-

A legal safe harbor designed to protect lenders that make "qualified mortgage" loans from consumer lawsuits is likely to expose institutions to potentially even greater liability, according to several banking experts.

September 5 -

Will mortgage reform rectify past discriminatory practices or close the gap between white and nonwhite rates of homeownership? The major proposals in Washington show little interest in these critical questions.

September 5 -

A call to reassign GSE affordable housing goals to private securitizers ignores important changes in underwriting standards and the nature of federal mortgage guarantees in the conventional conforming market.

August 27

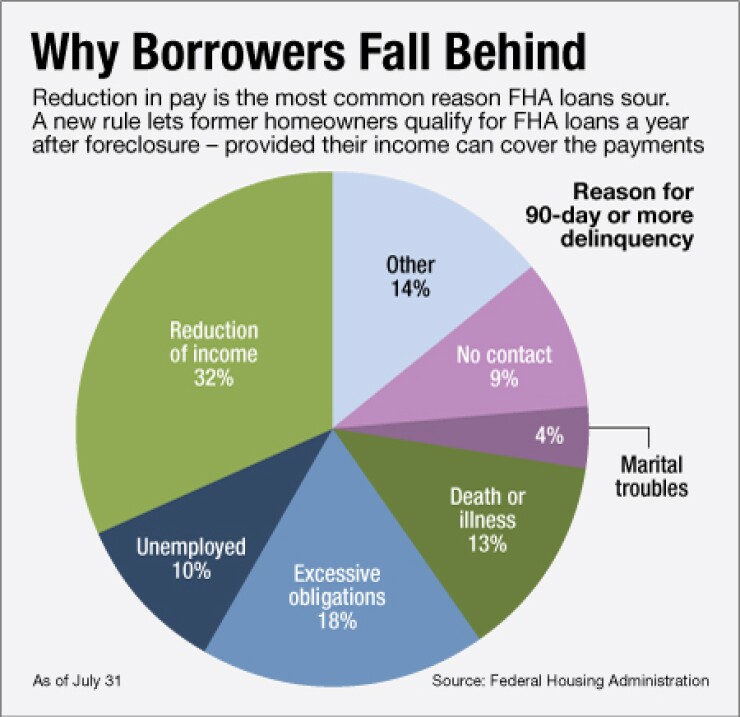

PHOENIX Some mortgage experts are criticizing a recent rule change by the Federal Housing Administration that would allow borrowers who lost their homes to foreclosure or a short sale to qualify for a new mortgage in as little as a year.

Typically homeowners must wait three years after a foreclosure before they can qualify for an FHA-insured loan and up to seven years to obtain a conventional loan backed by Fannie Mae or Freddie Mac.

But even those who agree that the pendulum of extending credit has swung too far, making it difficult for even creditworthy borrowers to qualify for a home loan, are warning of the danger of loosening standards so soon after the housing market's collapse.

"We are crowding out creditworthy buyers, but this wasn't necessarily the group I was thinking of," Robert D. Broeksmit, a managing director at Treliant Risk Advisors, and the former president of B.F. Saul Mortgage, a unit of Chevy Chase Bank, told an audience of risk managers here Tuesday. "I hope I'm not the only one in the room who claims that making a loan to someone who was foreclosed on 13 months ago is not plain-vanilla lending."

To be clear, the FHA changes, announced in August, target borrowers who lost their homes to foreclosure or a short sale because they were unemployed or had a drop in income due to circumstances beyond their control. The FHA has strict documentation requirements for borrowers who are given a second chance at homeownership.

(FHA loans are aimed at primarily at first-time home buyers and require only a 3.5% minimum down payment.)

The change indicates that lenders are grappling with the government demands to expand credit while also balancing the risk of doing so, including ultimately suffering losses from bad loans. Exacerbating the problem is that loan opportunities have declined as interest rates have risen and refinance volumes plummeted.

Some lenders say they welcome the FHA's change.

Jamie Korus, president of Alliance Financial Resources, a Phoenix mortgage lender, says she is taking a cue from the FHA, which has urged lenders for years to drop so-called "credit overlays," typically credit score or debt-to-income requirements that are above and beyond what a loan purchaser demands. For example, the FHA will accept loans with FICO scores of 580 or lower but large bank aggregators often will not originate a loan to a borrower with a credit score lower than 640.

"We are looking at reductions in overlays," Korus said at a Mortgage Bankers Association conference here. "We have to find the delicate balance between looking at risk and providing for the vast majority of borrowers where credit is not available."

Charles Coulter, deputy assistant secretary for single-family housing at the Department of Housing and Urban Development, told lenders Wednesday that the agency does not want lenders to hinder or dissuade lending to borrowers with FICO scores below 620.

The FHA's "Back to Work" policy was designed to help borrowers who had a one-time event because of the economic downturn, he said.

"We can put all the policies out in the marketplace but if people have overlays in place, it doesn't matter," Coulter told about 650 credit risk managers here. "We are seeing an improvement in underwriting of credits below 620 and 640."

But John Robbins, president of the Robbins Group, a San Diego consulting firm, says he has his doubts that the FHA's policy change will encourage more lenders to extend credit to borrowers who had previously defaulted.

"There is a fair amount of skepticism in the industry and an enormous hesitance to do this kind of lending because the U.S. government could walk away from their obligation," Robbins said. "How many hundreds of billions of dollars have the major banks paid to repurchase loans?"

Mark Garland, president of MountainView Capital Holdings, a firm that values mortgage servicing rights, agreed. "When you go month after month not knowing where the bottom of the market is, you get very skeptical about [borrowers'] credit history," he said.

He also said that servicers might be skittish about holding the servicing rights to such loans because they might have trouble selling them down the road.

"When it comes to the servicing side of the equation, we give advice that you better be prepared to hold the loan on your balance sheet," he said.

Rising interest rates, falling market share, lower gain on sale margins and an arduous regulatory environment have created one of the most difficult cycles for mortgage banking. Now lenders are being forced to find creative ways to capture market share.

Some lenders are trying to help new borrowers compete against all-cash buyers by collecting the homebuyers' information, underwriting the loan and providing a fully approved purchase amount. Because the underwriting process has already started, the loan can close more quickly.

Korus, the Phoenix lender, is looking at cutting back from originating home loans in some states where home prices have rebounded dramatically, creating the potential for another bubble, and focusing on less-frothy markets.

"We can choose counties and states and target those areas where we are not providing services to clients," she says. "I don't want to have all of my loans in this state where a bubble could burst again."