-

The banking industry's loan losses could stay elevated for years, recent federal data suggests, even after appearing to peak in late 2009.

August 31

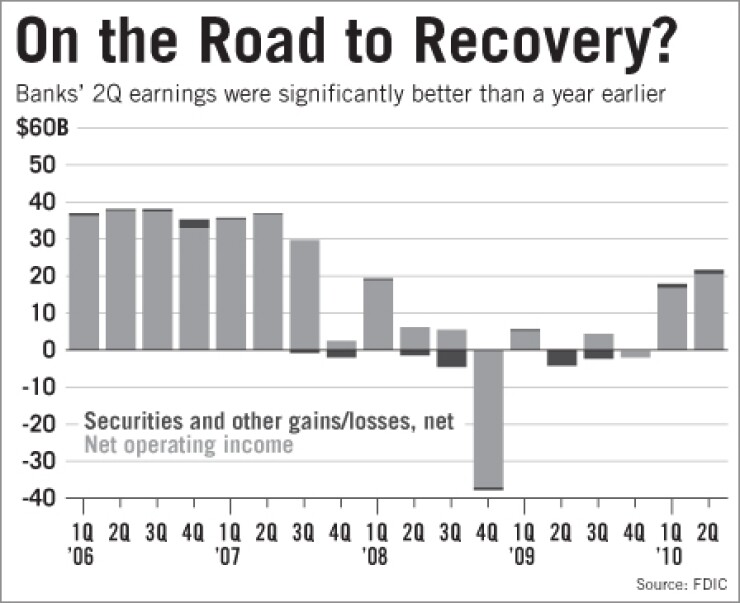

WASHINGTON — Despite another encouraging quarter for banks, highlighted by relatively high profits and lower loan-loss reserves, Federal Deposit Insurance Corp. officials said uncertainty about the broader economy is keeping lending depressed.

The FDIC's second-quarter earnings report showed that the industry's cautious approach is leading to profits, if not necessarily loan growth. Institutions steadily reduced delinquencies and loss provisions as they worked through problem loans, and margins benefited from lower funding costs.

But even though banks earned more than $21 billion, a 16% increase from three months earlier, assets fell for the fifth time in six quarters and loan balances fell in all major categories.

While banks are better equipped now than during the crisis to handle the economic future, that future remains unclear, FDIC officials said. Banks' steps to tighten credit could soften the impact of further recession, and their improved capital position would make it easier to lend if the economy grows stronger.

"Our predictions are it will continue to be a slow recovery, but a recovery nonetheless," FDIC Chairman Sheila Bair said Tuesday at the release of the Quarterly Banking Profile. "But we're also somewhat in a wait-and-see posture. But I don't think if" a recession "happens, it would have as profound an impact on the banking sector as" it did before.

