- Ohio

Fifth Third Bancorp in Cincinnati reported a higher third-quarter profit, although the restructuring of a commercial credit cut into the results.

October 20 -

Regions Financial in Birmingham, Ala., reported gains in loans and overall revenues in the third quarter, but its net income declined from the same period last year due to increases in its premium for federal deposit insurance and provision for loan losses.

October 20 -

Regional banks did a much better job of expanding revenue than their megabank counterparts in the third quarter, but they had to spend more to do so and risk angering investors in a tight-margin environment.

October 15 -

Acquisitions would seem to be a logical course of action for regional banks struggling to cut costs and boost revenues in the low interest rate environment, but some bank chief executives are less open to the idea than others as comments by the heads of First Horizon and SunTrust demonstrate.

October 16

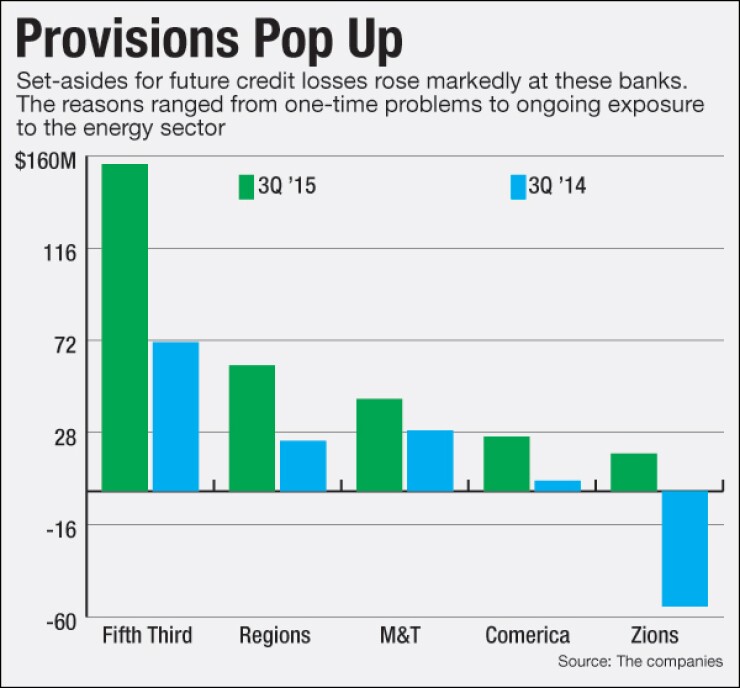

Don't look now, but red flags are flying again in credit books.

And that bad flashback is making banks' already muddled third-quarter results even harder to judge.

On one hand, loan balances are up at most banks, which is a sign that the economy is improving and that consumers and businesses are eager to borrow again after a prolonged period of retrenchment.

On the other hand, loan-loss provisions are trending up again, partly due to an increase in overall lending but also because lenders are worried about future losses on loans tied to the energy and manufacturing sectors.

Regions Financial, for example,

Other regionals that boosted loss provisions in the third quarter include KeyCorp, PNC Financial Services Group, Comerica, U.S. Bancorp, Zions Bancorp. and M&T Bank.

Chris Marinac, managing director and head of research at FIG Partners in Atlanta, said the increase in provisions is mostly a function of an improving economy.

"These companies have to grow reserves again to cover new loan growth," Marinac said.

Indeed, Regions, based in Birmingham, said that its total loans increased 6% year over year, to nearly $81 billion, as balances increased in all loan categories except home-equity lending.

Still, there is ample reason for investors to be cautious, said Marty Mosby, an analyst at Vining Sparks. While he was pleased to see Regions post increases in loans and net interest income, he pointed out that its total classified loans have now increased in three consecutive quarters.

On a conference call with analysts Tuesday, Regions CFO David Turner said that the 150% increase in the loss provision, to $60 million, in the third quarter involves a small number of large loans to a handful of energy-related firms and "does not reflect a broad deterioration in credit quality."

No energy loans have defaulted as of yet, but company officials said they expect to downgrade some larger loans in its $2.8 billion energy portfolio over the next few quarters. The bank is also keeping close tabs on businesses with indirect exposure to the energy sector as well as real estate vacancy rates in cities like Houston and New Orleans that are home to a number of energy firms.

"We don't want to be a Pollyanna," said Chief Credit Officer Barb Godin. "If we do see softness, we want to react quickly."

The higher loan-loss provision is a big reason why Regions' overall profits fell 17% year over, to $246 million. To cope with the increase in problem loans and the challenge of meaningfully growing revenues in this low-interest-rate climate, Regions plans to establish hiring restrictions and thoroughly review all of its expenditures.

"In this environment, the most prudent thing for us to do is to be much more thoughtful, much more rigorous in how we manage expenses," Regions Chairman and Chief Executive Grayson Hall said on Tuesday's conference call.

Fifth Third increased its provision by 120% in the quarter, to $156 million, from a year earlier. Excluding $35 million for the restructuring of a student-loan-backed commercial credit, the $121 million provision was still higher than Morgan Stanley analyst Ken Zerbe's projection of $86 million.

During a conference call, Fifth Third CEO-in-waiting Greg Carmichael attributed the higher provision to the "the stresses that are building in the domestic global economic environment."

Terry McEvoy, an analyst at Stephens Inc., pressed management to elaborate, noting that the manufacturing sector makes up about 20% of Fifth Third's commercial-and-industrial loan book.

"We are not seeing necessarily an impact of the slowdown yet in our manufacturing base," CFO Tuzun said. "All we are doing is we are just recognizing that, globally, manufacturing is slowing down. The global slowdown may impact U.S. manufacturing activity, but this is nothing specific relative to our specific clients or borrowers."

Fifth Third also is not exempt from the energy industry worries that have plagued other banks. Carmichael noted that about $1.6 billion of Fifth Third's loan book, or 2% of total loans, is related to energy.

"The place where we've seen the most stress has been in the oilfield services sector and that sector is $330 million of outstandings, or only 20% of the total," said Frank Forrest, chief risk officer. "We have no loans in the energy sector that are [classified as nonperforming], and losses have been minimal over the last four to six quarters."

The $58.4 billion-asset Zions, in Salt Lake City, started building its reserve for potential losses tied to its energy book in the fourth quarter of last year and added $18.3 million to its provision in the third quarter.

Management estimated during a conference call with analysts to discuss its quarterly results that it could lose between $75 million to $125 million from energy credits but it had already reserved for the majority of that. The company used four different methodologies to reach that estimate, including looking at results from its federal stress testing and an in-depth analysis of its energy credits, said Scott McLean, president and chief operating officer at Zions.

That's "a very manageable number given the overall size of our company," McLean added.

Zions has been proactive in reserving for its energy portfolio as oil prices fell and management has openly discussed the topic, McEvoy said in an interview Tuesday. He wondered, though, why the company took $17 million in chargeoffs related to its energy portfolio this quarter while other banks with significant energy exposure are not yet charging off loans.

"The question I have is why are they taking chargeoffs when others haven't?" McEvoy said. "Is that another example of the company being proactive?"

Still, it can be difficult to make comparisons across banks, McEvoy warned. Loans can vary greatly among energy sectors, and oilfield services – which involves companies that provide services to the petroleum exploration and production industry – is one of the sectors showing greater stress. That is an area Zions is more heavily involved in – it makes up 29% of its oil and gas related credits – and could explain some of the differences, McEvoy said.

The chargeoffs from this quarter generally relate to companies that have been troubled since the last downturn and "are not really indicative of the underwriting we've been doing since" then, McLean said.