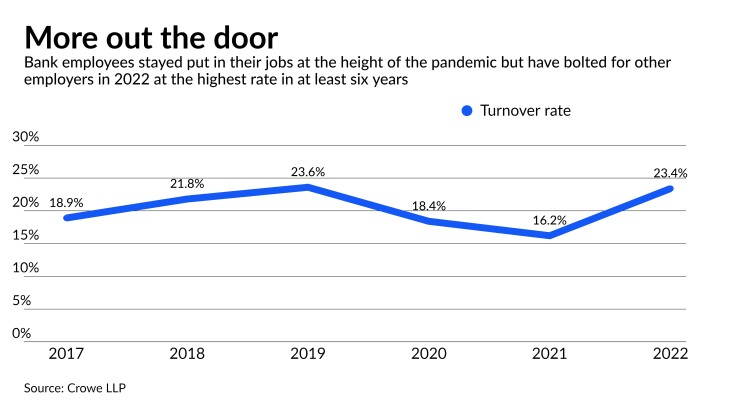

Employee turnover has soared at banks of all sizes this year amid a tight labor market and fierce competition for talent, a new study shows.

The average pay for front-line bank staff has risen 5% this year, yet the turnover rate for the same group shot up to 23.4% from 16.2% in 2021 — its highest point since 2019, a

Crowe, an accounting and consulting firm with a prominent financial services practice, compiled data from 429 financial service organizations this year as part of a survey it has conducted for more than four decades.

"The data shows it is becoming increasingly difficult for banks to retain and recruit talent," Thomas Grottke, a managing director specializing in financial services consulting at Crowe, said in a report.

"The industry cannot compete for talent based on compensation and benefits packages alone, so organizations must work to improve their training programs and culture," he said. "Banks have had success in doing so by engaging their staff in innovation teams, new projects and initiatives; and utilizing automation to help streamline mundane processes."

However, with unemployment low and recruiters circling not just from competitors but also companies in other industries, elevated turnover rates could persist.

The

With the highly competitive job market, the top five human resource management issues were related to finding, motivating and developing the right people, according to Crowe. Its survey found that "finding and hiring the right people" was top of mind for 95% of respondents.

The survey also found that 54% said retaining young talent is "somewhat challenging," up 19% from 2021.

For their part, growth-minded banks are

B.J. Berrettini, a recruiting manager for the search firm AJ Consultants, said in a recent interview the trend is snowballing.

"One A-player lender changed institutions, then another and another, until a few 'lifers' started to reevaluate their priorities and developed a wandering eye. Movement always begets movement," he said.

The $40 billion-asset Pinnacle Financial Partners in Nashville, Tennessee, is among the most active on the hiring front.

"In truth, hiring bankers who have been handling a book of business for decades is the single best mechanism with which I'm familiar to ensure better client selection, and better client selection is how loan quality is produced," Pinnacle President and CEO Terry Turner said on the company's second-quarter earnings call.

Pinnacle has recently hired bankers to expand in Georgia, Alabama, Kentucky and the District of Columbia, among other markets — often drafting lenders away from peers.

"We're hiring record numbers of bankers and wealth managers, both in the new and existing markets. We've hired 334 revenue producers since 2019." That's "a huge lift in market share moving capacity," Turner said. "Year to date through June of this year, we've hired 65 with 37 of those in" the second quarter. "So you can see the momentum continues to build."

Such aggressive hiring is paying off for the likes of Pinnacle but is creating turnover challenges for others, Berrettini said.