Banks have waited a year for loan demand to come back, and investors are eager to see if any progress has been made.

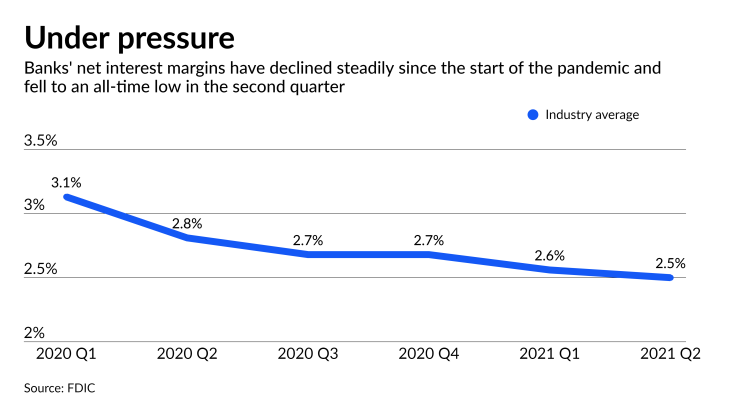

A rebound in loan growth is vital to propping up net interest margins, which fell to all-time lows in the second quarter, and to bolster profitability, which has been sluggish for much of the last two years.

“It’s loan growth, loan growth, loan growth — those are the three themes for earnings,” said Brad Milsaps, an analyst at Piper Sandler. “It’s key to start building back the margins.”

Federal Reserve policymakers slashed interest rates to near zero shortly after the

At the same time, as both consumers and businesses hunkered down amid the pandemic and saved cash, they stashed away more money in their bank accounts and put off plans to borrow. This left banks flush with deposits yet with relatively

The result: In the second quarter, banks’ average net interest margins contracted 31 basis points from a year earlier to 2.5% — the lowest level on record, according to the Federal Deposit Insurance Corp.

“The big concern is that there’s just not enough loan growth to sop up that liquidity,” Milsaps said. “It’s tough to see margin pressure easing for a lot of banks, but we could see some signs of improvement.”

Pandemic pressure

After successful vaccination rollouts last spring and into the summer, hopes were running high that Americans would spend more of their savings and begin to borrow again for travel and big-ticket purchases. Business would follow suit to meet higher demand, the thinking went.

Analysts say there were positive indicators over the summer — notably, strong economic growth in the second quarter. Gross domestic product accelerated 6.7% on an annualized basis in the period, even better than the 6.3% rise in the first quarter, according to the U.S. Commerce Department.

But the delta variant of the

Americans “have grown more cautious and are likely to curtail spending going forward,” said Lynn Franco, senior director of economic indicators at the Conference Board.

Milsaps said that the delta variant makes third-quarter earnings “a bit of a wild card.”

Banks in markets with rising populations, high vaccination rates and corresponding economic growth could report increases in loan demand, Milsaps said, while those in areas harder hit by the delta variant may not.

Loan growth is particularly crucial for community banks, most of which generate the bulk of their income on interest from loans. For the second quarter, banks with $10 billion of assets or less reported a 0.5% decline in loan balances from the previous quarter, FDIC data shows.

Shan Hanes, the president and CEO of the $133 million-asset Heartland Tri-State Bank in Elkhart, Kansas, said loan demand looked promising at the start of the quarter. But, he said, “This new variant is a threat to people’s mindsets and sentiment. That affects loan demand, and growth can be tough.”

Growth alternatives

Robert Bolton, the president of Iron Bay Capital, a firm that invests in banks, said those banks that are unable to meaningfully increase loan balances will be under pressure to beef up businesses, such as insurance or wealth management, that generate fee income, hiring bankers who can bring business with them, or merge with other banks.

“Either you start to get that lending momentum going or you find the growth somewhere else,” Bolton said. “People are starting to expect that banks turn a corner in the second half” of 2021.

Jon Winick, the CEO of the bank consultancy Clark Street Capital, agreed.

“I do think we are going to see more of a divide between the winners and laggards on loan growth,” he said. What investors will be watching for, he added, is how the laggards can make up for the lack of volume.

The $18.9 billion-asset United Community Banks in Blairsville, Georgia, has been buying both banks and fee-based businesses.

Last week, it completed its acquisition of the $750 million-asset

Raymond James analyst Michael Rose expects “robust” M&A levels through 2022 as banks look to offset the effects of "near-zero interest rates, subdued growth opportunities, and upward expense creep” driven by