-

First Horizon National in Memphis said Thursday that its first-quarter profit fell l3% from the same period in 2011, to $30.5 million, as improvement in its banking and capital markets units could not offset steep losses in its defunct mortgage operations.

April 19

First Horizon National (FHN) in Memphis will take a $272 million charge in the second quarter primarily for mortgage repurchases from Fannie Mae and Freddie Mac.

The $26 billion-asset parent of First Tennessee Bank said in a regulatory filing Monday that $250 million of the pre-tax charges will be a provision expense to increase its repurchase reserve. Another $22 million in charges comes from pending litigation, which bank executives said on a conference call late Monday that they could not discuss.

First Horizon expects to realize a $60 million loss in the second quarter that will be charged against the reserve, the company said in the filing. As a result, the bank's total repurchase reserve is expected to be $351 million at June 30.

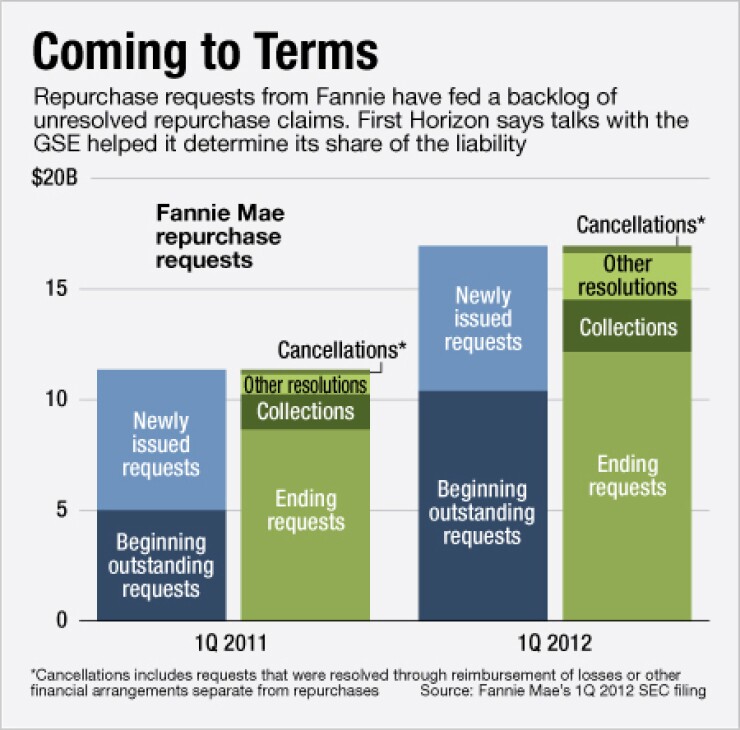

A recent review by Fannie Mae drove the increase in the repurchase reserve, according to William "BJ" Losch III, First Horizon's chief financial officer.

"We felt like the requests had increased but the exposure hadn't," Bryan Jordan, First Horizon's chief executive officer, said during the conference call. "Now we have better insight into our exposure, and the sooner we can work through them, the better off for everybody."

First Horizon sold its mortgage origination platform in 2008 and has sold mortgage servicing rights as well, so the company had "limited visibility" into its total repurchase exposure, Losch said. Fannie provided new information on delinquencies and defaults and the bank used that information to extrapolate what its exposure to Freddie would be as well, he said.

"We would expect that this reserve level would cover current and future requests," Losch said. "Our biggest issue has always been that we didn't service most of the book, so it made it hard for us to pinpoint the estimate. That (discussions with Fannie) allowed us to increase the reserve for the aggregate exposure."

First Horizon sold roughly $57.6 billion in conforming loans to Fannie and Freddie from 2005 to 2008.

Total cumulative losses, including reserves to both GSEs, will be roughly $750 million, the bank said in the filing. Roughly 70% of its loans were sold to Fannie.