With a wry smile and a bit of sarcasm, my renegade uncle once told me that he didn't have a credit problem, "the people I owe money to have a credit problem." Well, the failures of more than 200 banks since October 2008 provide some support for my uncle's quip. However, beneath this tattered surface is a surprisingly strong element of the banking sector: the community banks in the nation's bread basket.

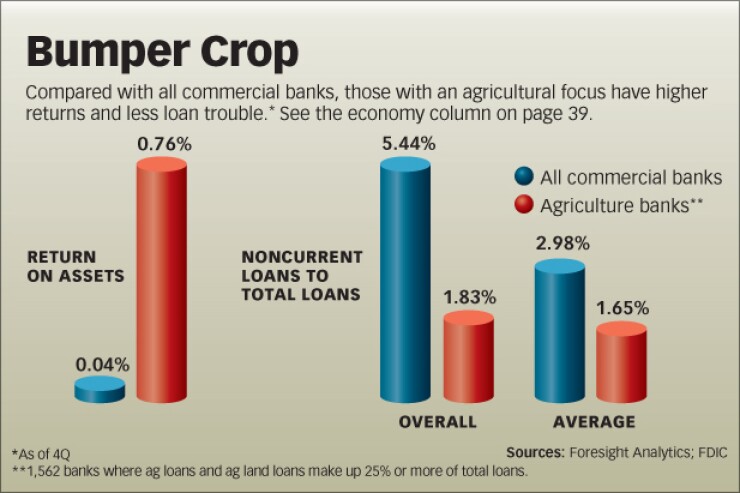

These agricultural banks outshine their peers on profitability and credit quality. The return on assets for all commercial banks averaged 0.04 percent in the fourth quarter, compared with 0.76 percent for those with at least one-fourth of their loan portfolios in the agricultural sector. The ag banks also had noncurrent loan rates half that of all commercial banks.

Each month since January 2005, Creighton University has been surveying chief executive officers at community banks in rural, agriculturally dependent areas of 10 states (Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming). The average population size of the communities served by the banks in our survey is 1,300. These surveys confirm the relative strength of ag banks. While the economic sledding has been a bit tougher since the beginning of the recession, these community banks have not just survived, they've prospered. I expect an even brighter future for these banks as their big-city counterparts get pinched by a tougher regulatory environment.

Admittedly, 2010 has not begun on the side of ag banks. The dollar has strengthened, and trade skirmishes with some of our nation's chief trading partners threaten to reduce agricultural exports. However, I do expect these two negatives to be reversed by midyear, with an improving profit outlook for ag banks in the intermediate and long term.

But why am I so bullish on agriculturally dependent banks? First, a weaker dollar, which I fully expect for the foreseeable future, will make agricultural goods, such as beef, and energy commodities, such as coal, much more price competitive abroad. According to my calculations, a 10 percent decline in the value of the dollar raises agricultural commodity prices by approximately 7 percent.

Despite the recent strength in the dollar, why do I think it will once again continue its downward trend? The No. 1 reason for the weakness will be less enthusiasm among foreign investors for U.S. assets, including Treasury bonds, as safe-haven investments. Additionally, I expect the trade deficit to once again move above $50 billion per month as the U.S. economy crawls out of this deep recession. A larger trade deficit puts more dollars in the global money market, pushing the greenback's value down. Moreover, I expect the Chinese to allow their currency to appreciate more sharply against the dollar in the months and years ahead.

A second factor improving the prospects of ag banks will be the continuing ascendency of economies such as Brazil, Russia, India and China (the BRIC nations). As these emerging economies expand, their demand for food will grow at even faster rates. We economists call this "income elastic." The U.S. market and other more mature markets are by contrast more income inelastic in terms of food demand; if these mature economies grow by 4 percent, their demand for food grows by less than 4 percent. But, for example, between 2003 and 2009, BRIC nations' gross domestic product expanded by 173.2 percent, while their imports of U.S. agricultural goods increased 191.8 percent. During this same period, BRIC countries' importation of nonagricultural goods rose 145.4 percent. The International Monetary Fund has raised the economic outlook for the BRIC nations from flat for 2009 to an average of 6.5 percent for 2010. Based on past patterns, this will stimulate the 2010 sale of U.S. agricultural goods in BRIC nations by 7.2 percent, or approximately $1 billion.

A third factor benefiting ag banks is the current commitment from the Obama administration and Congress to advancing alternative energy, such as ethanol and wind. The rural areas in our 10-state survey region are already taking advantage of financial incentives from the government via wind farms and ethanol production. Approximately 77 percent of the nation's ethanol plants, either already built or under construction, are located in this region. Additionally, according to the American Wind Energy Association, seven of these states rank in the top 10 for wind-energy potential.

President Eisenhower once said, "Farming looks mighty easy when your plow is a pencil and you're a thousand miles from the corn field." While I may not know a steer from a heifer, my economic crystal ball says that the long-term outlook for banks dependent on farming looks good indeed.