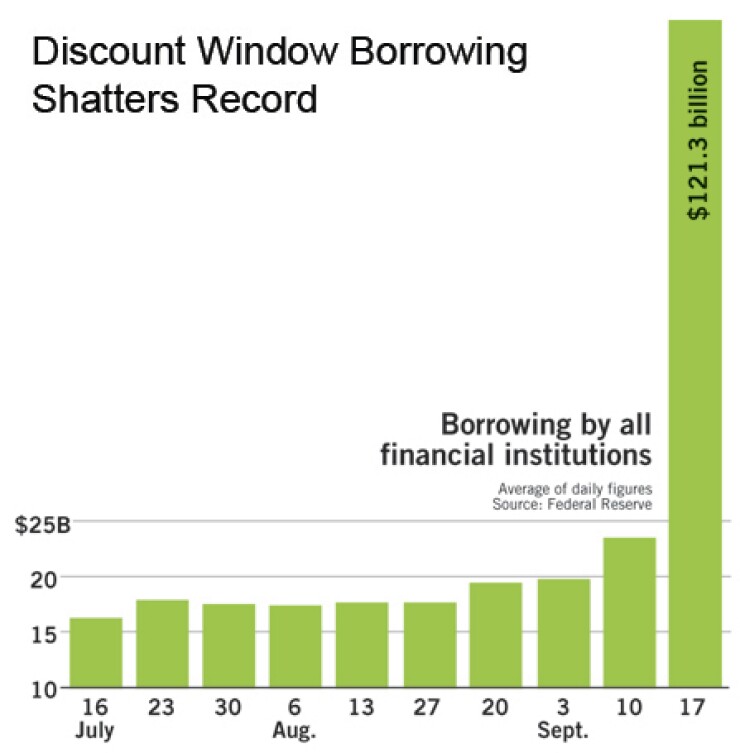

WASHINGTON — During a week that witnessed the collapse of a major investment bank and the bailout of the world's largest insurer, lending through the Federal Reserve Board's discount window shattered all records, totaling $121.3 billion Wednesday.

With Wall Street staggering, investment banks ended their 11-week boycott of the window and borrowed $59.8 billion. The Fed does not disclose the identities of its borrowers, but the dramatic spike was during the same week Lehman Brothers filed for bankruptcy protection and Merrill Lynch & Co. made a deal to sell itself to Bank of America Corp.

Loans to commercial banks jumped 42%, to a record $33.4 billion. The previous record of $23.5 billion was set last week.

The bulk of the balance went to American International Group Inc. The Fed said the insurance company had borrowed $28 billion of the $85 billion rescue loan it arranged Tuesday.

In a sign of the stress the industry endured during the past week, the Fed also said it distributed $18 million in the form of secondary credit to weak institutions. The central bank last made loans to weak banks July 23, when it distributed $60 million.

The remaining $95 million was sent to banks in rural or resort regions.

The vast majority of the loans — $101.2 billion — were short-term ones scheduled to mature within 15 days. The remaining $20 billion will come due in 16 to 90 days.

Since the Federal Reserve Bank of New York is taking the lead on lending to investment banks and AIG, it dominated the discount window, lending $112.3 billion of the total.

The San Francisco Fed came in second, with $3.7 billion, versus $4 billion a week earlier.

The discount window has emerged as the central bank's primary tool to fight the market turmoil.

Since the credit crunch began the Fed has narrowed the spread between the discount rate and the federal funds rate from 100 to 25 basis points.

The central bank has consistently resisted calls to bring the discount rate below the fed funds rate, most recently Tuesday, when its policymaking committee elected to keep rates unchanged.

But as the turmoil has broadened in the past 13 months, the Fed has widened the scope of the discount window. Investment banks gained access in March after the collapse of Bear Stearns Cos. Lending peaked at $37 billion on March 26.

The Fed has also become more liberal in its acceptance of collateral that can be sent to the discount window.

After initially taking only the highest-grade assets, the Fed said Sunday that it would begin taking more forms of collateral, most notably equity holdings.

The discount window has been complemented by cash and securities auctions. The last cash auction, held Sept. 9, was worth $25 billion.

It attracted 53 bids worth $46.2 billion. And the New York Fed said it auctioned $24.9 billion of Treasury securities Thursday.

The Fed's rapid expansion of its liquidity facilities has raised concerns that it might be devoting too much of its balance sheet to helping banks.

The Treasury Department said Wednesday that it would essentially backstop the liquidity programs by selling bills on the open market and sending the cash generated to the New York Fed.