The three U.S. custody banks may want to give a shoutout to British voters when they report financial results this month.

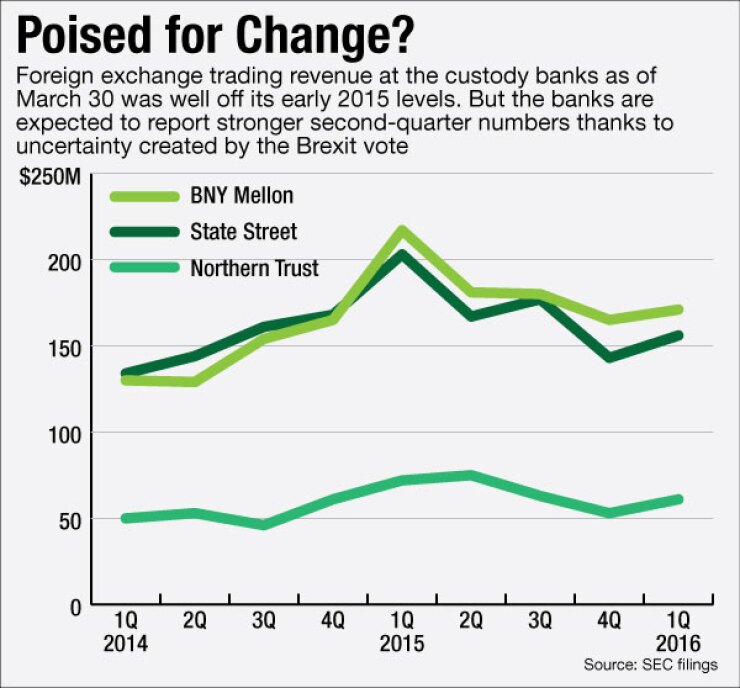

Before the United Kingdom voted in June to leave the European Union, the projection for the stand-alone custody banks — Bank of New York Mellon, Northern Trust and State Street — was that a drop-off in foreign exchange trading would crimp their earnings.

Brexit may have changed all that. The surprising results of the U.K.'s referendum led to worldwide market volatility and a crash in the value of the British pound. The British currency

-

For the first time, the Fed this year is requiring banks subject to stress tests to show how they would cope with the possibility of rates dipping into negative territory. Analysts say they will be keeping close watch on custody banks, asset-sensitive regionals and banks with little overseas exposure.

June 20 -

Bank of New York Mellon and Northern Trust are charging money market investors more fees after previously cutting them major breaks in the low-rate environment.

April 28 -

The scramble to cut costs at State Street continues as the custody bank seeks to make up for declining fees and add revenue-generating businesses.

April 27

"It was only two weeks ago that we're going to have an increase in interest rates and that Brexit wasn't an issue," Todd Gibbons, BNY Mellon's vice chairman and chief financial officer, said at the Morgan Stanley Financials Conference last month. "And now that seems to be have completely reversed itself."

"So at one point, we were seeing lower volatility in the currency markets," Gibbons said. "Now, we're seeing a little bit higher volatility in the currency markets, as you might expect."

And Gibbons' comments came before the U.K. voted to bolt from the EU.

BNY Mellon posted $171 million of foreign exchange trading revenue in the first quarter, with State Street reporting $156 million and Northern Trust $61 million. Before the Brexit vote analysts had expected their second-quarter numbers to fall, but increased trading after the vote may have lessened the drop-off or perhaps boosted trading revenue. Northern Trust is scheduled to report quarterly results on Wednesday, BNY Mellon on Thursday and State Street on July 27.

The foreign exchange volatility was more than just a response to the pound, as money managers worldwide had to adjust their positions over numerous different currencies, primarily the dollar, pound and yen, said Marty Mosby, an analyst at Vining Sparks.

Investors and corporations were busy altering hedges on their exposures, explained Jason Goldberg, an analyst at Barclays.

"It still resulted in increased volumes, which should benefit results," he said.

However, the Brexit results won’t eliminate all the custody banks’ problems.

For one thing, custody banks' foreign exchange trading volumes were depressed before the Brexit vote, Goldberg said. The Brexit vote happened late in the second quarter, and may serve to merely offset weak results from earlier in the quarter.

Custody banks also continue to struggle with the issue of money market fee waivers, as interest rates remain at historically low levels. The three custody banks for years have been

When the Fed raised rates in December, banks recovered about half of the revenue they had been losing from fee waivers. Absent another rate hike, the banks will continue to give away money with the fee waivers. Goldberg said he expects the level of money market fee waivers to remain little changed the rest of this year.

Each bank also has its own specific set of issues. BNY Mellon has hit a dry spell in its chase for new contracts for its asset-servicing business, Goldberg said. Its total new wins for that category in the first quarter — about $40 million — were BNY Mellon's lowest in at least six years, he said.

BNY Mellon could also be affected in other ways by the Brexit vote, as it operates two separate banks in the U.K. and in Belgium, and about a quarter of BNY Mellon's total revenue comes from its European region. The British vote could lead to weakness throughout European economies.

BNY Mellon could be prepared to deliver some good news on the expense front. The bank is ahead of schedule for a cost-cutting plan that had been pushed by activist investors. BNY Mellon said that, during the second quarter, it completed a project to create about $500 million in yearly expense savings; those cuts included the sale of its landmark headquarters building at 1 Wall Street. The bank's original target to complete the cost cuts was the fourth quarter of 2017.

Those cost cuts were prompted by the activist group Trian Investment Management, which last year gained a board seat at BNY Mellon. Anne Tarbell, a Trian spokeswoman, declined to comment when asked about the firm's assessment of BNY Mellon's progress.

State Street has also been hurt by high costs, but it is much earlier in the process of reducing expenses than BNY Mellon. The Boston company projects it will

However, State Street is positioned to receive a greater benefit from improvements in worldwide equity markets, said Jeffery Harte, an analyst Sandler O'Neill. State Street has a larger exposure to emerging markets than BNY Mellon or Northern Trust, and it has an asset mix that is heavy on equities.

Northern Trust has the smallest business in foreign exchange trading and will thus get the least benefit from Brexit-related volatility. But the Chicago company is also expected to grow faster than its rival custody banks in the areas of assets under custody and assets under administration, both for the remainder of this year and in 2017, Harte said.