Dime Community Bancshares and Bridge Bancorp are sticking with a traditional playbook for their

The companies will rely on a bigger branch network and more lending capacity to build a sizable bank around New York City. And they plan to reduce technology costs, with no expected branch closings, at a time when other deals have been built around fewer physical locations and more tech spending.

The approach seems outmoded as the coronavirus pandemic steers more banks and borrowers to digital channels.

"The old-school community model is still on their minds," said Chris Marinac, an analyst at Janney Montgomery Scott.

"I admit it is strange and the opposite of what other people have been doing," Marinac added. "Then again, New York is a different market. It's highly concentrated. It will come down to execution."

Executives said during the call that the merger was long overdue, adding the intensifying pandemic would not deter them from making it happen.

“Why should we stop now?” Bridge CEO Kevin O’Connor said during the call. “Why should we not take advantage of the value that’s here? This is a way for us to deliver value to our shareholders, so we should strike now.”

The merger “leapfrogs our strategic plan by three or four years,” added Kenneth Mahon, Dime’s CEO. “It gives us a larger capital base and improved pretax, pre-provision earnings, as well as better positioning the company to meet the challenges of COVID and the recession.”

The announcement caught industry observers flat-footed.

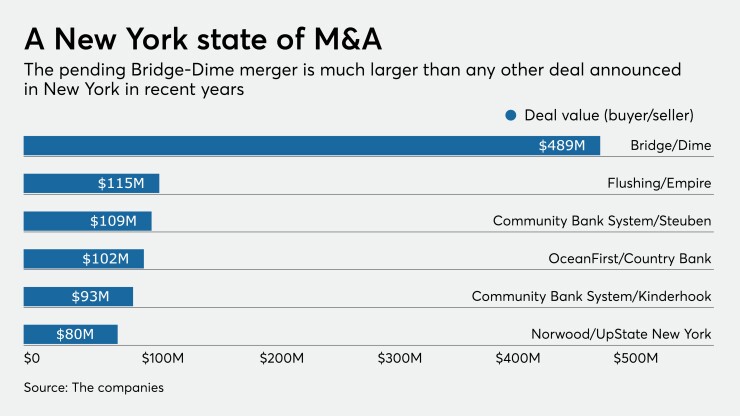

Overall consolidation has languished since March and at least six proposed deals — including the

"We are surprised to see a merger announced at this stage of the pandemic and overall economic cycle,” Collyn Gilbert, an analyst at Keefe, Bruyette & Woods, wrote in a Thursday note to clients.

Will Curtiss at Hovde Group was also taken aback by a large deal being announced in an “uncertain operating environment” at a time when “deal activity in the space has been modest at best.”

While the game plan is traditional, the process of striking a deal was anything but that.

Dime and Bridge, both based on Long Island, had to scrap face-to-face negotiations that began last fall as the pandemic forced New York to shut down. Most of the due diligence had to be conducted remotely.

In addition to their own reviews, the companies hired an outside consultant to conduct remote evaluations of each loan book, O’Connor said.

Each company also juggled negotiations and due diligence while participating in the government’s Paycheck Protection Program. Bridge has made about 4,000 PPP loans, while Dime has originated nearly 1,700 loans under the program.

The companies could face challenges as they navigate the approval process in the midst of a pandemic and look to integrate their banks and grow at a time when interest rates are expected to remain at historic lows for another year or more.

While the $6.3 billion-asset Dime has spent recent years reducing its dependence on commercial real estate, notably multifamily lending, its ratio of CRE to total risk-based capital was 556% on March 31. Its ratio will still remain above 500% after merging with the $5.1 billion-asset Bridge.

Commercial real estate, as a percentage of total loans, will fall from 61% to 44%, and executives plan to reduce that amount even more after the deal closes.

The goal is to push the ratio of CRE to total risk-based capital closer to 400%, Stu Lubow, Dime’s president, said during Thursday’s call. “We think we can get there very quickly,” he said.

Still, regulators tend to give extra scrutiny to banks with ratios above 300%, which can include reviews of mergers.

O'Connor acknowledged that on Thursday, but he said the companies were ready for any attention that comes their way. "We've both been exposed to heightened scrutiny," he said.

Dime and Bridge are hopeful that increased scale will help them counter a low-rate environment.

“We both have customers we’re struggling to serve at our current size,” Lubow said, adding that becoming an $11 billion-asset company should help the merged bank retain clients and attract new middle-market customers, especially in Manhattan.

New York is a crowded market, and a number of its banks have assets of $10 billion to $50 billion.

Long Island, however, is a consolidating market. Several banks there — Suffolk Bancorp, Gold Coast Bancorp and Empire Bancorp — have been sold or have agreed to be sold in recent years.

Credit quality is another area to watch, industry observers said.

The companies have granted forbearance on $1.7 billion in loans, or nearly a fifth of their combined portfolio, Marinac said. But the merger’s 2.1% credit mark “signals confidence that these high loan deferrals return to full payment status” before the deal closes early next year.

“Executing on credit is key to any merger, especially here,” Marinac added. "You have to assume that forbearance will stick around in some fashion."