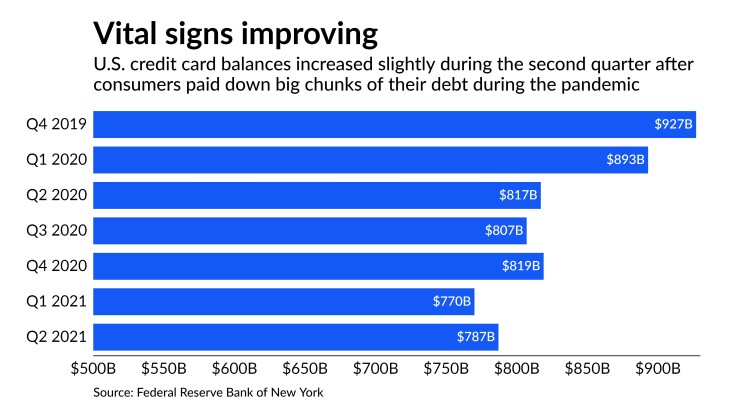

After a year in which consumers paid down big chunks of their credit card debt, loan balances rose slightly last quarter, suggesting the return of more normal borrowing patterns.

U.S. card balances outstanding in the second quarter totaled $787 billion, a 2% increase from the first quarter, according to a report released Tuesday by the Federal Reserve Bank of New York. Card loans remained far below their peak of $927 billion in the fourth quarter of 2019.

The findings back up recent comments by bank executives about signs that card balances are finally starting to rebound.

“We do expect consumer lending to get a little bit stronger,” U.S. Bancorp Chief Financial Officer Terrance Dolan said during the company’s earnings call last month. “In the credit card space, we saw some nice growth rate at the end of the June timeframe.”

The uptick in outstanding credit card debt was driven by a combination of stronger consumer demand and a bigger credit supply from card issuers, New York Fed researchers said. In the second quarter, credit limits on cards rose by $36 billion to $3.87 trillion, according to the report.

In addition, consumer credit inquiries within the last six months rose after hitting a trough in the first quarter, the report found.

Card balances shrunk during the pandemic as many consumers paid down existing debts with government stimulus payments, savings from their reduced spending and funds that they had accumulated as a result of forbearance on other loans.

But as many Americans became vaccinated this year, growth in consumer spending has buoyed hopes in the card industry that loan growth will follow.

U.S. consumers have built up the capacity to spend, said Brian Wenzel, the chief financial officer at the credit card issuer Synchrony Financial. He noted in a recent interview that customers continued to pay off an elevated percentage of their debt, but said that number has fallen a bit from its peak in March.

Overall, household debt in the U.S. rose by 2.1% to $14.96 trillion between the first and second quarters, the New York Fed report found. Higher balances in credit cards, mortgages and auto loans more than offset a decline in outstanding student debt.

The quarterly report is based on a nationally representative random sample of anonymized debt and credit records from Equifax.

Polo Rocha contributed to this report.