-

LendKey, a white-label marketplace lender that partners with credit unions and community banks, has reached a deal to sell MidCap Financial up to $1 billion in student-consolidation loans.

April 15 -

Citizens Financial in Providence, R.I., is continuing its push into consumer lending by offering loans to the parents of college students.

April 2 -

The recent history of bankruptcy law suggests there's a way to provide relief to borrowers overwhelmed by student loans while minimizing concerns about moral hazard.

March 27

Low-income borrowers are responsible for much of the recent surge in student loan defaults and delinquencies, according to new research by the Federal Reserve Bank of New York.

Among students who left school in 2009, 55% of borrowers from low-income households either fell more than four months behind in payments or defaulted altogether.

The default rate among low-income students who left school in 2005 and in 2007 was better, but it was still higher than the rates for middle- and high-income borrowers. By contrast, default and delinquency rates for high-income borrowers - those from households earning more than $80,000 annually - were approximately 20% for students who left school in 2005, 2007 and 2009.

Given that historical data suggests repayment difficulties continue for a number of years after students leave school, the rates of delinquencies and defaults experienced by the 2009 class will almost certainly grow in the near future, said Andrew Haughwout, senior vice president and director of microeconomic studies at the New York Fed.

"This is a new finding and it presents a difficult dilemma for policymakers," Haughwout said. "It suggests the people [student loans] are intended to help the most are also struggling the most."

The New York Fed presented its findings Thursday in a press conference at its 33 Liberty Street headquarters. It based them on figures compiled from its quarterly consumer credit panel, which is derived from a sampling of credit report data.

In what amounted to a silver lining, researchers said the improving labor market would likely result in improved payment metrics over time. In addition to the obvious benefit of making it easier for borrowers to repay, Wilbert van der Klaauw, a senior vice president for microeconomic studies at the New York Fed, said it is likely individuals from lower income households would choose to defer college and go to work as more jobs continue to open up.

Indeed, the study found that the number of active student loan borrowers has fallen each year since 2010, dropping to 9 million last year, down from 12 million three years earlier. In the same four year period, unemployment has fallen to 5.5% from 9.8%, according to the Bureau of Labor Statistics.

"The fact students that left school in 2009 entered into a very poor job market was probably a contributor maybe the most important contributor" to their payment woes, Haughwout said.

Still, New York Fed officials did not say how long it might take for student loan repayment rates to return to pre-financial crisis levels. In the meantime, the numbers continue to be troubling.

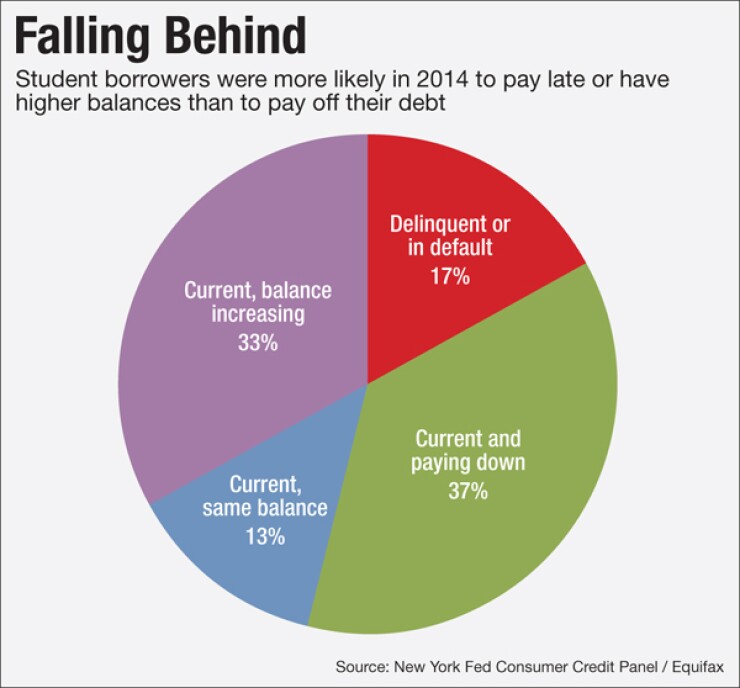

Student loan debt totaled slightly less than $1.2 trillion at the end of 2014, up from about $380 billion a decade earlier. Of the 43.3 million individuals who owe student loan debt, 17% are either behind in their payments or in outright default. The default rate has risen from 2.4% in 2004 to 3.2% in 2014.

Currently, just 37% of borrowers are making payments large enough to reduce their balances. The New York Fed study did not measure the impact of President Obama's "Pay-As-You-Earn" loan plan, which caps federal loan payments at 10% of a borrower's income. Haughwout, however, said income-based repayment schemes would probably push repayment rates even lower.

Getting student loans right has critical implications for future economic health. According to the New York Fed study, individuals holding a bachelor's degree earn $23,000 more on average than high school graduates. Their unemployment rate is lower, too: 3.5% compared to 6%.

At the same time, the recent surge in in problem student loan debt appears to be creating significant economic headwinds. A study released last year by John Burns Consulting estimated that high levels of student debt resulted in 414,000 fewer home sales in 2014.

Ironically, the New York Fed's research found that high-balance student loan debts, which have received considerable attention from the media, account for a relatively tiny slice of overall student loan debt. Less than 5% of student loan borrowers are carrying more than 100,000 in debt.

According to the study, the median student loan debt balance was $14,400. The mean, or average balance was $26,700.