the fact that they are grappling with so many other regulatory issues and the cost of adopting such technology as the biggest barriers to online lending, the survey found.

"If 71% of banks say they will have to adopt online lending, then it's inevitable," Welbaum said. "It's on their radar screens because the customer wants it."

When banks create an online channel they tend to capture a larger percentage of borrowers "because customers like the convenience," he said.

Lieberman Research Group conducted the study for Mortagebot. It polled 330 banks and credit unions by phone, none of which were Mortgagebot clients.

Many large lenders considered technology leaders were excluded, possibly skewing the results, making banks appear to be laggards in adopting online applications.

Roughly 50% of Mortgagebot's current clients originate between 20% to 25% of their loan volume online, he said.

Four of the top 10 residential lenders dominate online originations: Quicken, JPMorgan Chase & Co., PHH Corp., and SunTrust Mortgage Inc.

The survey found that smaller lenders tended to be more concerned about budget conflicts and preserving the status quo, with some believing that accepting mortgage applications online was simply too impersonal.

However, some small lenders said that technology could help them compete more effectively against large rivals.

Emerson said Quicken does not sit down with any borrower face to face but does have a call center for borrowers who want to have some contact with the lender.

He said the lending process is only going to get more automated, and predicted that one day, borrowers will be able to apply for a mortgage from an iPhone or iPad and get an update of the status of the loan "all the way through the transaction, to the closing."