The percentage of U.S bank employees who work at least partially from home nearly doubled over the past year, and more than half of the industry’s workers want to keep performing job duties remotely.

At the same time, more than seven out of 10 bank staffers believe that their employer is likely to allow some workplace flexibility going forward.

Those are some of the key findings from a recent survey of industry professionals that was conducted by Arizent, the parent company of American Banker.

The results show how the extraordinary circumstances of the last 15 months have changed many employees’ attitudes about working from home, leading many of them to place more value on remote arrangements, and how their evolving attitudes will have long-term ripple effects on how banks configure their workforces.

As the industry begins to bring workers back to the office, many firms are keeping at least some of the flexibility that they adopted last year out of necessity.

“One lesson we learned from the pandemic is that offering flexibility and support programs leads to a more productive, engaged workforce,” Claudine Hoverson, Synchrony Financial’s chief talent strategy officer, said in an email. “Permanent work flexibility has become central to our new way of working.”

Some financial institutions are considering hybrid work models, and a few have decided to offer all of their employees the option to work remotely. In interviews and emails, some bank executives described bringing employees back in phases and said they anticipate greater adjustability in the workplace of the future.

Stamford, Connecticut-based Synchrony

Still, not everyone wants to work from home, and Synchrony is now in the initial phase of its return-to-office pilot. So far, about 200 employees have returned to four locations, and that number is expected to grow through the summer and fall, according to Hoverson.

Ally Financial is among the banks that are considering hybrid models.

In February, the Detroit-based company started bringing employees back to the office, opening eight of its 23 worksites to roughly 145 employees who volunteered to return. Childcare was a major challenge, according to Chief Human Resources Officer Kathie Patterson, who said that it was difficult at that time for many workers to commit to being in the office on certain days.

The $182 billion-asset Ally now anticipates that most of its workforce will be back in the office after Labor Day. Employees are being encouraged to return over the summer at their own pace, so they have time to establish new routines, Patterson said.

“The expectation when we go back is th at we will move towards a hybrid schedule, but we’re still determining what that means for us, and we want to be really intentional about it,” she said.

Ally has also reconfigured some roles, including software developers and cyber and data engineering functions, to allow workers in those jobs to go fully remote.

Other banks appear to have less certainty about what their post-pandemic policies will look like. Some banks declined to discuss their return-to-office plans when contacted by American Banker, citing uncertainty, disagreements or ongoing planning.

Meanwhile, certain banks seem eager to bring their workers back to the office full time.

Some functions simply need to be performed in person, or at least are done much better in person, executives at these banks note. What’s more, many employees actually prefer to work in the office — maybe because they dislike the isolation of remote work, or perhaps because their homes aren’t conducive to productivity.

Goldman Sachs called almost all of its New York employees back to their desks this week, while JPMorgan Chase has told its U.S. employees to be prepared to return to the office next month. Citigroup expects about 30% of its U.S. employees to return to the office this summer.

Bank of America Chairman and CEO Brian Moynihan recently told Bloomberg Television that the Charlotte, North Carolina-based company plans to bring back all of its vaccinated workers after Labor Day. He said that so far, over 70,000 employees have voluntarily disclosed their vaccination status.

“We are a work-from-office company,” Moynihan said at BofA’s annual meeting in April. “We have always had a work-from-home program, but it requires great discipline to execute on that appropriately.”

The benefits and downsides of flexibility

Among bank employees who responded to Arizent’s survey, 43% said they worked from home at least some of the time before the pandemic. That figure jumped to 85% over the past year, with 55% of bank employees saying they’d like to keep working from home some of the time in the future. Some 71% of respondents said that their bank is very likely or somewhat likely to allow remote work options in the future.

The online survey of 491 employees and employers was conducted in April. (American Banker subscribers can read the full report

The findings suggest that as banks vie for talent, some of the most competitive workplaces will likely be those that offer their employees some autonomy and flexibility in how they get the job done. The pandemic demonstrated that many jobs can be performed well in a remote setting if the right resources and support are in place.

Workplace flexibility can also help companies build a more diverse and inclusive workforce, said Malia Lazu, CEO and founder of The Urban Labs in Boston. Flexible work policies can be especially beneficial for people with disabilities, an often-overlooked demographic, according to Lazu, who consults with real estate and financial services firms.

“When it comes to transportation and when it comes to the realities of navigating this world, for someone who’s differently abled ... this is a win,” she said.

Proponents of flexible work also note that 2020 was an exceptionally stressful year even for the most fortunate Americans. Working from home will likely look and feel a bit different when parents are not scrambling for consistent child care.

“This wasn’t just a grand experiment in virtual work. This was a grand experiment in telecommuting during a pandemic,” said Manar Morales, president and CEO of the Diversity and Flexibility Alliance, a coalition of organizations dedicated to sharing best practices for workplace flexibility.

