Varo Money in Salt Lake City is one step closer to becoming a national bank.

The fintech firm, which aims to lower the cost of banking through a mobile-only platform, recently received preliminary and

Colin Walsh, Varo's co-founder and CEO, is optimistic that the company will be operating as a bank within a year. He characterized the OCC's decision as a pivotal moment for banking — one that shows regulators are more willing to consider nontraditional models.

“I think this preliminary approval marks the beginning of a new age where digital banks are going to come into their own and bring a different experience, and hopefully help improve financial lives and raise the consumer expectation of what banking could be and should be,” Walsh said in an interview. “That is the part I am the most excited about.”

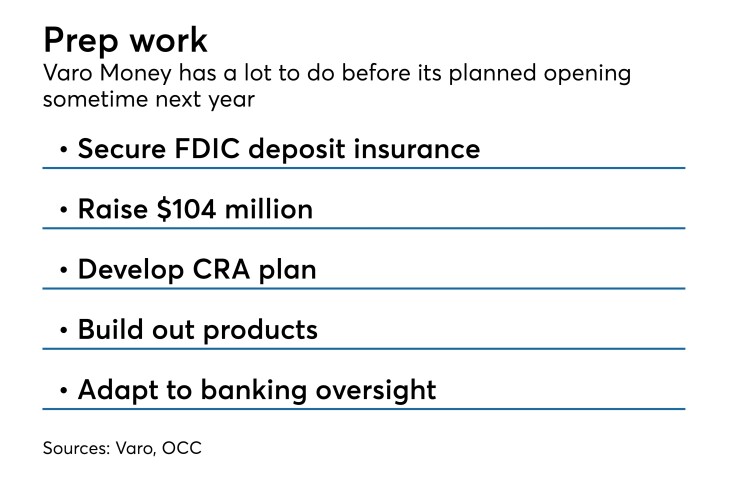

Varo still faces challenges that include operating in a heightened regulatory environment and receiving FDIC approval, industry observers said. While regulators have expressed a willingness to work with bank organizers, it is unclear whether a fintech firm will pass muster.

Varo has aspired to become a bank since its early days.

“I decided to start Varo very much from the belief that I think the world needs better banks that are going to use technology to help people solve everyday financial problems and really improve their financial lives,” said Walsh, who previously worked at Wells Fargo and American Express.

From the start, Walsh recognized that it would be difficult for Varo to receive a charter because very few de novos have been approved since the financial crisis.

The company, which largely appeals to millennials, initially partnered with The Bancorp Bank to offer banking services in 2016. Later that year, Walsh said his team noticed that the OCC was showing signs of becoming more open to the idea of innovators entering banking. Talks between Varo Money and regulators ensued.

“That was the beginning of a pretty lengthy engagement,” Walsh said.

The Independent Community Bankers of America has no qualms about Varo's plans to become a bank, though the trade group takes issue with industrial loan company charters.

"This is exactly the way a fintech company should proceed if they want to get in the banking business," said Chris Cole, the ICBA’s executive vice president and senior regulatory counsel. "That is to say they should apply for a bank charter nationally or statewide, and then get FDIC approval for depository. To us, Varo Money is more competition, but we're ready to compete with them."

The OCC wrote in its decision letter that Varo must raise $104 million to receive a charter. Walsh declined to discuss the capital raise. A source familiar with the OCC said a de novo bank’s capital raise is based on the applicant’s business plan and projected growth.

Varo would be able to offer a breadth of consumer banking products with a charter, Walsh said. It plans to offer core checking and savings accounts, credit cards, home equity products and personal loans.

The company launched its mobile app in the Apple App Store last June. Walsh declined to say how many customers have signed on, though he said the product has twice as many customers as he had expected at this point. The company uses social media to spread the word and share marketing content.

“There is a real demand out there for credible alternatives to the existing banking system,” Walsh said. “There a lot of fundamental things in the banking system that are broken," including "all of the fees and charges.”

While Varo may consider expanding into small business lending at some point, it will initially hone in on consumer banking, Walsh said. The company has selected a core technology platform and cloud services from Temenos to support its strategy.

Varo, which submitted its application for a bank charter last summer after filing a draft application in the spring of 2017, would also be able to fund the balance sheet through deposits as a traditional bank.

Walsh said conversations with regulators have gone well so far, adding that Varo is in talks with The Bancorp about moving customers over to Varo Bank when the time is right.

“They’ve been incredibly supportive," Walsh said of The Bancorp. "I think they're excited about the fact that they helped get us off the ground."

To be sure, there will be growing pains once Varo gets a bank charter, industry observers said.

The company will be subject to the banking industry’s complex regulatory environment. Some digital banks have struggled to expand customer relationships beyond checking accounts, said Raja Bose, global retail banking consulting leader at Genpact.

“While they can get the initial customers to sign up, where they struggle is growing that relationship to be a boarder, more profitable customer relationship,” Bose said, though he thinks it is a positive sign that Varo is trying to build a digital bank.

“The U.S. market is overdue for digital-only banks. It’s a lot more common in Europe,” Bose said. “It will be interesting to see how this evolves over time.”

It can also be challenging for startup banks to create multiple revenue sources through referral or cross-selling programs, said David Albertazzi, senior analyst at Aite Group. Building a more robust product line will be crucial, he added.

Some industry observers have expressed concerns over how digital banks would comply with the Community Reinvestment Act. While most banks adhere to the law by opening branches in underserved communities or neighborhoods, digital banks like Varo lack physical offices.

“We already have one class of federally insured financial institutions exempt from CRA, namely credit unions, and we do not need to create another one,” Kenneth Thomas, president of Community Development Fund Advisors, wrote in a memo to the OCC tied to Varo’s proposed plans for complying with CRA.

Varo, which will include the Salt Lake City combined statistical area as its geographic area for CRA compliance, needs to finalize its CRA plan before receiving final approval.

“I think CRA is a regulation that serves a very important purpose,” Walsh said. “Now that you have companies like ours that really don’t have geographic constraints, it’s time to start rethinking that a little bit. That is something we intend to work with the OCC and the FDIC to think through where we ultimately land with our CRA plan.”

Five years from now, Walsh envisions Varo Bank serving millions of customers, possibly as a public company. There could also be opportunities to buy other fintechs or banks down the line, Walsh said.

“I could see us playing a broader role in terms of helping shape policy,” Walsh said.

“As we get bigger and more impactful in society, in terms of helping to lower the cost of banking and helping people build greater financial resilience, hopefully we can have a broader role that we can play with policymaking," he added. "I am very excited about the future of where the company is going to go.”