-

Ordered by regulators to boost capital levels immediately, Frontier State Bank in Oklahoma City has sold a chunk of its securities portfolio, returning it to well capitalized status.

June 17 -

Hudson City Bancorp said it completed a "restructuring" of its balance sheet that reduced its high-cost borrowings and should allow for "increased future net interest income."

March 28 -

Two big questions face Hudson City Bancorp as it copes with a surprising wrist-slap from regulators: What will it cost to appease the OTS, and is its rich dividend threatened?

March 3 -

Republic Bancorp Inc. is fighting to keep a right that most other banks have surrendered. The Louisville, Ky., company is preparing to square off against the Federal Deposit Insurance Corp. over refund-anticipation loans, a product that regulators have pressured several other lenders to stop making because it is viewed as predatory.

February 15

Frontier State Bank's continuing legal battle with the Federal Deposit Insurance Corp. is gaining more attention from other revenue-starved banks.

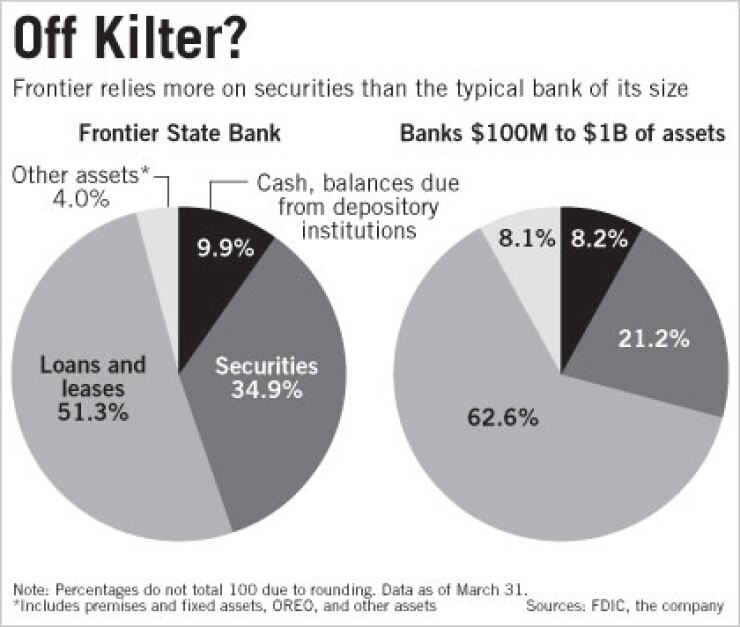

The Oklahoma City bank has spent seven years wrangling with the FDIC over a balance sheet strategy that uses short-term funds to buy long-term securities. Despite legal setbacks and receiving a final cease-and-desist order in April, Frontier continues to exhaust all legal options.

Frontier filed a motion Wednesday in the U.S. Court of Appeals for the 10th Circuit, hoping to delaying the order's June 12 deadline, seeking more time as it requests that the court appeal the order.

More banks are watching the case. Similar investment strategies are becoming a more attractive backup plan for bankers who need to boost the bottom line in an environment of lagging loan demand and depressed pricing.

"The secondary strategy is probably becoming somewhat more common because of the hunt for margin and spread," said Orlando Hanselman, the education programs director at Fiserv Inc. He said such backup plans seem inconsistent with the "charter business purpose of a financial institution — to meet the needs of the communities that they serve."

Since early 2009, the FDIC has made a final decision on six banks that went to a hearing. In nearly every case, the FDIC has historically won by a landslide.

"I don't think I've seen anybody come out of a regulatory action with complete exoneration," said a former federal regulator who asked not to be named. For regulators, "it's never an, 'Oh my gosh, we are completely wrong.' "

With the $517 million-asset Frontier, the FDIC gave it 30 days to overhaul its leverage strategy, restructure its balance sheet and raise capital to support its interest rate risk despite that it was well capitalized based on official standards. The final order requires a Tier 1 leverage ratio of 10%.

In comparison, Frontier had a 7% requirement when it received a memorandum of understanding in late 2004. At that time, Frontier's ratio topped 7% though nearly 87% of its $396 million of assets were in securities, mostly collateralized mortgage obligations issued by government agencies.

J.D. McKean Jr., Frontier's chairman, said in an email that the leverage strategy, discontinued in 2009, was consistent with safe and sound business practices and generated significant profits in "an extremely volatile interest rate period."

McKean said the legal fight would "remove the control of the decision from the FDIC and put it on a level field where objectivity is more likely to prevail."

An FDIC representative said the agency would not comment.

Regulators are tracking in leverage strategies, turning to enforcement actions tied to interest rate risk as credit issues subside.

Hanselman said the concern is that banks using such a strategy could falter if interest rates jumped sharply in a short time frame. "Banks should be testing their interest rate risk exposure for at least a 400-basis-point change."

Hudson City Bancorp Inc. in Paramus, N.J., restructured its balance sheet in March, resulting in about $644 million in net losses, after receiving an order from the Office of Thrift Supervision largely over concerns about its interest rate risk exposure. The $52.4 billion-asset company paid off $12.5 billion in certain borrowings it had funded by selling $8.7 billion in securities and $5 billion in short-term borrowings. The moves contributed to a first-quarter loss of $555.7 million.

Bank Mutual Corp. in Milwaukee had a loss of $76.4 million in the fourth quarter after repaying $756 million of Federal Home Loan Bank borrowings. The $2.5 billion-asset company ultimately benefited, reporting a first-quarter profit when the move helped reduce interest expense by 58% from a year earlier, to $7.2 million

The trend has been for banks to lower wholesale funding, mainly brokered deposits and FHLB advances. FHLB advances among FDIC-insured institutions fell 7.4% in the first quarter from a year earlier, an FDIC report said.

Hanselman said such moves make sense. "When interest rates rise, the short-term funding will reprice much more quickly than" longer-term assets, he said. "Then the … margin will continue to deteriorate and, in the worst case, it may actually turn negative."

Frontier said in its motion that it is trying to comply. Its leverage ratio was 10.5% at March 31, compared with 8.6% a year earlier. Securities made up 35% of total assets at March 31, compared with 45% a year earlier.

McKean said Frontier changed its course due to the low interest rate environment, deciding to let existing securities roll off.

Frontier's concern, the motion said, is the costs it would incur from taking "drastic and harmful actions" to meet the FDIC's demands. The bank said it would incur "millions of dollars in penalties" to liquidate certain liabilities.

Of the banks that have restructured their balance sheets, it comes at a significant cost in the short term. And the extra attention from regulators should be expected.

"Once a bank's model starts to look more like a hedge fund than a bank — whenever bankers cross over that area of its leverage strategy, it runs the risk" of regulatory scrutiny, the former regulator said. "Regulators don't deal well with those kind of principles creeping into the industry."