Another factor that could motivate some firms to allow greater flexibility is that having a smaller physical footprint results in cost savings.

In the Arizent survey, 29% of respondents across the broader financial services sector said that their companies expect to downsize as a result of increased remote work. Those respondents cited employee feedback and reduced costs as their two main reasons for doing so.

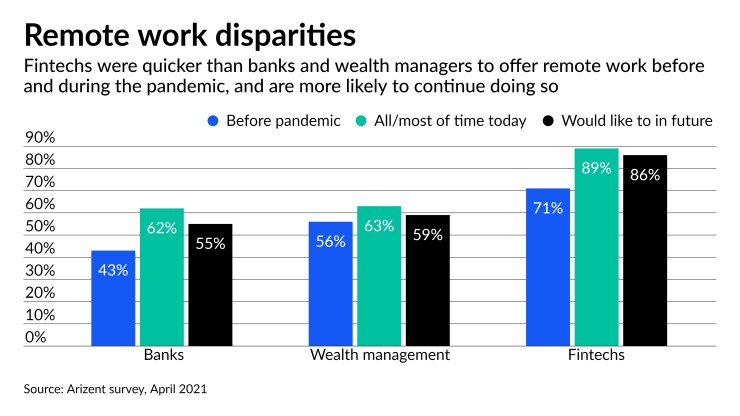

The survey also found that banks are lagging behind some other parts of the financial services industry in switching to remote work. Some 43% of survey respondents at banks said that they worked from home all or some of the time before the start of the pandemic, which compared with 71% at fintechs.

In the future, 55% of the bank respondents said they would like to work from home all or most of the time if their employer offered that option, compared with 86% at fintechs.

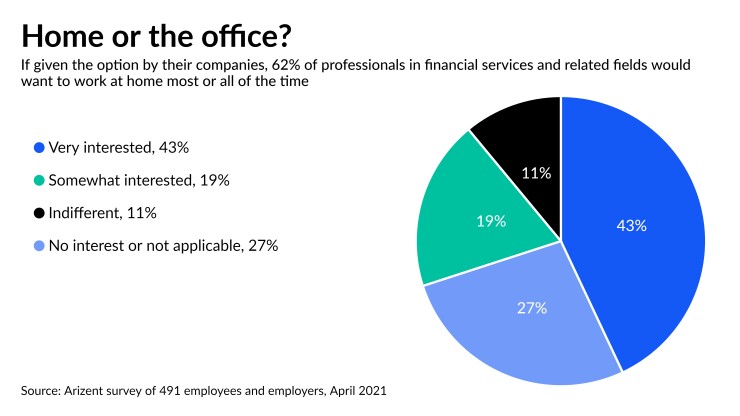

Across all survey respondents, which included professionals in the financial services industry and related fields, 43% said that they were very interested in working from home at least some of the time, and 19% said that they were somewhat interested.

Consistency could prove to be a challenge for companies that are exploring a hybrid work environment. Some 33% of the people surveyed by Arizent said that their companies had no set expectations for how those employees will divide their time between the office and remote work.

Organizations that want to offer their employees flexibility need to define what that means and clearly communicate those expectations from the beginning, experts said.

Sometimes flexibility includes remote work, but it might also mean being able to adjust work hours around other obligations. Or, for people easing back into the workforce after a hiatus, flexibility might mean starting with a part-time role.

However flexibility is defined, the business case for granting more leeway to employees is largely a talent play. Not only is greater flexibility a draw for potential hires, it also gives existing workers a measure of autonomy and trust in how they do their jobs.

“Even more than working from home, what [employees] have liked is the trust they feel they have gained,” said Mariemi Sierra Alvarez, chief of our people at Banco Popular in San Juan, Puerto Rico. “You don’t necessarily have to see me 24/7 to know that I’m doing my job.”

Managing employees in a remote or partially remote environment has its own unique challenges and demands.

TD Bank has brought “very, very few roles” back into the office so far, said Ryan Pritchard, the bank’s head of U.S. talent management and executive development. While some jobs, including those in branches, will always need to be done in-person, TD Bank is turning some roles into hybrids, he said.

In order to make the hybrid environment work, the $411 billion-asset company is trying to figure out how to provide internal networking opportunities for hybrid and remote workers. It is also encouraging managers to adapt to that new setting by communicating more frequently with their employees and through a variety of channels.

“Our leaders need to lead differently in a hybrid environment,” Pritchard said. “Leaders need to lead with empathy and be really clear about priorities and make sure they’re communicating effectively and not just through email.”

It is not uncommon to hear bankers and other corporate leaders express concern about the fate of their workplace cultures in hybrids or remote settings. That is a valid concern, Lazu said, but companies have a number of platforms they can use to connect with employees and build a corporate culture. Executives can also look to their own workforces for ideas about how to build a culture in a hybrid work environment, she said.

“Your 40-and-younger set is where you’re going to find a natural understanding of how to build culture online,” she said.