- Key insight: New Treasury protocols use high-performance data processing to review millions of past records for links to cartels and benefit fraud.

- What's at stake: Banks in targeted zones face a choice between paying for expensive enhanced due diligence or exiting these markets entirely to avoid liability.

- Supporting data: A Fincen order requires banks in the Twin Cities to report funds transfers of $3,000 or more if the beneficiary is outside the U.S.

Overview bullets generated by AI with editorial review

Legal experts are warning financial institutions to brace for escalating anti-money-laundering enforcement in 2026 as President Donald Trump's administration wages political battles against drug cartels, illegal immigration and domestic political adversaries.

The warnings caution that the Treasury Department is using "all of its tools" to target the specific geographies of Minneapolis and the U.S.-Mexico border, according to

These efforts in the Twin Cities and the southern border effectively deputize bankers and money service businesses, which transmit or convert money, to act as the front line in the administration's battles.

These battles — nominally against cartels and fraud rings — are part of the president's efforts to

The legal analyses, this week from Holland & Knight and previously from other law firms, detail the administration's weaponization of banks' compliance data, intertwining regulatory obligations with the administration's aggressive stance against documented and undocumented immigrants.

For example, Fincen has issued multiple Geographic Targeting Orders, or GTOs, that compel banks and money services businesses to report customer data on transactions

The Minnesota model

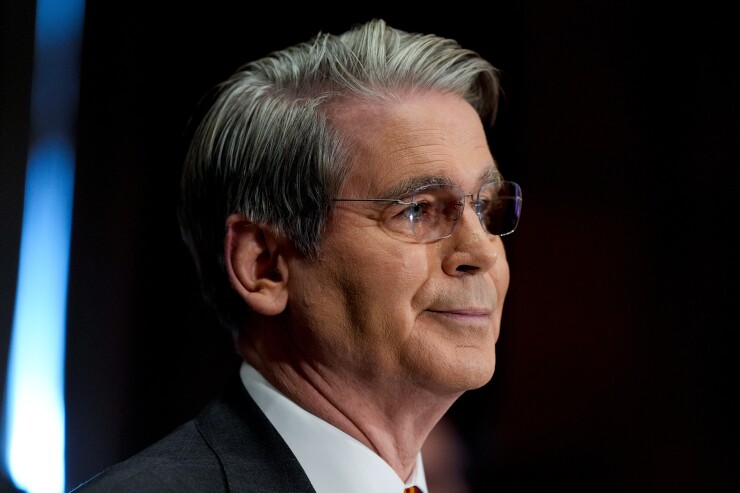

The Treasury Department's focus on Minnesota comes as the administration accuses the state's Democratic leadership, specifically Governor Tim Walz, of enabling what

The administration has cited a $300 million fraud scandal around the pandemic-era "Feeding Our Future" child nutrition funds as the catalyst for the Treasury's crackdown, which also coincides with broader federal enforcement actions in the state.

Prior to the financial crackdown, the administration deployed approximately 3,000 immigration agents to Minnesota in "Operation Metro Surge," an action Walz described at the time as an "unprecedented federal invasion." The surge inspired widespread anger toward the administration after agents shot and killed U.S. citizens Renee Good and later Alex Pretti.

In January, prior to immigration agents killing Pretti, Treasury Secretary Scott Bessent visited Minnesota to announce a suite of financial enforcement initiatives, stating that the president "wants to scale the model we have established in Minnesota to root out waste, fraud and abuse in every corner of the country."

Central to this effort has been

"The extensiveness of these designations presents complex sanctions and anti-money laundering compliance challenges," attorneys from Holland & Knight wrote in the Wednesday client alert, regarding the administration's broader use of designation powers.

Fincen also

Surveillance at the southern border

At the U.S.-Mexico border, the administration is targeting the flow of narcotics through granular financial surveillance.

In March, Fincen

The order cast a sprawling surveillance net designed to enable the administration to track many more remittances and currency exchanges in the targeted areas, with the stated goal of monitoring foreign cartels' financial activities.

The administration later

The administration has framed these moves as necessary to combat the "unusual and extraordinary threat" posed by transnational criminal organizations, according to

The scrutiny also explicitly extends beyond cartels to undocumented immigrants. Fincen issued

"Money services businesses should be vigilant in identifying suspicious financial activity involving illegal aliens who present significant threats to national security and public safety," said Under Secretary for Terrorism and Financial Intelligence John K. Hurley in

Mining financial data for enforcement leads

Beyond lowering thresholds, the administration is also using the existing data it gets from banks and other financial services companies to find new prosecutorial targets.

Bessent in December

This data-driven crackdown places a premium on the accuracy of reports filed by institutions. Fincen said it has already issued notices of investigation to six money services businesses and sent over 50 compliance outreach letters based on this automated review.

Legal experts also warn that the administration is pushing financial institutions toward a "know your customer's customer" standard, particularly regarding jurisdictions like Iran and potentially regarding the beneficiaries of remittances in Minnesota.

"Financial institutions should closely monitor Treasury's determination with respect to the 'know your customer's customer' standard, which could meaningfully increase the burdens financial institutions bear in conducting business with a range of customers and geographies," lawyers from New York law firm Paul, Weiss, Rifkind, Wharton & Garrison wrote in

Comply or de-risk?

The intense regulatory pressure puts banks in a precarious position. The price of enhanced due diligence required in Minneapolis and southern border zones forces institutions to decide whether to eat these costs or simply exit the markets.

Attorneys from Holland & Knight in December

According to the message the Trump administration is sending to banks through its enforcement actions in Minnesota and southern Texas and California, failure to detect the specific types of actors the president has targeted — cartels, undocumented immigrants, benefit fraudsters or others — carries the potential for significant liability.

"FinCEN's recent actions collectively signal that BSA/AML enforcement is likely to continue, if not escalate, in 2026," warned the Holland & Knight legal team. "Financial institutions or other businesses with potential exposure in these areas should consider enhanced compliance steps to mitigate enforcement risk."