In a blow to activists who want the largest U.S. banks to take

The results from the big banks' annual meetings were not uniformly negative for environmental activists. But at both BofA and Citi, less than 10% of shareholders voted in favor of enacting a timed phaseout of lending in connection with new oil and gas exploration and development, according to preliminary results.

At BofA, just under 7% of investors threw their support behind such a proposal, a decline from 11% of investors who voted in favor of a near-identical measure last year. And 9.9% of shareholders at Citi voted yes, down from 12.8% a year ago.

Wells Fargo shareholders voted down the same resolution at the bank's annual meeting on Tuesday, but the percentage breakdown of votes was not immediately available.

After the votes were tallied, a coalition that targets the financial sector's support of fossil-fuel production accused large investors in big banks of ignoring both science and the needs of affected communities.

"A transition is coming one way or another: banks and their investors can help make it orderly and just, or they can pretend they don't see what's coming as they drive the planet off a cliff," Alec Connon, co-director of the Stop the Money Pipeline coalition, said in a press release. "Investors who voted against these resolutions should expect to have a hard time sleeping at night with the knowledge that their misplaced greed will lead to climate destruction and chaos."

The boards of directors at BofA, Citi and Wells had urged their shareholders to vote against the climate-related proposals, saying that their existing policies are doing enough to lower carbon emissions.

All of the three banks have made commitments to achieve net zero emissions by 2050, and they have also sent interim goals for 2030.

Some of the results on Tuesday were more positive for climate activists.

At BofA, a shareholder resolution on setting a clear climate transition plan, which would include publishing a road map for meeting 2030 targets, gained 28.5% of votes.

"That's almost 30% of shareholders asking for additional information from the company," said Danielle Fugere, president of As You Sow, a nonprofit organization that promotes corporate social responsibility. "That sends a strong signal that the company should provide a clear plan on how it can actually meet its targets."

Still, the waning support for phasing out lending on new oil and gas projects dampens momentum that activists built last year, when they introduced

JPMorgan Chase, the largest U.S. bank by assets, will face a similar proposal at its May 16 annual shareholder meeting, along with two other climate-related resolutions. The company's board of directors is recommending a vote against all three proposals.

At Wells Fargo's annual shareholder meeting on Tuesday, Dan Chu, executive director of the Sierra Club Foundation, argued that climate change poses a large risk to the financial system, and said that fossil fuel expansion will make that risk greater.

"Scientific consensus on new fossil fuel exploration and development is clear," Chu said. "To get to net zero by 2050, the world cannot continue to develop new oil and gas fields or coal mines beyond those that have already been approved for investment."

Shareholders in BofA, Citi and Wells Fargo also voted on various other climate-related proposals on Tuesday.

Wells Fargo's ballot included a proposal advocating for an annual climate lobbying report and another calling for the publication of a climate transition plan. Those measures also failed to garner majority support, according to the San Francisco bank. The company plans to release official vote tallies in a regulatory filing.

At BofA, 11.5% of shareholders voted in favor of setting absolute emissions targets.

And at Citi, a proposal for a report showing how the company's financing of certain fossil-fuels projects affects indigenous peoples' rights won 31.06% support from shareholders.

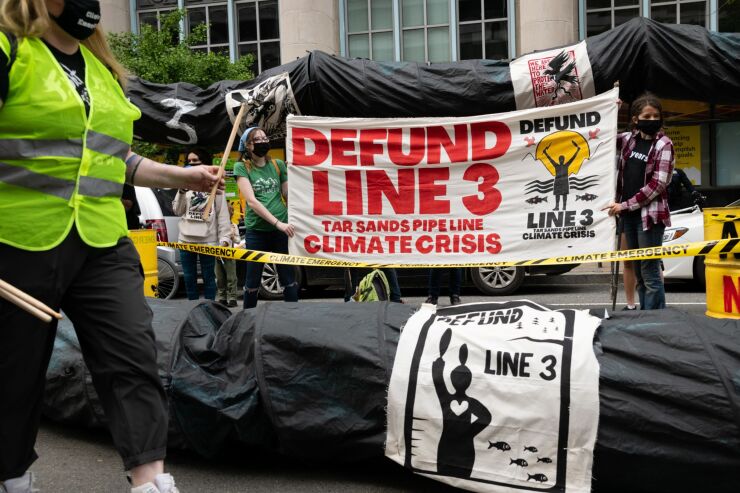

The specific project mentioned involves the replacement of an oil pipeline by the energy infrastructure company Enbridge. In its proxy statement, Citi said that it hasn't provided any financing for the project.

During Tuesday's annual meetings, bank CEOs defended their actions and policies around climate change.

BofA CEO Brian Moynihan said the Charlotte, North Carolina, bank is one of largest financiers of clean-energy projects in America and around the world. "We continue to work with our clients to help make the transition," he said.

One shareholder, Ariel Zwirnoff, questioned BofA's position that it's helping clients finance a green energy transition, considering that one of its largest clients is ExxonMobil.

"A question about ExxonMobil is more appropriately answered by them, and so I'd encourage you to talk to them," Moynihan responded. "But our plans will include all our clients."

Citigroup CEO Jane Fraser argued that energy transformation and energy security "are not mutually exclusive" and said that the New York-based bank is "focused on supporting clients on both fronts."

Echoing comments she made during last year's annual meeting, Fraser added that government action is also necessary. "This cannot be done by the private sector alone," she said.

Frank Gargano contributed to this report.