Upward pressure on banks' commercial deposit costs, which started earlier this year, is picking up as the Federal Reserve pushes ahead with interest rate hikes.

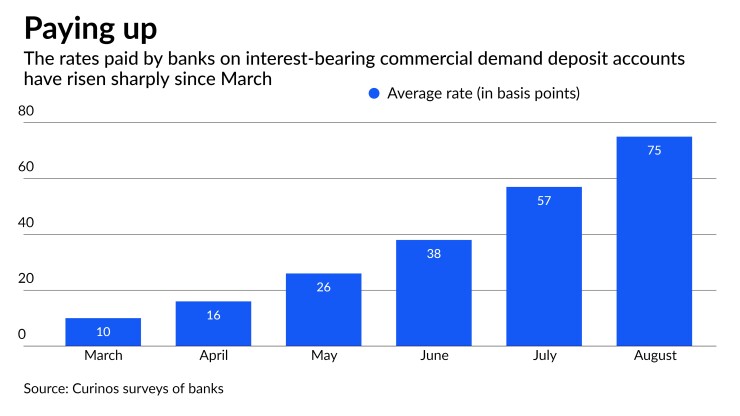

The average interest rate paid on commercial clients' demand deposits jumped to 75 basis points in August, up from just 10 basis points in March and approaching pre-pandemic levels, according to a survey of 21 regional, super-regional and national banks by the consulting firm Curinos. Rates on commercial clients' money market deposit and savings accounts saw a bigger jump, rising to 88 basis points in August, the survey showed.

Curinos also found that rebates for non-interest bearing deposits — where commercial clients get credits to offset the costs of other services they buy from the bank — are also starting to tick up slightly.

Among banks' commercial clients, the "rate picture is really starting to heat up," said Peter Serene, a consultant at Curinos.

Serene and other analysts say the pressures in the coming months will vary depending on each bank's mix of deposits. Banks with large retail footprints and

But even if the pressures remain relatively mild, particularly at certain banks, observers predict that commercial deposit costs will accelerate further as the Fed keeps hiking rates.

The topic is likely to be prominent in some banks' third-quarter earnings calls, with analysts and investors trying to discern which institutions will be forced to pay more for their deposits.

The rate increases are coming as banks' overall deposit growth has

But in the span of six months, the Fed has hiked short-term interest rates to levels last seen in 2008. That's raised the yields on alternatives to deposits, and has driven rate-seeking customers to switch to money market funds or similar instruments.

Commercial clients are more sensitive to rate changes than consumers, particularly when it comes to extra cash that they don't use for operational purposes. Commercial deposits declined by an average of 6.1% in August from a year earlier at the banks Curinos surveyed. The banks whose growth was in the bottom quartile recorded a 15.4% decline.

Bank executives

Analysts expect banks to report solid net interest margins — a measure of the interest they earn on loans compared with the interest they pay on deposits — in their upcoming earnings releases. Earnings season kicks off on Friday, with JPMorgan Chase, Citigroup, Wells Fargo, Morgan Stanley, U.S. Bancorp and PNC Financial Services Group all reporting their quarterly results.

When the Fed raises rates, banks collect more interest on their loans, but their funding costs may also rise. At this stage, the benefit of each Fed rate hike is fading, according to a research note from Raymond James analysts. In recent meetings, bank leaders suggested an elevated focus on deposit outflows and some agreement that NIMs will "likely peak in the next few quarters," the Raymond James analysts wrote.

Banks have "successfully defended deposit costs thus far," but they are starting to see their customers migrate into higher-yielding products, or they are giving one-off increases to customers who request higher rates, the analysts wrote.

Some banks are being "more proactive" than others, which are more comfortable watching certain deposits leave, given the excess liquidity they sat on during the last couple of years, according to Tim Partridge, commercial banking leader at the consulting firm Deloitte.

The latter group is in a "wait-and-see mode," letting some excess deposits and less profitable relationships leave while they "retain the ones that they really want," Partridge said.

Dallas-based Comerica is seeing some competitors offer higher promotional rates "that might attract hot money," Chief Financial Officer James Herzog said at an industry conference last month, referring to extra funds that commercial clients may use to chase higher rates.

"We're not necessarily interested in hot money. Having said that, we're very attentive to what's going on in the rate environment," Herzog said, according to an S&P Global Market Intelligence transcript. "And as a commercial bank, those are very much one-on-one customer discussions, and we feel like we're being very prudent in that regard."

Fifth Third Bancorp CEO Timothy Spence said at the same conference that the Cincinnati bank "remained disciplined from a pricing standpoint," even as it expected so-called surge deposits to continue leaving the bank.

While deposit outflows have been significant and are continuing, a sizable chunk of those funds is going to Fifth Third's money market portal and generating fee income, and Fifth Third has been letting more expensive deposits leave.

The extent to which the deposit market gets much more competitive remains a "looming investor concern," but near-term concerns about increased deposit pricing may be overstated, RBC Capital Markets analyst Jon Arfstrom wrote in a research note focused on midsize banks.

That's partly because even though deposits have waned from their peak, the banking system's liquidity remains elevated, Arfstrom wrote.

"Commercial banks are not yet facing the same funding pressures today that they would have in prior tightening cycles," he wrote.