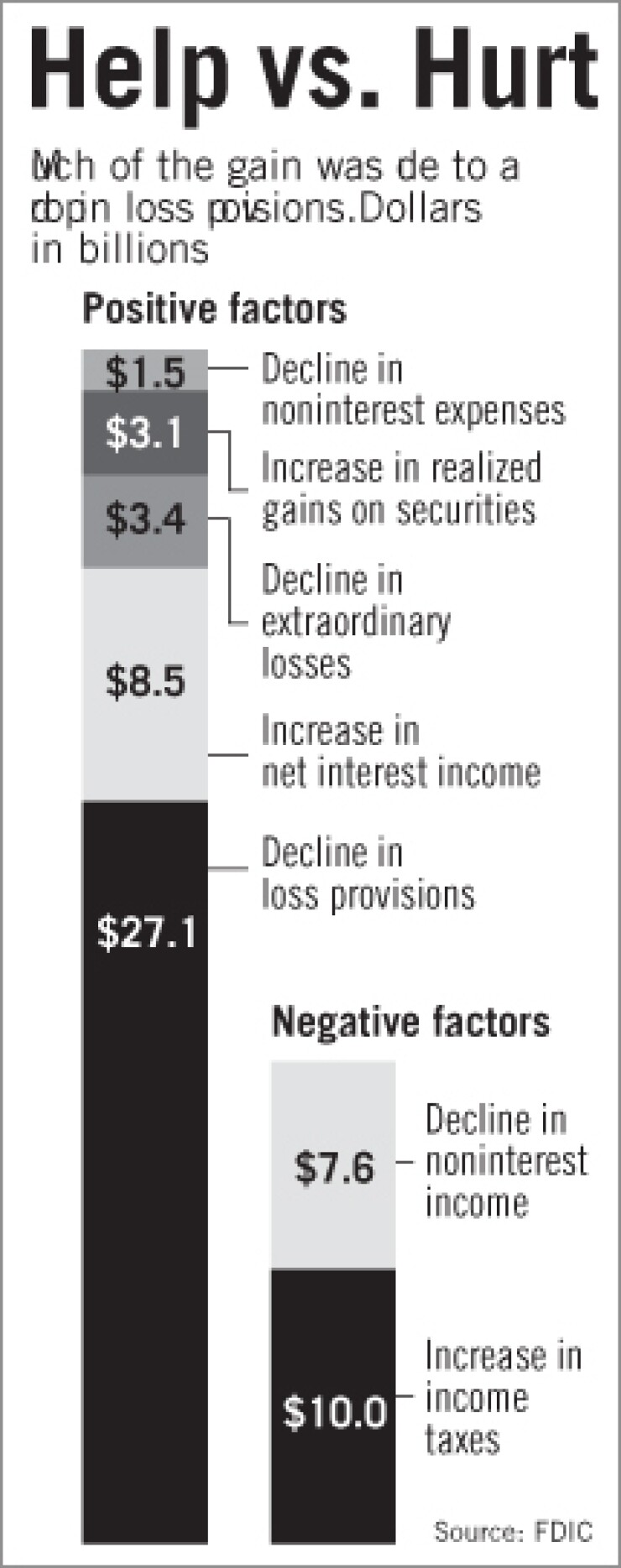

The quarterly profit was a huge improvement over the industry's $4 billion loss a year earlier. The agency attributed it in large part to the smallest loss provision in nearly three years, driven by less aggressive reserving at large banks. (Nonetheless, two-thirds of banks increased loss reserves in the second quarter.)

The $40 billion provision was still historically high, but it was 40% less than the provision a year earlier.

As a result, total loan-loss reserves dropped 4% in the quarter, to $251 billion, the first such decline since the fourth quarter of 2006. The industry's ratio of reserves to total loans fell to 3.40% from 3.51% during the quarter. But the FDIC noted that was the second-highest ratio in the 63 years for which data is available.

"Lower expense for loan losses, particularly at the largest banks, was the biggest factor in the improvement in earnings," Bair said.

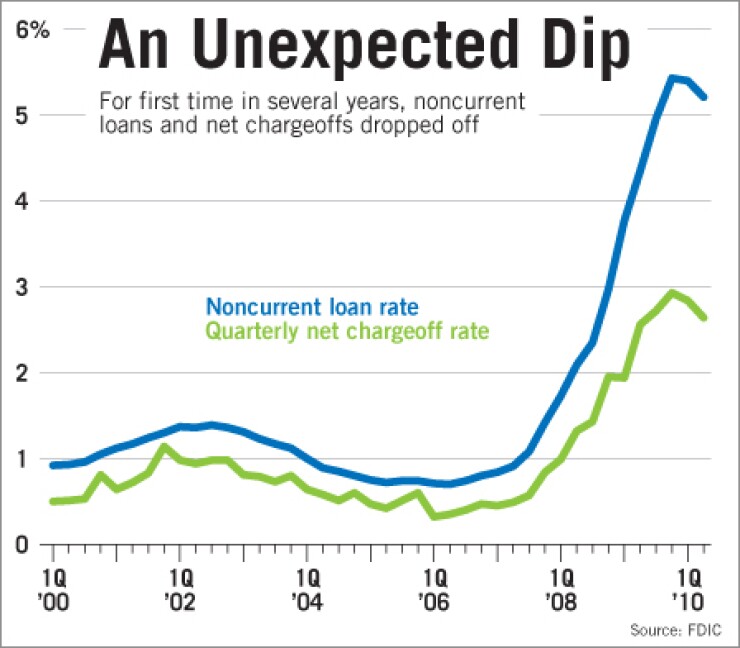

Other promising signs included the first declines in both net chargeoffs and noncurrent loans in four years. But a drop-off in negative indicators was not accompanied by new growth.

