Four former employees of Washington Federal Bank for Savings have been charged with taking actions that led to the Chicago bank’s failure in December 2017.

The Justice Department said in a press release Friday that Rosallie Corvitte, who was the bank’s chief financial officer, and Jane Iriondo, its corporate secretary, were indicted on charges of falsifying bank records and helping a customer commit embezzlement. Alicia Mandujano, a loan servicer, and Cathy Torres, a loan officer, were also charged.

The indictments claim that the bankers worked with the client and “higher-ranking bank officials” to embezzle at least $29 million in the years before the bank’s closure. The customer, Robert Kowalski, and his sister, Jan Kowalski, were indicted last year on charges of defrauding his creditors and the trustee in his bankruptcy case.

The criminal investigation is continuing, the Justice Department said.

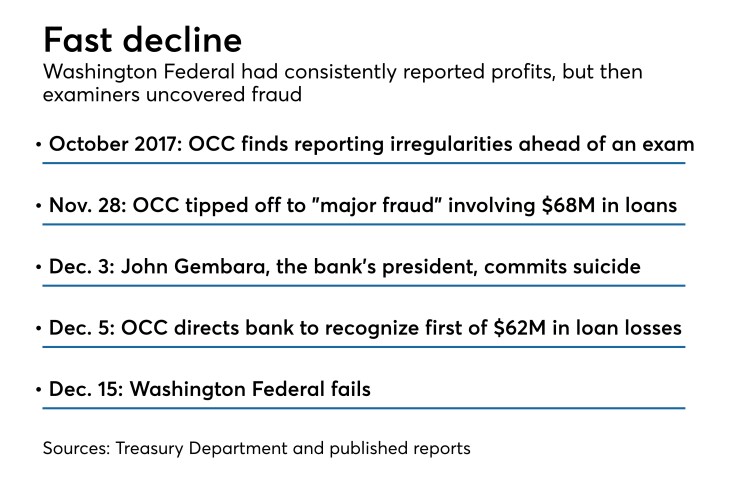

Washington Federal Bank for Savings was closed when the Office of the Comptroller of the Currency determined that it was insolvent and had at least $66 million in nonperforming loans.

The Federal Deposit Insurance Corp.

Regulators intervened less than two weeks after John Gembara, the thrift’s chairman, president and CEO, was found dead at another customer's home. The Cook County Medical Examiner’s office ruled the death a suicide.

A subsequent review by an internal government watchdog agency determined that supervisory lapses at the OCC made the failure’s costlier to the Deposit Insurance Fund than it should have been.

The Treasury Department’s Office of Inspector General determined in a material-loss review released in November 2018 that if had examiners acted in a timelier manner the fraud “may have been uncovered sooner and the loss to the DIF and individual account holders may have been reduced.”