Mortgage bankers are lobbying for a change from a conservative interpretation of an EITF ruling on the sale of mortgage loan servicing rights that doesnt allow for the recognition of the sale of those rights if risks are retainedregardless of the amount or duration of time the risks are held. The Emerging Issues Task Force, an arm of the Financial Accounting Standards Board which deliberates issues that need immediate attention, came to a consensus in 1989 with Issue No. 89-5, Sale of Mortgage Loan Servicing Rights. It agreed the sale of mortgage loan servicing rights should not be recognized before the closing of the sale, such as when the title and all risks and rewards have been irrevocably passed to the buyer, and there are no significant unresolved contingencies. But the task force said questions have been raised recently about whether the inclusion of certain provisions in a mortgaging sales contract would preclude the recognition of a sale because all risks have not been passed, and also whether these provisions give rise to insignificant unresolved contingencies for which a sale would be recognized and a liability accrued at the date of the sale. The task force is now considering two interpretations of Issue 89-5, Views A and B. Under the more liberal View A, as described by the task force summary, retention of minor risks by the transferorsuch as a nominal amount of prepayment risk for a short period of timewould not preclude the recognition of a sale at the date the title passes to the buyer. Under View B, however, the retention of any prepayment risk by the transferor precludes the recognition of a sale until those risks are transferred to the buyer. Supporters of this view believe a critical risk relating to MSRs is prepayment risk, and if the seller retains that riskeven for a short timethe risks of ownership have not passed to the buyer and a sale should not be recognized. One member of the task force said June 14 he endorsed the more conservative View B, and planned to vote for it when ballots are cast at the scheduled EITF meeting in Norwalk, Conn., July 21. The issue, which was passed over during the May 19 EITF meeting because of time constraints, may not make it to the agenda in July either, he said. Mortgage bankers, who staunchly support View A, are hopeful it will be addressed because of concerns about the effect some MSR sales contracts might have on the recognition of the sale of those rights. The trade group has recommended the EITF amend its consensus so the sale of MSRs wouldnt be recognized on the date of the sales agreementthe closing dateunless substantially all risks and rewards of ownership have irrevocably passed to the buyer and there is no significant unresolved contingencies, Alison Utermohlen, senior director of financial management of the Mortgage Bankers Association, said in a May 19 comment letter to EITF. The term substantially, which doesnt appear in the EITFs issue summary, would clear the way for sellers that retain nominal amounts of risk to recognize the sale of those MSRs. Utermohlen said this wording would clarify the contradictory language in 89-5 and would be consistent with the longstanding accounting treatment for these sales. She added this type of treatment has not been a problem in practice since such sales have rarely, if ever, been reversed and significant adjustments to sales prices generally have not been required.

-

Experts said that judges reviewing ongoing litigation between the Consumer Financial Protection Bureau and its employee union seem inclined to allow reductions in force to proceed if the CFPB presented a credible plan for running the agency.

5h ago -

MBS buying has become the near-term focus but a 2026 offering is still possible, Federal Housing Finance Agency official Bill Pulte told Fox Business.

February 26 -

The Royal Bank of Canada's base outlook is that tariffs will remain at their current levels. But it also sees a possibility that U.S. trade policy will bring on a severe North American recession.

February 26 -

The Brazilian neobank attributed a Q4 boost in its credit portfolio to its AI-powered underwriting tool, but expenses caused it to miss Wall Street estimates.

February 26 -

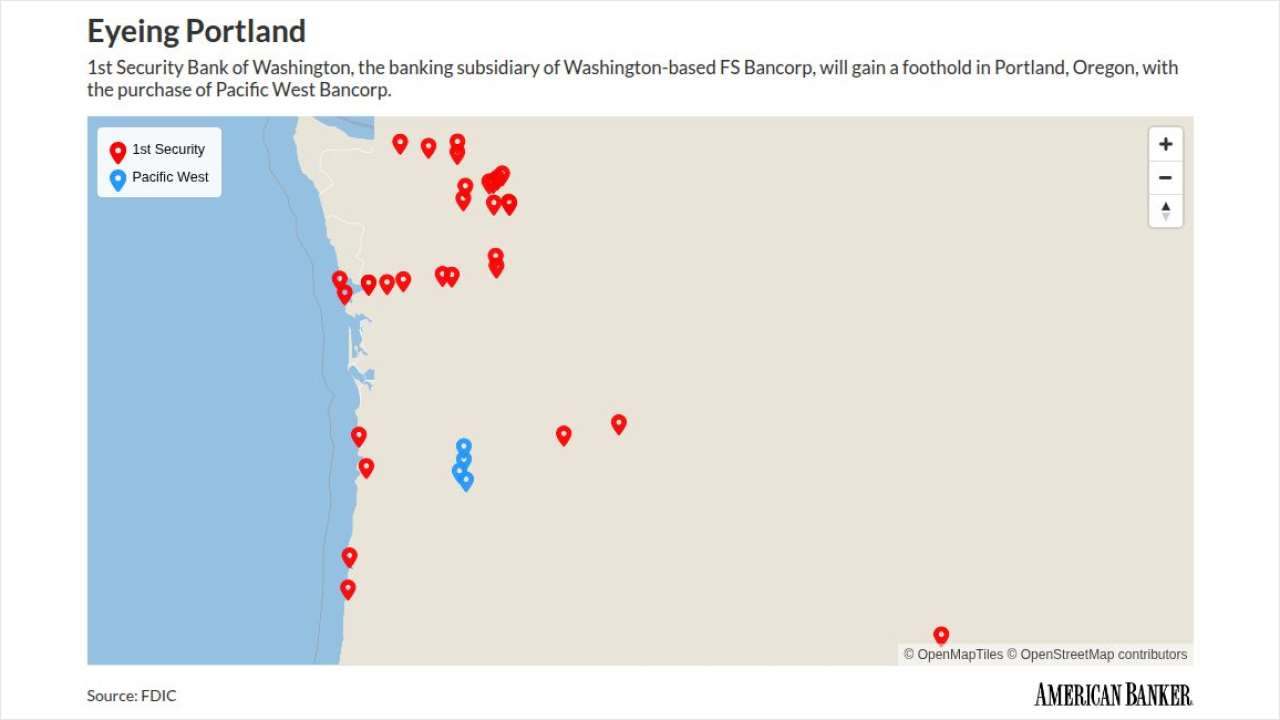

Acquiring the $386 million-asset Pacific West Bancorp extends a strengthening bull market for bank M&A.

February 26 -

After completing a migration to its proprietary tech stack, Chime is setting its sights on GAAP profitability in 2026 following a strong fourth quarter.

February 26