Total loan balances fell 1.4%, to $7.4 trillion. Real estate construction and development loans fell by $34.7 billion (8.3%); credit card loans by $17.6 billion (2.5%); residential mortgages by $13.2 billion (0.7%); and commercial and industrial loans by $12.1 billion (1%).

"A lot of this is about borrower demand," Bair said. "Consumers and businesses need to have confidence in the recovery before they start making decisions on credit."

Richard Brown, the FDIC's chief economist, said once borrowers show more interest, banks will be able to respond.

"The way the story is going right now is: financial institutions are making significant progress. Households are making progress too. But we're still not seeing the hiring in the economy, we're still not seeing the expansion in small businesses that we need to generate some loan demand," Brown said. "Our sense is once loan demand recovers, the banks are in pretty good condition from a capital standpoint and a balance sheet standpoint to meet that loan demand. It will take some time to pick up some momentum."

Still, there were enough indicators to show the banking industry has made significant progress cleaning up from its crisis.

Net chargeoffs declined 0.4% from a year earlier, to $49 billion, even though credit card chargeoffs were still high. The decline was led by a 37% drop in chargeoffs for commercial and industrial loans, to $5.4 billion.

Meanwhile, noncurrent loans decreased 4.8% from the first quarter, to $386 billion, and fell in most major loan categories. Nearly half of institutions reporting had noncurrent loan balances below what they were in the first quarter.

Noncurrent real estate construction and development loans fell 8.3%, to $64.6 billion, while noncurrent C&I loans fell 7.3%, to $34.2 billion.

Noncurrent residential mortgages fell 2.5%, to $183 billion. Noncurrent credit card loans fell 19%, to $18 billion.

Bair said while lower provisions, noncurrent loans and chargeoffs are positive signs, banks are not out of the woods yet. Referring to a chart showing a 20-year span of noncurrents and chargeoffs, Bair said it "vividly illustrates how high troubled loans and credit losses remain, compared with precrisis levels.

"Particularly given economic uncertainties, we believe all banks should continue to exercise caution and maintain strong reserves," she said.

Other healthy indicators included higher net interest margins and lower noninterest expense.

Net interest income rose 8.6% from a year earlier, to $216 billion, while noninterest expenses fell 1.5%, to $192.8 billion. Noninterest income dropped 11% from a year earlier, to $122.2 billion, driven by decreases in servicing income gains on loan sales. The FDIC said those declines were partly a result of new requirements from the Financial Accounting Standards Board that went into effect in the second quarter.

The FDIC said 20% of institutions reported net losses, versus 29% a year earlier. Nearly 60% of institutions reported higher net interest margins from a year earlier as, the FDIC said, "average funding costs fell more rapidly than average asset yields."

The industry's net interest margin — as calculated on an annualized basis — was 3.81% at the end of June, 38 basis points higher than at the same time last year. The Deposit Insurance Fund also grew, with federal reserves increasing by $5.5 billion during the quarter. Still, the fund remains insolvent, at negative-$15.2 billion.

The ratio of reserves to insured deposits rose by 10 basis points, to negative-0.28%. It was the second consecutive increase for the reserve ratio, but it was the third-lowest such level on record.

While the number of banks on the FDIC's "problem" list increased by 54 during the quarter, to 829, total assets of such banks fell by $28 billion, to $403 billion.

Bair said it was the smallest net increase of problem banks in over a year. She reiterated the agency's projection that failures this year will exceed last year's tally of 140, but she said "the total assets of this year's failures will probably be lower."

Diane Ellis, a deputy director in the FDIC's division of insurance and research, said projections for this year show failures generally are among smaller institutions.

"The way this crisis has unfolded is that the largest institutions were hit first, and then smaller institutions later. That's the way the failures are playing out as well," Ellis said.

Deposits fell for the second consecutive quarter, by $57.8 billion. Interest-bearing domestic deposits were off $45.4 billion while non-interest-bearing deposits rose by $20.8 billion.

The number of FDIC-insured institutions fell by 104 in the second quarter, the first time in almost 10 years that the number of banks fell by more than 100 in a single quarter.

During the quarter, 57 institutions were absorbed by mergers into other charters (including 29 charters that were consolidated into a single organization), and 45 banks failed.

No new banks were added during the quarter, the first time in the 38 years for which records are available.