-

After another disappointing quarter, Comerica is promising big changes in its ongoing quest to improve returns to shareholders. It appears to be considering all options, including selling off business lines and perhaps even merging with another institution.

April 19 -

Comerica reported a steep decline in first-quarter profits as weak energy prices forced the Dallas company to sharply boost its reserves for loan losses.

April 19 -

Word that Hancock Holding in Mississippi would more than double its loan-loss allowance has triggered broader questions about how the oil slump could spread beyond the energy portfolios of a whole class of banks.

March 30

DALLAS — Comerica may sell itself one day, but it won't be a very attractive takeover target — or fetch top dollar — until energy prices rebound and interest rates rise, company officials said Tuesday.

At a contentious annual meeting in which several investors urged the struggling company to explore a sale, executives and board members said that they are urgently examining ways to boost shareholder returns. They did not provide specifics but assured investors that all options — from expense cuts to divestitures — remain on the table.

A sale now, though, would not make much sense because low interest rates have suppressed commercial loan yields and falling energy prices have weakened its credit quality, depressing the bank's value. The $69 billion-asset Comerica is an active lender to oil and gas firms and its profits have plunged in recent quarters as it has boosted its reserves to guard against potential loan losses.

"It's very easy to throw out scenarios where you say, 'Well, XYZ institution would be more than willing to purchase a bank for X dollars," said Richard Linder, lead facilitating director at the $71 billion-asset company. "They would be buying an institution and a portfolio that's very interest-rate sensitive."

Acknowledging shareholders' frustration, Linder added that the "the board has a sense of urgency toward improving results and improving returns. We are with you on this."

Comerica's annual meeting has historically been a sleepy affair, but fireworks were expected after the company reported disappointing first-quarter earnings last week and announced that it had hired Boston Consulting Group to help it review its operations and find ways to boost returns.

Representatives from several l large institutional shareholders — including Hudson Executive Capital, Samlyn Capital, Invesco and Lockheed Martin Investment Management — traveled to Dallas for the event- to express their frustrations with the company's performance.

During the meeting, several shareholders pushed Comerica for details on its strategic review and on the timing of a potential turnaround.

"The management team has asked shareholders to wait one, maybe two years," said Jack Barnes, from Samlyn Capital. "We think this is unacceptable."

Some investors were skeptical that internal review would result in the necessary fixes, calling it a "plan to have a plan."

But Comerica executives pushed back, emphasizing ongoing efforts to make meaningful changes to its interest rate-dependent business model.

The company has begun cutting back its exposure to energy, after bulking up on oil loans over the past few years, said Ralph Babb, the company's chairman and chief executive.

"With every cycle, including this one, there are lessons to be learned that we plan to apply to this business going forward," Babb said. "This includes having a relatively smaller energy portfolio in the future, so that we can more easily withstand the tremendous volatility that is common in this sector."

As part of its internal review, which began just a few weeks ago, it has begun exploring ways to generate more fee income.

"There have already been some things that have come up," Babb said. He declined to provide additional details in a follow-up interview after the meeting.

Still, executives made a point throughout the meeting of saying that much of what ails Comerica these days is out of its control. They also sounded hopeful that Congress might raise the asset threshold for determining if a bank is systemically important to well above the current $50 billion. Lifting that cap would substantially reduce compliance costs for Comerica and other banks in its asset class.

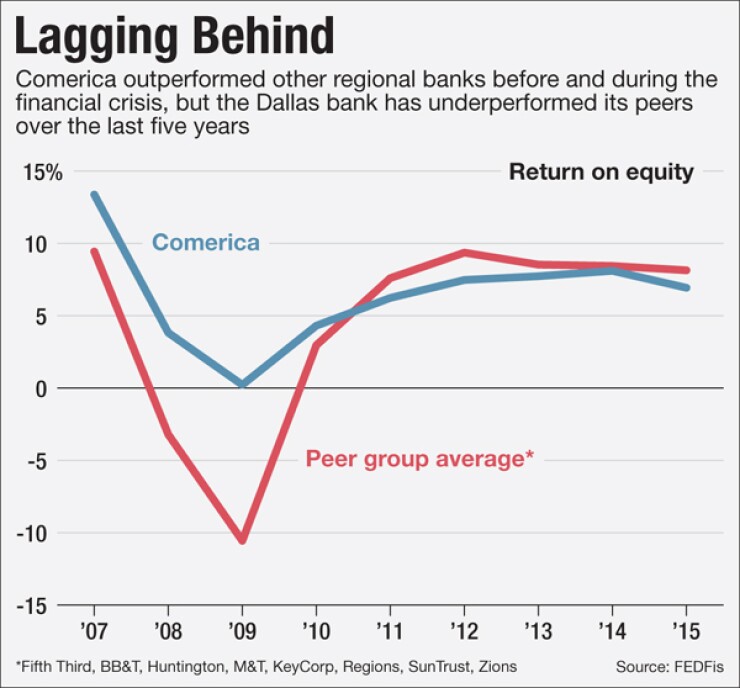

Comerica's first-quarter profit plunged 55% from year earlier, to $60 million, after the company increased its loan-loss provision nearly tenfold, to $148 million. Its return on common equity — which has lagged that of its peers for several years — slumped to 3.13%, from 7.20% a year earlier.

Mike Mayo, an analyst with CLSA, has been particularly vocal in recent weeks about the need for Comerica to start earning its cost of capital. He recently raised his rating in Comerica's stock, for the first time in 20 years, because he believes the bank is a takeover target.

"The market doesn't have enough confidence" in the company to turn itself around, Mayo, said in an interview before the meeting.

Comerica officials have not ruled out a sale. Babb said last week, and again Tuesday, that Comerica "must earn the right to remain independent every day." Meeting with reporters after the annual meeting, Babb acknowledged that a merger with another institution is "one of the elements that's on the table."

Several regional and foreign-owned banking companies — including BB&T, U.S. Bancorp and the Japanese-owned MUFG Union Bank in San Francisco — have been named in media reports as potential suitors for Comerica.

Despite the general unrest at the meeting, shareholders did re-elect the entire board and voted to approve executives' incentive-compensation plan.

Comerica's shares closed at $45.13 Tuesday, up 3.32%.