The consulting giant McKinsey has an urgent message for traditional banks.

While there’s a big opportunity coming out of the pandemic to scrap longstanding business models in favor of digital innovation, the chance to take market share and drive higher valuations is only going to last for a little while.

How long, exactly? The greatest opportunity to leapfrog competition from both banks and nonbanks will come in the first two years after the pandemic ends, McKinsey predicts in its

In that post-financial crisis period, 60% of the current-day gap in bank valuations emerged, McKinsey said. The remaining 40% took eight years to materialize.

Individual banks are going to have to develop a “future-proof” business model to rise above the rest of the industry, said Miklos Dietz, a senior partner at McKinsey and co-author of the report. Such business models are based on deep customer relationships, technology innovation, the speedy development of new products and growth beyond the balance sheet, he said.

To create real differentiation, Dietz said, banks need to transform their business models.

McKinsey’s latest report offers a recap of worldwide bank profitability during the pandemic and a somewhat sunny near-term outlook. Among the 599 banks globally that McKinsey analyzed, return on equity in 2020 beat expectations at 6.7%, less than the cost of equity but higher than the industry’s 4.8% return on equity during the throes of the financial crisis in 2008.

In North America, banks’ ROE fell from 12% in 2019 to 8% in 2020. In Europe, it declined from 6% to 3%, while the drop was less severe in Asia.

By 2025, a global economic recovery could yield a sectorwide return on equity of between 7% and 12%, McKinsey projected.

Actual bank performance will vary by region and be impacted by three macroeconomic factors: inflation and interest rates, government stimulus support and liquidity levels, which have skyrocketed worldwide due largely to stimulus spending, the report noted.

Still, while banks are currently in relatively good standing, the pandemic is paving the way for bigger gaps in performance between stronger and weaker firms, said Nuno Ferreira, McKinsey’s principal author of the report.

He said that the era in which the industry was moving in the same direction is probably ending. “Now, top performers are diverging more and more,” Ferreira said.

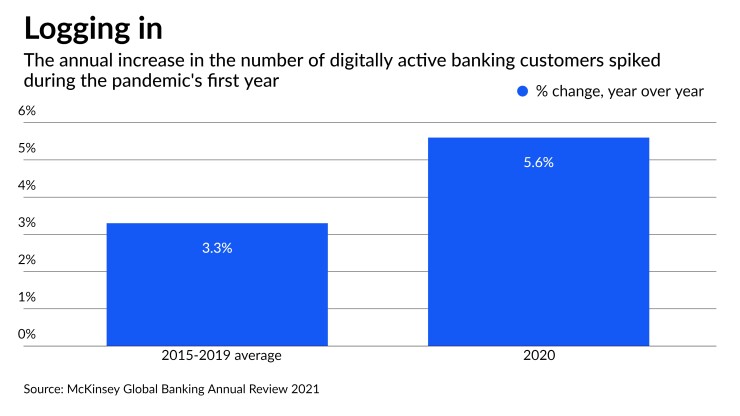

The high achievers include fintechs and other digitally savvy competitors that continue to take market share. According to the report, 28% to 30% of Americans already bank with fintechs, which have captured 3% to 5% of total U.S. banking revenues. In 2020, the number of digitally active banking customers rose 5.6% from the previous year, compared with an average year-over-year increase of 3.3% between 2015 and 2019, according to McKinsey.

What’s ahead is what McKinsey calls “the great divergence,” a period in which some banks will outperform the rest by reconfiguring their business models.

Four factors will drive the split — the geographies in which banks operate, their relative scale, their customer bases and their business models, according to McKinsey.

Banks have limited control over the first three factors, the report said. But they can make bold changes so that their business models will be able to withstand disruption.

The banks that lap their peers will be those that build deep, digitally based financial relationships with customers, improve their efficiency in order to support growth in fee-based businesses such as payments and wealth management, and get their products and services to market faster than others, McKinsey said.

Banks also need to incorporate sustainability into their business models, according to McKinsey.

“The coming years will be golden years when strategy will really matter,” Dietz said.

The McKinsey report does not say that smaller banks are doomed. The United States has more than 4,300 banks, and most of them are community banks.

Small and medium-sized banks often have higher levels of customer loyalty, and sometimes they can achieve higher valuations than larger banks, Dietz and Ferreira said. Smaller institutions can also partner with fintechs and other banks to maximize their capabilities.

“There are plenty of levers that smaller banks call pull,” Dietz said. “However, they need to be more agile. It’s going to be very hard otherwise.”