Just when the market for mortgage servicing portfolios was showing signs of life again, something has come along to throw a wrench into the works: counterparty risk.

Investment bankers and advisers are pointing to recent efforts by Freddie Mac to make a privately held Texas servicer repurchase troubled loans because the firm in question owned the servicing rights.

Though loan repurchase requests are all the rage in the mortgage industry, investment bankers are concerned about the Texas case because Freddie facilitated the sale of some of the rights to the company.

In other words, the servicer was not the original seller of the mortgages to Freddie. Freddie allowed the servicer to take over servicing of the portfolio and then asked it to buy some of the loans from the government-sponsored enterprise.

Freddie did not respond to e-mails and telephone calls about the matter. The servicer's identity could not be confirmed, but several advisers are aware of the case and spoke about the situation on the condition of anonymity

A trade group official close to the situation said because of the case the servicer in question has stopped doing deals with Freddie.

"Right now, they're saying they won't buy any more Freddie servicing rights," said the official, who fears the case could lead to a situation where "there is no bid for Freddie [bulk] servicing rights. And that means the value of Freddie servicing on [mortgage bankers'] books is zero."

He noted that there is some optimism, however. Freddie Mac officials are aware of the matter and are said to be working on a resolution.

The official said a similar instance has not yet risen with Fannie Mae.

"Fannie seems to more reasonable on these things," he said.

Still, it appears that concerns over counterparty risk and servicing rights are affecting bidders' appetites for portfolios.

An East Coast-based servicing adviser said counterparty risk "has been an explicitly and commonly expressed issue with prospective servicing buyers for the past nine months or so."

He said that he had one "big" servicing client say it would not purchase any rights unless the GSEs explicitly gave the company what he called a "get out of jail free card" on the prior servicer's representations and warranties.

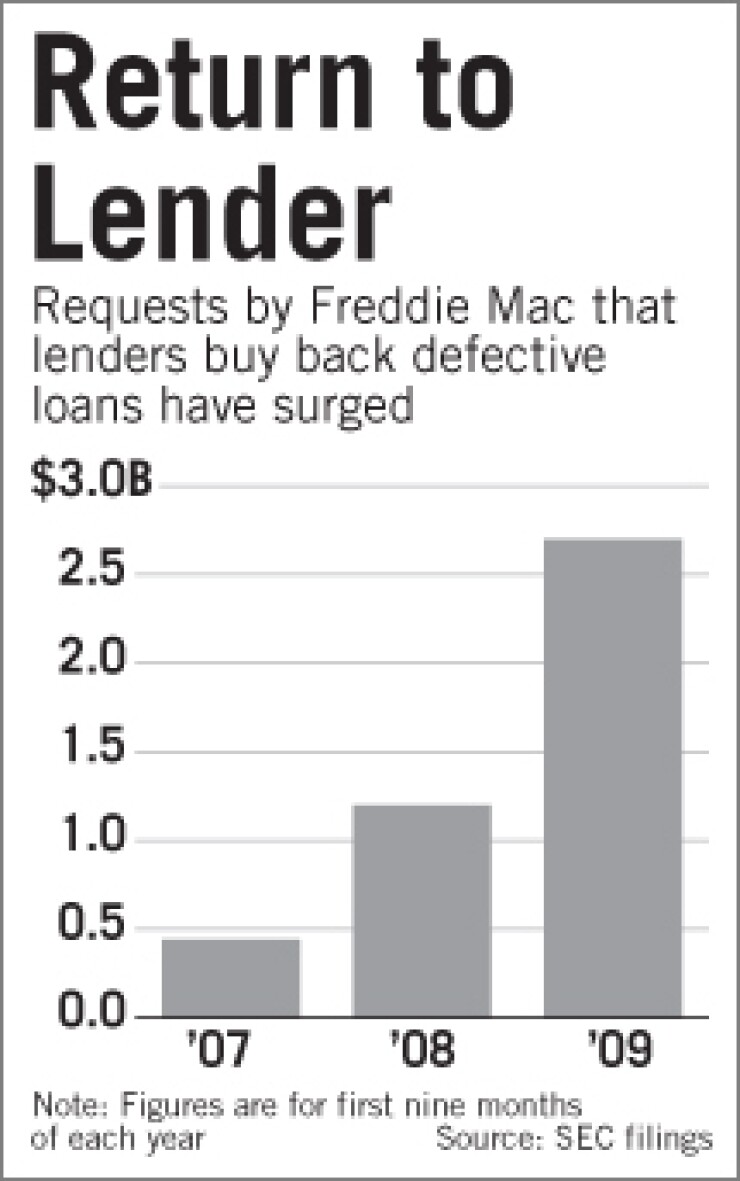

According to Securities and Exchange Commission filings, Freddie made lenders buy back $2.7 billion of mortgages in the first nine months of last year, more than six times the figure of two years earlier. Fannie does not disclose its volume of repurchase requests but has said that there has been a "substantial increase" in them since 2008, and that it expects these requests to remain high into this year.

Some large servicing deals are getting done, but mostly on portfolios that have to be sold because the seller is either out of business or desperately needs the cash.

Milestone Merchant Partners of Miami is premarketing a $20 billion package of mortgage servicing rights that belonged to the now-defunct AmTrust Bank of Cleveland.

The portfolio is the property of the Federal Deposit Insurance Corp., which seized control of AmTrust in December. Most of the thrift's assets were sold to New York Community Bancorp, but not its servicing portfolio.

Flagstar Bancorp of Troy, Mich., is offering a package of servicing rights on $10 billion of Fannie Mae loans.

The thrift has declined to talk about the sale and neither will its investment banker, Interactive Mortgage Advisors of Denver.