A proposed 20-year government-backed mortgage program could allow new homeowners to build wealth twice as fast as they would with a traditional 30-year loan.

However, industry participants question whether this is the best way to help minorities and low-income families

The Low-Income First-Time Homebuyers Act, LIFT for short, sponsors are all Democrats: Sens. Mark Warner and Tim Kaine of Virginia; Raphael Warnock and Jon Ossoff of Georgia; and Chris Van Hollen of Maryland.

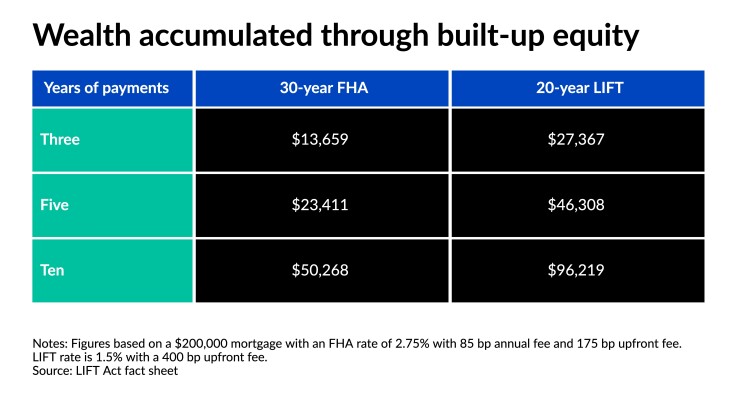

LIFT would allow eligible first-time, first-generation borrowers to build equity twice as fast as they would with a traditional 30-year Federal Housing Administration loan, by waiving the annual fee and offering a lower interest rate but paying a higher upfront fee and a slightly higher monthly payment overall.

The fact sheet for the LIFT Act provides a scenario comparing the traditional 30-year FHA loan against the LIFT proposal: a $210,000 property for which the borrower puts down $10,000 (slightly less than 5%) and takes out a 30-year FHA loan at 2.75% — with an annual fee of 85 basis points and an upfront fee of 175 bps — would result in a payment of $970 per month.

In the proposed LIFT program, the borrower gets a 20-year FHA loan at 1.5%, with a 400 bps upfront fee but no annual fee. The payment is $1,004 per month.

After 10 years of payments, the LIFT borrower would have $96,219 in equity, compared with $50,268 for the 30-year FHA mortgage.

While some industry figures applaud the idea, they’re not throwing their wholehearted support behind it.

The LIFT plan echoes something already in the budget reconciliation proposal before Congress, which would provide $500 million to subsidize 20-year mortgages for first-generation homebuyers in order to accelerate the development of home equity.

Also, another piece of the budget reconciliation proposal involving down payment assistance would have a more immediate impact on addressing housing affordability problems, said Doug Ryan, interim vice president for policy and applied research at Prosperity Now, a nonprofit group dedicated to increasing economic opportunity for low-income families.

"Our position" is that a wealth-building mortgage or LIFT "should not be part of conciliation," Ryan said. "That doesn't mean that on paper, it's not worth pursuing otherwise, but right now reconciliation is the only game in town, and we feel that the commitment to down payment assistance is a priority.”

Congress likely won't have the appetite to pursue the LIFT Act once the budget reconciliation is complete, he added.

And while using some of the profits being generated from the FHA and Ginnie Mae to help homeowners build equity makes sense, there are other more efficient ways of doing so, said Scott Olson, executive director of the Community Home Lenders Association.

"Secretary [Marcia] Fudge could make this happen immediately — just end HUD's policy put in place in 2013 to charge FHA premiums for [the]

In an example from CHLA, a $200,000 loan with 3.5% down ($7,000) has an upfront FHA premium of $3,436.61. Including the 85 bps monthly fee, the total premiums paid until the loan reached a 78% loan-to-value ratio would approach $20,000 and if the loan runs the full term, it would be over $35,000 of potential savings.

While the Mortgage Bankers Association did not comment on the LIFT proposal, it gave a tepid response to the similar wealth-building component in the reconciliation proposal. In a letter sent Sept. 13 to House Financial Services Committee Chairwoman Maxine Waters, D.-Calif., and ranking member Patrick McHenry, R.-N.C., they wrote "while MBA appreciates this section's intent, we note, however, that this program has significant operational complexities and more limited borrower appeal (to be determined by the extent to which the monthly payments would differ between the 20-year and 30-year options) when compared to the forgivable grants," for down payment assistance included in the reconciliation bill mentions, the organization's comment letter said. It did not comment on LIFT.

Taking a more positive view of the proposal is Marvin Owens, chief engagement officer of Impact Shares, whose products include an exchange-traded fund that invests in agency mortgage-backed securities that invest in affordable housing.

"This much needed innovation to the FHA lending program … shows that Congress can think creatively about solutions to this persistent problem," Owens said. "What's more, the program also recognizes the important role that capital markets play as we work to level the playing field of opportunity for all Americans."

After the LIFT loan is originated and then securitized through Ginnie Mae, the Treasury then would buy the loan at a premium, in order to compensate the lender. It would then turn around and resell the securities at below par into the fixed-income market.

While the bill mentions participation by both the FHA and the U.S. Department of Agriculture Rural Housing Service, it does not include Veterans Affairs.

"The mechanics of securitizing these targeted pools of mortgages is in alignment with our existing Impact Shares Affordable Housing MBS ETF," Owens said. "LIFT affirms our strategy and we look forward to even more ways to build upon public/private partnerships in creating solutions to closing the racial wealth gap."

Ginnie Mae does not comment on pending legislation, a spokesperson said.

While it’s a positive to see the focus on affordable homeownership, "there are so many pieces to this. It's a really complex, complicated problem," Ryan said.

Meanwhile, the Senate has yet to approve

"These are pieces of the puzzle that need to be filled out to help pursue the administration's goals of expanding homeownership, those key administrative posts being part of this. I would like to see the Senate focus on that," he said.