-

WASHINGTON — State regulators in Georgia closed the $125 million-asset Hometown Community Bank in Braselton late Friday, stretching the industry's failure toll this year to 50.

November 16 -

In inaugural meeting for directors Hoenig and Norton, agency's staff outlined further reductions in projected losses from bank failures.

April 23

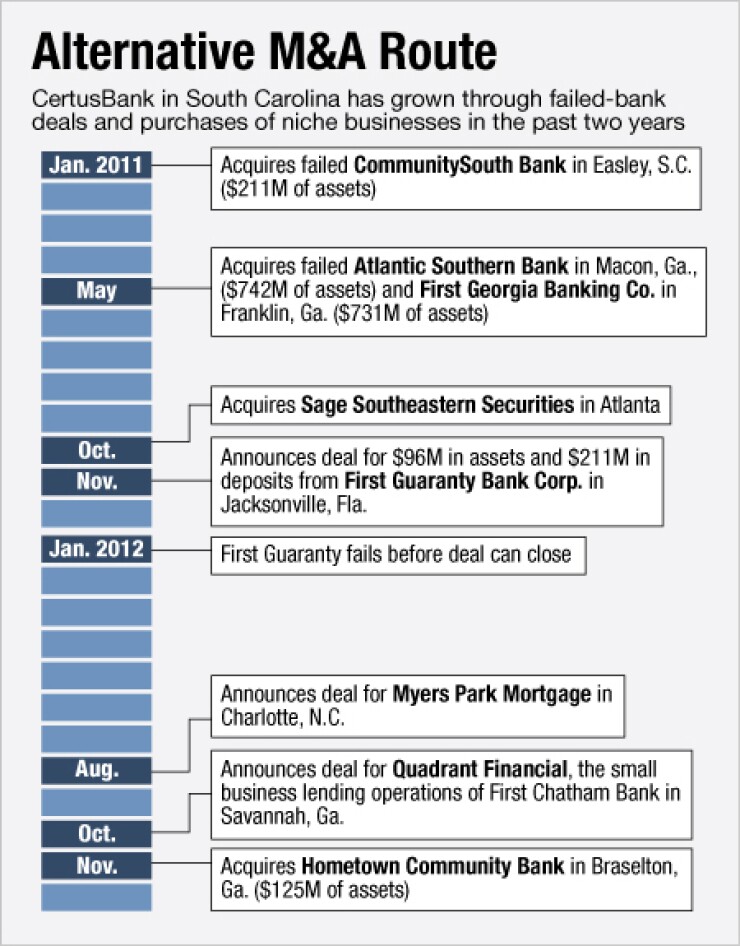

CertusBank has returned to the failed-bank-deal game.

After spending nearly 18 months on its sidelines, the Greenville, S.C., company this month

CertusBank, with $1.8 billion of assets, was one of several companies formed in 2009 and 2010 to buy failed banks. Its parent company, CertusHoldings,

However, CertusBank executives kept busy during the long hiatus since their last one. They integrated three failed banks and bought three niche businesses to supplement net interest income.

Co-chief executives Charles M. Williams and Walter L. Davis discussed their M&A outlook for 2013 and their views on the possibility of going public in an interview this week. The following is an edited transcript:

Hometown Community Bank is your first bank deal with the FDIC in a year and half. Why the gap?

CHARLES WILLIAMS: It was two things. For one, there were not a lot of banks in our footprint that the FDIC pulled into the receivership process. There were not a lot for us to consider.

Also, the regulators wanted to make sure we had the infrastructure in place before we went back out and looked at other banks. They want to see how you're absorbing the bank. We went from zero to $2 billion in assets very quickly, so as part of our normal CAMELS review, they came in and examined us and ultimately allowed us to continue looking.

WALTER DAVIS: We also wanted to get on one platform, as well. We come from institutions where we did a lot of M&A and ended up with multiple systems at one time. We decided early on that it was important for us to get on one.

How many banks have you bid on between the May 2011 deals and Hometown?

WILLIAMS: We've bid on a total of six, [there were] so two in the interim that we didn't win.

The Hometown deal did not include a loss-sharing agreement with the FDIC. Why not?

WILLIAMS: We've been in the Georgia market for some time. We know how it is performing, and we felt comfortable with our ability to manage the risk. Also, loss share is somewhat confining. You have to work within the FDIC guidelines and have less opportunity to work out a problem quickly. It is also a very, very small bank.

I've heard that

DAVIS: No, I think it is what Charlie said. We haven't had any conversations about winding up loss share. If there are other opportunities, we may bid with loss share if it is appropriate.

Hometown is the 50th bank to fail so far in 2012. That compares to 92 failures in 2011 and 157 in 2010. What are your expectations for failures in 2013?

WILLIAMS: We think there will be more in 2013. We can't tell why there was such a slowdown this year, but we believe that regulators going into 2013 — and this is simply our belief — are going to be busy. There are banks that cannot survive. We'll see if we are right or wrong.

WILLIAMS: We feel strongly that there are some attractive institutions that we'll be able to effect an open transaction with. They are banks that won't fail. We are looking to find the right bank in our footprint, which stretches from North Carolina to northern Florida. The pricing has to be right. We are not interested in buying banks that despite their performance think they deserve huge premiums to tangible book. And the culture has to be a right fit. I can't overemphasize that.

You've announced several side business acquisitions in the last year. How do those businesses fit into your overall strategy and are there others you'd like to add?

DAVIS: We want to make sure we have a diversified income stream. Look at the businesses we've added. They've all been very strategic, and they add to our core businesses.

Sure, we are looking for others. I don't know that we want to talk about them much, but we are looking for things that will be a very good additive. We are not trying to be a financial supermarket; we want to be relevant to the consumer. Taking deposits and making loans is a low-return business, so we have to be able to evolve.

We've seen a few of your roll-up peers, either backed by private-equity or blind pools, go public in the last year. Are you feeling any pressure to give your backers liquidity?

WILLIAMS: We have investors who are patient and there are always some looking for liquidity. Before going public, you have to consider if it is the right way and the right time. If you don't, it will take a long time for your value to be realized. Look at the market today — it is not a good time to go public. We would at least wait until there is some clarity and the markets are feeling better.

We also think it is critical to have a dominant market share position in a couple of our MSAs [before going public]. That would give us a great story that would lead to future growth.