Last year Cornhusker Bank in Lincoln, Neb., launched a debit card reward program for the usual reasons — generating more interchange income and more opportunities to cross-sell customers.

But the $263 million-asset bank is getting a side benefit from increased debit card use: more overdraft protection fees.

Cornhusker's income from nonsufficient fund fees rose 10% last year, to $1.1 million, and a good deal of that increase came from the fact that debit transactions doubled from the previous year, said Cindy J. Draper, vice president of retail banking and marketing.

"We're not out there saying, 'Please overdraw your account, and we'll reward you,' " Ms. Draper said. "It's just a side impact that happens when people are more active with their accounts, and they know we'll cover them."

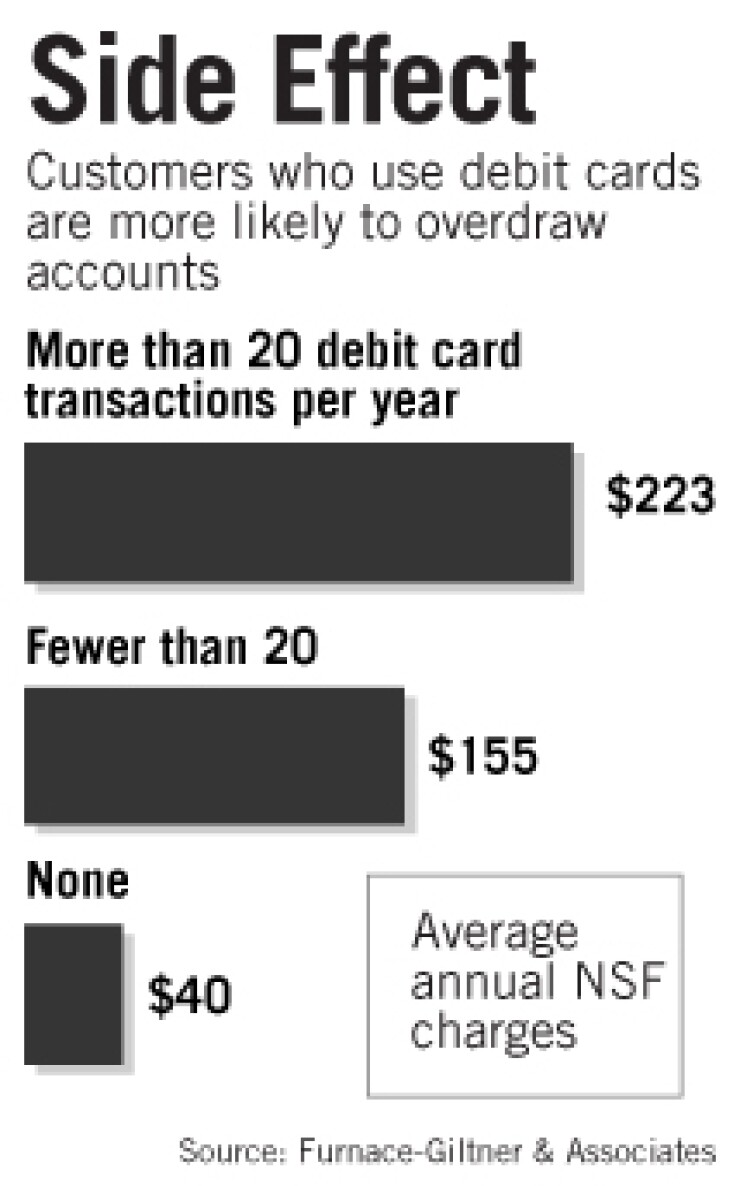

David Furnace, the chief executive of Furnace, Giltner & Associates Inc., an Austin firm that administers debit reward programs for Cornhusker and other banks, says there is a correlation between debit card use and overdraft fees.

His firm studied 50 banks with $50 million to about $25 billion of assets and concluded that customers who used their debit cards fewer than 20 times a year paid an average of $155 of NSF fees, while those who used their cards more than 20 times paid an average of $223. Customers who did not use their debit cards were charged an average of $40 of NSF fees a year.

The typical fee for overdrawing an account is $25, Mr. Furnace said.

"That's another source of fee income at a time when banks are seeing margins squeezed and net interest income declining," he said.

Consumer groups do not see it that way.

Gail Hillebrand, a senior attorney in the San Francisco office of Consumers Union in Yonkers, N.Y., said her group has been receiving more and more complaints from consumers dinged with $25-plus fees for inadvertently overdrawing their accounts with very small expenditures using their debit cards.

"There's something wrong when a customer buys a $2 cup of coffee and gets charged a $25 overdraft fee," Ms. Hillebrand said. "I think the NSF fee should never be more than the amount of the overdraft."

Last month, Rep. Carolyn Maloney, D-N.Y., reintroduced legislation to prevent banks from charging overdraft protection fees unless customers ask for the protection. The bill is cosponsored by House Financial Services Chairman Barney Frank, D-Mass., and Rep. Julia Carson, D-Ind.

Still, Ms. Draper said a number of Cornhusker's customers have actually thanked the staff for offering overdraft protection. "They tell us that they don't mind paying the fees. They just want their items to be paid, because they don't want to be embarrassed bouncing a check."

Tony Hayes, a vice president at Dove Consulting Inc., a Boston division of Hitachi Consulting Corp., said that even though fee income — from both interchange and NSF fees — may be one reason banks launch debit reward programs, banks mainly benefit from the boost in customer retention.

"Active debit card users in these programs are much more loyal to the bank than other customers," Mr. Hayes said. "Customers are loath to leave the bank and walk away from all of those rewards they have accumulated."

That is why debit reward programs are becoming increasingly popular at banks, he said. The percentage of financial institutions offering them rose to 37% this year, from about 24% in 2003, according to a Dove study released Wednesday that was commissioned by Morgan Stanley's Pulse EFT Association.

According to Ms. Draper, Cornhusker's program has helped boost its customer retention rate. In 2005 the bank on average was closing more accounts than it was opening each month, for a net decrease of 18 accounts a month. Last year it gained a net average of 23 accounts a month, and Ms. Draper said she strongly believes the reward program has been a huge factor in both attracting and retaining customers.

Mr. Furnace said that some banks have told him it is difficult for them to operate a debit reward program profitably. He contends that many banks are not encouraging enough use, because they are touting rewards that can seem unattainable. For instance, he said he would receive a free airline ticket from his bank — if he spent $100,000 using his debit card.

"This is not about having to do an activity for years to get a reward. It's about changing behavior one month at a time and then immediately giving customers a reward, like a Smoothie maker," he said. "That's the concept that many banks are missing."