After a slow start, the Small Business Administration is trying to gin up demand for its Small/Rural Lender Advantage program.

The agency launched the program in January hoping to combat a wider drop-off in SBA lending by offering bankers and borrowers streamlined loan applications and quick decisions on loan approvals. But so far demand has not met expectations; to date the SBA has approved fewer than 200 loans through the program.

Charlie Thomas, the SBA's director of program development, said the initial response has been soft because many of the targeted lenders have not worked with the agency for years and "it's taken a while to train lenders and educate them and regenerate interest in SBA loans."

But banking officials say interest has been tepid because the SBA has mainly marketed the program in rural areas, and there are simply more businesses — and eligible borrowers — in more developed markets.

"They haven't hit the sweet spot in terms of where the small businesses are located," said Bob Siewert, the head of the American Bankers Association's Center for Commercial Lending and a senior vice president at the trade group.

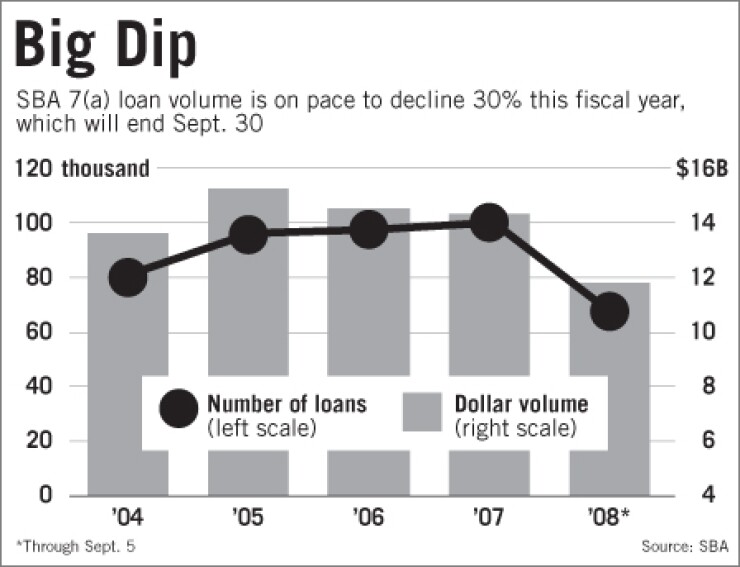

The sluggish economy could be a factor as well. Overall SBA 7(a) loan volume is down significantly compared with years past as loan demand has weakened and some lenders have focused on working out troubled loans rather than originating new ones.

Championed by former SBA administrator Steven Preston, now the secretary of Housing and Urban Development, the Small/Rural Lender Advantage program was established to win back the hundreds of community banks that stopped originating 7(a) loans after the agency abolished a streamlined application program called, Low Doc, in 2005. Many community banks that do not make large volumes of SBA loans say the application process is too cumbersome.

The Small/Rural Lender Advantage program targets lenders that have made no more than 20 SBA loans in the last three years. The application is a single, two-sided page for loans of $350,000 or less, and decisions are rendered in three to five business days.

Mr. Thomas said he is confident the program will catch on once lenders and borrowers become more aware of it.

The agency rolled the program out in New York, New Jersey, and the Middle Atlantic states in early September, and when it is launched in California today it will be available in every state.

Mr. Thomas said that with the new fiscal year set to begin Oct. 1, its 10 district offices have been instructed to step up their marketing.

The offices will be distributing more marketing materials, hosting more introductory sessions, and offering more lender training. The SBA is also "working on incentives that would encourage our district offices and encourage these small lenders and get them more involved with SBA lending," Mr. Thomas said.

Mr. Siewert said the reduced paperwork alone could eventually encourage more lenders to give Small/Rural Lender Advantage a try as word spreads.

But he said he believes the agency needs to publicize it better.

"If you go on to the SBA's Web site and go under the 7(a) loan program, it's not even mentioned. You have to go to a Google search under 'small/rural lender advantage' to even know about it," he said.

Emphasizing "rural" in the name could confuse potential borrowers and lenders, Mr. Siewert said.

"When people talk about the program they don't even use the word 'small'; they just say 'rural lender,' " he said. "There are more small businesses in urban areas and more community banks to serve them."

Still, it is in rural regions where the program has been most successful.

Interest has been particularly high in the SBA's Region VIII, which covers states in the upper Midwest and Rocky Mountains. Fifteen percent of the 7(a) loans in Wyoming and 25% in South Dakota are being made through the program, according to the SBA.

Dennis Melton, the district director for the agency's St. Louis office, said the program is likely to have more economic impact in rural markets.

"A $250,000 loan in a very rural county is equal to a million-dollar loan in a larger area," he said.

In more urban markets, Mr. Melton said, many lenders would not qualify to make loans through the Small/Rural Advantage program because they make too many SBA loans each year. In fact, Mr. Thomas said some banks asking to participate in the program have been turned away.

Another explanation for the low volume of loans made through the program is the overall decline in SBA lending.

The agency is on pace to approve roughly 70,000 7(a) loans this fiscal year, which ends Sept. 30, down from nearly 100,000 last fiscal year.

The dollar volume of approved SBA loans is on pace to fall below $12 billion for the first time since 2003, according to the agency's data.

Steve Fitzgerald, a principal at Acquisition Services Group, a small-business brokerage in La Jolla, Calif., said he is brokering fewer deals this year because businesses that would typically use SBA loans to finance acquisitions cannot get them.

Local banks have scaled back their SBA operations and the SBA itself has gotten more cautious in its approvals with the economy slumping, he said.

"For businesses that we sell for less than $2 million it is having an effect because basically to get the seller cashed out, the SBA's the only player in town," Mr. Fitzgerald said.

Some banks in Southern California have stopped originating 7(a) loans entirely, and Mr. Fitzgerald said those still making them are requiring more than the usual proof of cash flow.

"If you look at what the rules the SBA has, there's not a very high bar to get over," he explained. Borrowers "have to have a good credit score and a 20% deposit, and the business has to have cash flow sufficient to support the loan. But what we're seeing now is, unless you come to the table basically with enough collateral to back up the loan, they're just not interested."