-

Both sides of a bank deal need to meet with their regulators well ahead of announcing it in today's complicated world.

May 14 -

Few so-called good bank/bad bank deals have been completed, with regulators or investors serving as key impediments. Bar Harbor Bankshares hopes to become the second acquirer in the past two months to complete such an acquisition.

May 4

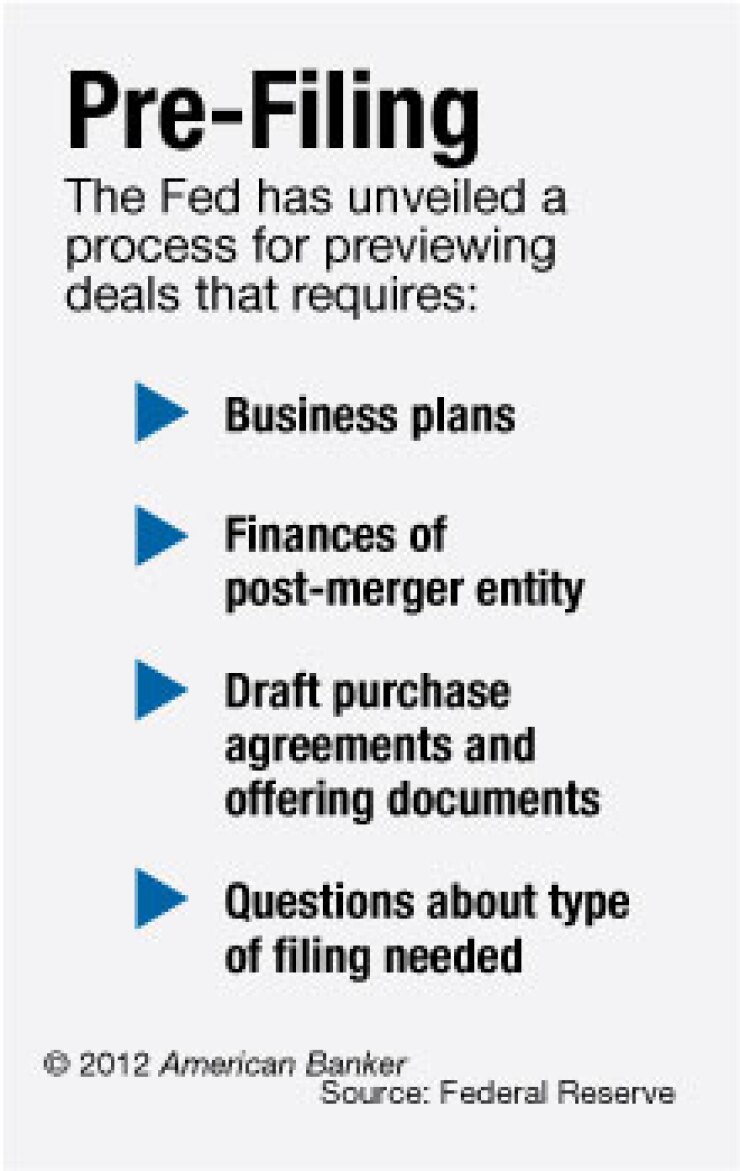

The Federal Reserve, looking to speed up the approval process, has quietly resurrected a practice it nixed during the late-1990s merger boom: preliminary vetting of deals-in-progress.

The Fed on Wednesday released a three-page policy letter outlining an optional "pre-filing" process for banks it oversees with $10 billion in assets or less that "could shorten the review period for many formal applications."

Pre-filings resemble the "draft applications" the Fed stopped accepting after a broad overhaul of bank holding company rules in 1997, when a surge in mergers made it logistically difficult for the regulator to handle a glut of formal and preliminary applications, industry experts say.

"The Fed has been trying very hard over the last six months or so to speed up the processing of applications, which have been very slow in the credit crisis," says Chip MacDonald, a partner with Jones Day in Atlanta. "It'll clearly allow [banks] to determine whether an application is viable or not and what [they] might have to do to make it viable."

So why bring pre-filing back now?

Mergers have gotten more complicated in the last five years, as the financial crisis saddled banks with bad assets and new mandates. Experts say that such complexity has slowed down the pace of mergers and regulatory approvals. As activity accelerates, the Fed is trying to help small banks and creative deal makers work out potential kinks before they submit an official application.

Multiple time-related mandates buried throughout the Bank Holding Company Act of 1956 have always made the Fed a bigger stickler for tighter deadlines, compared to the Federal Deposit Insurance Corp. or the Office of the Comptroller of the Currency, industry experts say.

In recent years, sophisticated acquirers have made it standard practice to give their regulator an informal glimpse at a potential merger before pulling the trigger. The policy unveiled last week codifies this practice for untested buyers and for acquirers that are pursuing particularly tricky deals, the policy statement says.

It "can be very useful in helping organizations understand relevant issues and the overall process," the statement says. "The pre-filing process is not expected to be typically used by organizations that frequently file proposals with the Federal Reserve."

The Fed says it may take up to two months to review and reply to each pre-filing, which may include post-merger financial data, a draft of the deal proposal, details of the merger structure and offering documents.

The Fed stresses that the early review "is not part of the formal review." It is also "not intended to identify or resolve all issues or concerns" about a deal, nor is it "to be a forum for negotiating the structure."

Acquirers may send requests for the early reviews electronically to their local Fed office. While the aim is to process early reviews "swiftly," pre-filings will have secondary priority to formal applications and notices, the paper states. That could discourage some buyers from making a pre-filing, industry experts say. A benefit of informal pre-deal meetings is that parties often get an immediate sense of where regulators stand on a transaction. A buyer may be discouraged from doing a pre-filing that could take up to two months to be processed, experts say.

Bankers may be wary of leaving paper trails that could become public. While draft applications were entirely confidential as a rule, the Fed says in its policy statement that applicants must request to keep certain information remain private and shielded from the Freedom of Information Act. Pre-filings will not be published in the Fed's weekly updates on bank applications and reports received.

The Fed did not return calls seeking comment.

The policy paper is a positive step to smoothing out the application process despite the questions it raises, says Jacob Lutz 3rd, a partner and leader of the financial institutions practice at Troutman Sanders.

"It is recognition by the Federal Reserve that in the post-Dodd-Frank era, bank counsel and bankers find it absolutely necessary to have a pre-filing discussion with the appropriate regulators," Lutz says. "The concern is whether this formal pre-filing process will undercut informal vetting.