WASHINGTON — Community banks are still consolidating at a quick pace, but fewer new charters are more to blame than mergers and many smaller institutions are even reaping the rewards of the industry's restructuring, the Federal Deposit Insurance Corp. said Wednesday.

In a sweeping report on community banking trends, the FDIC found that the number of local financial institutions continues to dwindle — from 6,802 community banks in 2011 to 4,750 at the end of 2019.

But the report, which is an update to a previous study released in 2012, found that community bank performance was strong heading into the pandemic year of 2020. And while hundreds of banks are still being acquired through mergers and acquisitions, the vast majority of those deals involved a community bank as the acquirer. (The reported contained data updated through the end of last year.)

"After the 2012 study the banking industry continued to consolidate, but existing community banks were less likely to close than noncommunity banks," the agency said in the report. "Of the 6,802 institutions identified as community banks at year-end 2011, just under 30% had closed by year-end 2019. In comparison, over the same period, more than 36% of the 555 institutions that identified as noncommunity banks had closed."

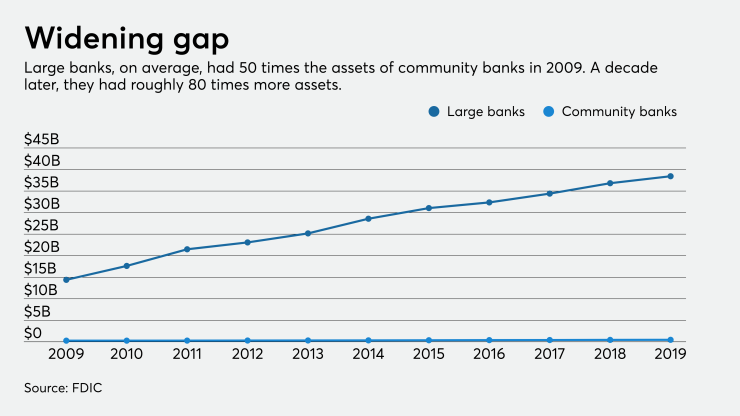

Still, the dominance of industry assets by the largest banks has continued to grow. In 2019, the average asset size of noncommunity banks was $38.4 billion, about 80 times larger than the average size of community banks. In 2009, that gap was only about 50 times.

“Look, community banks are still consolidating,” said Diane Ellis, the FDIC's director of insurance and research. “That definitely is the state of affairs right now.”

"It's still a consolidating industry and I think our expectation is that it's going to continue," she added.

While the report clearly is focused on smaller banks, the FDIC does not use asset size strictly to determine which institutions fall into the community bank bucket. The agency instead uses a mix of factors like geographic spread and financial ratios such as core deposits to loans. Banks with only a specialty focus, like credit card lending, are excluded from the designation. Banks below an "indexed asset threshold" of $1.65 billion are assumed to be included, but the study includes certain banks above that threshold and leaves out other institution below that threshold.

The report also found that when community bank consolidation does occur, more often than not the buyers have been other community banks. Among community banks that ceased operations between 2012 and 2019, two-thirds were sold to other community banks. Among banks with less than $100 million of assets, 89% of buyers were community banks, compared with 65% of banks with assets of $100 million to $500 million and 32% of those with assets of $500 million to $1 billion.

As bank failures declined in the years after the financial crisis, the FDIC found that voluntary mergers between unaffiliated institutions — meaning banks not already owned by the same holding company — was the “predominant cause of the decline in the number of insured depository institutions.”

But notably, the FDIC found that “the main contributor” to the actual number of banks dropping industry-wide stemmed less from consolidation and more from a drastic decline in the number of newly chartered institutions. From the end of 2011 to the end of 2019, the total number of depository institutions fell from 7,357 to 5,177.

“Between 1985 and 2011, 183 new institutions were chartered per year on average, compared with four per year between 2012 and 2019,” the FDIC reported. “This combination of factors pushed up the rate of net consolidation for the banking industry between 2012 and 2019 to 4.3%, compared with its average of 3.2% during the years 1985 to 2011.”

Community banks as a whole finished 2019 on a strong note heading into the coronavirus pandemic, the FDIC said. In some key respects, they are narrowing the gap with their larger counterparts. For example, their pretax return on assets was 22 basis points below that of noncommunity banks, “a significant improvement from the 43 basis point gap at year-end 2012,” the FDIC said.

The FDIC report also stressed the importance of community banks in key lending sectors of the economy, including commercial real estate, small business and agricultural lending. While community banks only hold 15% of the industry loans, they hold 30% of the nation’s CRE loans. Community banks also hold 36% of small business loans and 31% of agricultural loans.

“The FDIC recognizes the critical role community banks play in providing loan and deposit services to customers throughout the United States,” FDIC Chairman Jelena McWilliams said in a press release. “By continuing to study community banks, the FDIC can provide support to these institutions and the communities they serve.”

The challenges ahead

However, even though the report is generally upbeat on the state of community banking, the sector's challenges remain considerable, especially amid persistent economic fallout from the pandemic.

“The significant uncertainty that the COVID-19 pandemic has presented to the economy, the banking industry, and society at large cannot be overlooked,” the FDIC wrote in its report. “As earnings decline and credit losses materialize, community bank performance is likely to deteriorate.”

The FDIC also noted that some of the same credit sectors in which community banks compete strongly with larger banks are the ones threatened by the pandemic.

“The COVID-19 pandemic has substantially altered the landscape of CRE markets in the United States,” the FDIC wrote. “As the pressure on rents and occupancy rates continues, ultimately CRE property prices are expected to show the strain.”

While early action from Congress helped blunt some of the pandemic’s early damage, “economic challenges related to the pandemic have continued to affect many small businesses,” the FDIC wrote. “The full effect of the pandemic on small businesses may not be fully known for several years.”

Unlike the original 2012 community banking study, the 2020 version looked at the impact of regulation and financial technology on banks’ bottom lines. According to FDIC staff, the study’s two new areas of focus were personally requested by McWilliams.

With regulation, the FDIC suggested that “the pace of regulatory change may have been one factor that contributed” to several developments in community banking after the 2008 financial crisis, including the number of community banks that closed in the years prior to 2020 and the “high proportion” relative to other banks of community banks that exited residential mortgage lending.

“Based on their sheer number and scope, changes to rules regarding 1–4 family residential mortgage lending and servicing have a strong claim to being the most important rules of the post-crisis period,” the FDIC wrote.