The trend has been clear for years, but LendingClub Corp. confirmed this week that it is getting out of the business of peer-to-peer lending.

The San Francisco-based fintech, which is in the process of acquiring Radius Bancorp in Boston, said that retail investors will soon lose the ability to fund consumer loans on its platform. The decision marks the end of the 14-year-old company’s original vision: to serve as a matchmaker between individual savers and borrowers.

The move announced Wednesday is tied to the firm’s work with regulators to devise a product suite for the company following the acquisition of the $2.2 billion-asset Radius, LendingClub said in an email to its retail investors.

For LendingClub, the costs of enabling everyday Americans to invest in consumer loans have been substantial.

Some of that spending arose from scrutiny of the peer-to-peer model by the Securities and Exchange Commission in 2008 that led to LendingClub’s temporary shutdown. There are also the costs of answering questions from individuals who may be investing as little as $1,000.

“It’s hard to scale a business that has just lots and lots of small investors,” said Peter Renton, a longtime investor on the LendingClub platform and a co-founder of a conference for the online lending industry, LendIt Fintech.

Renton made his first investment on the LendingClub platform in 2008, using $55,000 from an individual retirement account. He said Thursday that he plans to keep reinvesting until LendingClub discontinues the peer-to-peer model in December.

Renton said that he has been averaging returns of 6% to 7%. He plans to divert some of his dollars to Prosper Marketplace, a smaller platform that competes with LendingClub. He also expects to move some of his money to other sectors, such as real estate.

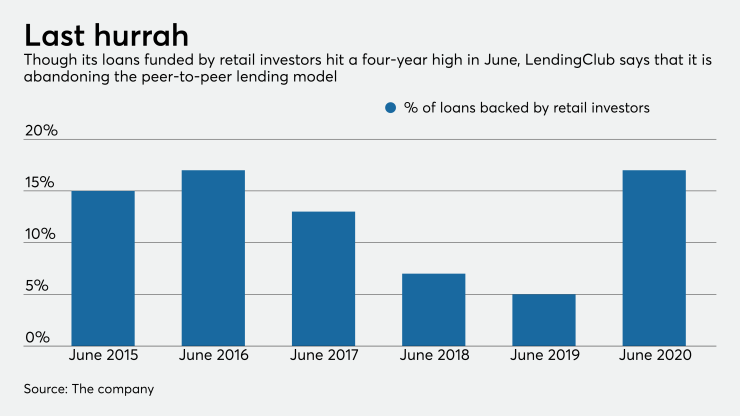

While LendingClub was born as a peer-to-peer loan lender, its rapid growth last decade was fueled by backing from hedge funds, banks and other institutional investors. In recent years, the everyday investors have typically funded less than 10% of LendingClub’s loans, though that percentage rose in the second quarter of this year as the pandemic-induced recession scared away some larger investors.

LendingClub, which offers loans that consumers often use to consolidate credit card debt, is hoping to maintain relationships with retail investors. The company said that it will launch a high-yield savings account that will initially be available only to its existing retail clients, who will be able to automatically transfer cash from their investment accounts on a weekly basis.

But a savings account, even one that offers industry-leading yields, is not a substitute for the larger returns that LendingClub investors currently collect. “They’ve just lost a lot of goodwill with that investor base,” Renton said.

LendingClub hinted this week that it wants to find new ways to appeal to its retail investors. The company said that it is scoping out new products that would operate under the “prospective banking framework” and that it would “retain the peer-to-peer spirit” of the platform that will be discontinued.

“LendingClub plans to offer a full suite of products as a bank,” the company said in a securities filing Wednesday. It mentioned “products that take advantage of the marketplace to allow its customers to both pay less when borrowing and earn more when saving.”

In a blog post Wednesday, Renton described a few different approaches that LendingClub could potentially take. One suggestion was a product that would not have federal deposit insurance, and would pay 3% to 4% interest with a floor of 2%. But Renton acknowledged that any new products from LendingClub will have to get the blessing of banking regulators.

LendingClub is aiming to close the Radius acquisition, which was announced in February and was valued at $185 million, sometime in the first half of next year.