Boston Private Financial Holdings' new CEO has an aggressive plan to rebuild the bank’s wealth management business that relies more on hiring well-connected financial advisers and less on acquisitions.

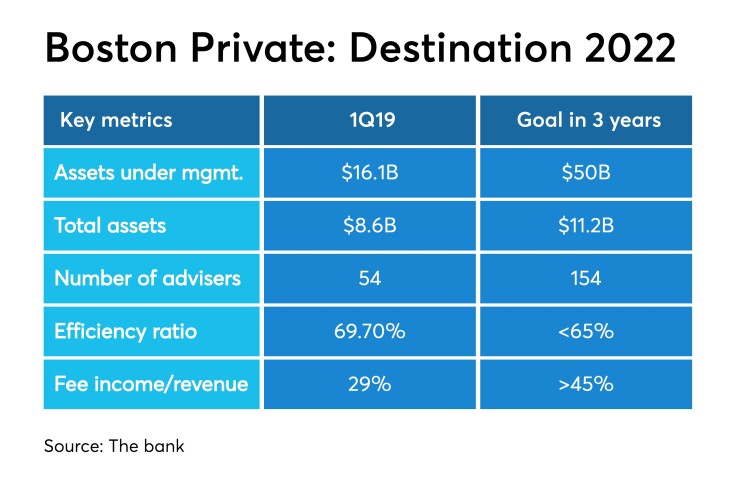

Anthony DeChellis has set several numerical goals for the next three years, but chief among them is to take assets under management from $16 billion to $50 billion. To do that, he plans to hire 100 financial advisers by 2022, mostly veterans of the business who could bring their clients with them to Boston Private; right now it has about 60 advisers.

Investors have reacted coolly to the plan so far. Boston Private’s stock has fallen 3.8% since DeChellis outlined his vision at a recent investor day. Most analysts seem to be adopting a wait-and-see attitude.

The reason for the mixed reviews? While big-city markets can offer a big payoff, they can also be highly competitive for smaller banks. Boston Private has just $8.6 billion in assets and is battling against much larger banks in its major markets, which besides New England include New York, Los Angeles, San Francisco and some upscale Florida cities.

Yet some observers say the assets-under-management target, though daunting, is feasible and that DeChellis needs to set aggressive goals to differentiate himself as a leader. Even skeptics say that if anybody can pull off such a challenging plan, it could be DeChellis, who has big-bank experience and connections to the wealth management business.

“You have to position your company with a bold move,” said Chris Marinac, an analyst with FIG Partners in Atlanta. “Maybe it is audacious, but I think he has to be given the circumstances. This is a company that’s needed a shot in the arm, and it’s an opportunity for him personally.”

DeChellis

Deutsch made just one acquisition,

Fee income from its wealth, investment management and private banking businesses fell 38% year over year to $24.3 million in the first quarter. Overall profits fell 7% to $19.4 million.

Now, DeChellis is tasked with reversing that decline. In an interview with American Banker, he said Boston Private is in attractive markets with plenty of room to grow. Furthermore, he predicted Boston Private will be an attractive proposition for advisers interested in leaving money center banks but deterred by the overhead required to start their own firms.

“A lot of them do that because there are some challenges inside a big organization, [such as] making your clients feel like they’re receiving boutique-type services. One of the other big challenges is, when you have four megabanks as we have now and you’re an adviser trying to grow your business, you will frequently run into people who already have a relationship with your firm,” he said.

Boston Private can offer them the technology and back-office support they would otherwise have to build from the ground up in starting their own firms, he said. Boston Private also has basic banking products those advisers can pitch their clients, whereas independent shops have to find banking partners for such things.

Christopher McGratty, an analyst at Keefe, Bruyette and Woods, said this is where DeChellis’s big-bank experience and connections will be useful.

“I imagine the prospect is, ‘We’re small, we’re nimble, we’re growing, we have an entrepreneurial environment. If you want to get away from the big banks, come on in and we’ll give you some freedom,’” he said. “He is clearly there to grow the business and grow the company.”

DeChellis is open to buying a small firm, but he said an acquisition may not be necessary. Prices are prohibitive at the moment, and an acquisition would have to be a good cultural fit, too, he said.

Most of DeChellis’ goals are less ambitious than his aim to triple assets under management. He wants balance sheet assets to rise to $11.2 billion by 2022 from $8.6 billion at March 31, and he expects much of that to be linked to growth in the bank’s wealth businesses. For example, new wealth or private banking clients who run a professional services firms might decide to move their business accounts to Boston Private, too.

And while he does not rule out a geographic expansion should the right opportunity come along, he said he does not think that will be necessary, either. Boston Private has already established a presence in five of the top 10 markets for high-net-worth households and should have “lots of room to grow,” he said.

Yet those are challenging markets, and competition is stiff for clients and talent alike. Greater Boston alone has an abundance of banking options, including

Boston Private’s stock price has fallen 17% since DeChellis was named CEO, but analysts say this likely is not a sign of a lack of confidence in the choice. More likely, it is because Boston Private was widely viewed as an acquisition target at one point, and DeChellis’ appointment as CEO sent a strong signal that the bank was not for sale.

“I think that before Clayton Deutsch left, there was a perception the company was for sale,” said Alexander Twerdahl, an analyst at Sandler O’Neill. “A lot of people made the assumption the prior CEO was going to clean up the shop, streamline it and sell it. I think all that takeover premium has come out since November.”

The big question now for investors and analysts will be whether DeChellis can deliver on his targets. Marinac remained upbeat, saying that even if Boston Private only gets halfway to its target in two years, that will still boost profitability.

“My attitude is, if you put a goal out there and you only get partially there, it’s still progress,” Marinac said.