The German challenger bank N26 said Thursday that it has raised $300 million in new funding, pushing its total valuation to $2.7 billion and providing ample backing for its U.S. expansion plans.

“We’re going to use the funds for international expansion in general, but the U.S. is the first market we’re targeting for release in the first half of this year,” said N26's U.S. CEO, Nicolas Kopp, who is in charge of building a mobile banking operation based in New York. The U.S. unit of the Berlin company will invest its share of the proceeds in hiring, technological infrastructure, marketing and planning tied to the rollout, Kopp said.

The Series D round was led by the New York venture capital and private-equity firm Insight Venture Partners, with participation from GIC, Singapore’s sovereign wealth fund, and several existing investors. All told, N26 has raised more than $500 million from investors including Tencent, Allianz X, Peter Thiel’s Valar Ventures, Li Ka-Shing’s Horizons Ventures, Earlybird Venture Capital, Redalpine Ventures and Greyhound Capital.

N26 is a mobile-only challenger bank, like Revolut, Starling, Atom, and Monzo in Europe and like Chime, MoneyLion and Varo Money in the U.S. N26 operates in 24 markets across Europe and says it has more than 2.3 million customers. It aims to reach 100 million customers globally.

Slow U.S. start

Kopp has been building a U.S. version of N26 customized to an American audience for the past year.

The U.S. launch was originally planned for last summer. According to Kopp, there was no one specific setback, but a few factors came together to cause the delay.

“This is a new market for us, a new regulatory environment, a different type of customer,” he said. “Also from the hiring side, we had to build out a new team in a new market. We didn’t budget enough time for the unknown unknowns.”

[Be sure to check out our

The company is still hiring for engineering, product marketing, compliance, legal and other jobs. “Any function you can think of that would exist in a normal bank will exist in our special bank,” Kopp said.

The U.S. unit, which now has 30 people, has moved its New York office three times in the past year because it keeps outgrowing its space.

One crucial element to N26’s U.S. launch is in place: It has a U.S. bank partner with which it has signed an agreement with but can’t name it yet, Kopp says.

N26 has been speaking with U.S. regulators, primarily through its bank partner, and making “minor tweaks” to its product to be fully compliant with U.S. laws, he said.

“That’s adding to our timeline,” Kopp said.

Universal brand, local tweaks

The U.S. version will be roughly similar to N26's product in Europe, Kopp said.

“We’re ... tweaking that slightly for the U.S. market, especially around regulation,” he said. “As we build out our solution here and get market feedback, we’ll customize certain things further to the U.S. market and add new products that may not exist in the EU,” he said.

But overall, N26 wants to be a global bank with a somewhat consistent brand and product line in each country.

“We think some of the underserved banking needs are globally relevant around fee structures and a lack of fully tech-forward, mobile-first, intuitive solutions,” Kopp said. “So some of these pain points we’re solving are more of a global, generational topic rather than country-specific topic.”

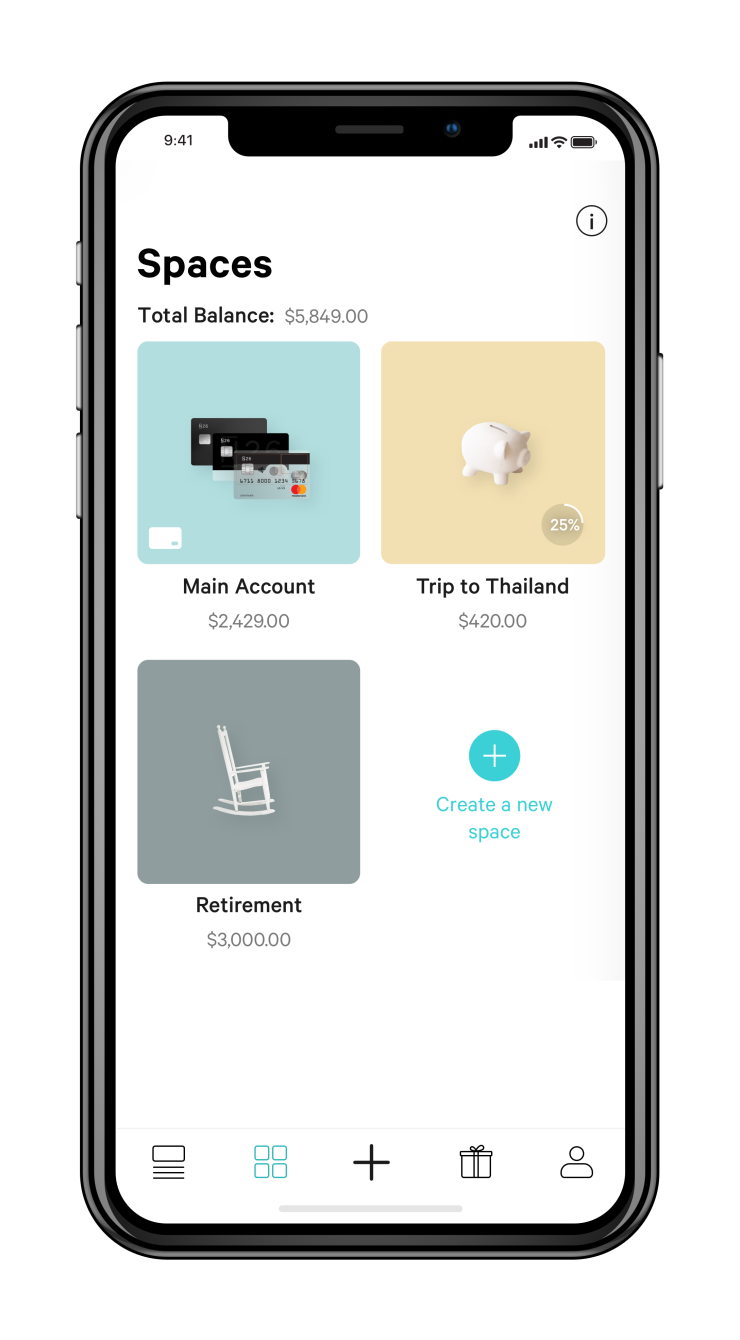

One product N26 introduced in Europe last year that it plans to offer in the U.S. is called Spaces. It lets customers create savings goals by dragging and dropping money on their screen.

“Savings is still a big topic for us at N26, and it will be relevant to U.S. consumers when we launch,” Kopp said.

One thing that has changed since Kopp came to the U.S. a year ago is that challenger bank competition has proliferated. MoneyLion, for instance, has more than 3 million users. Chime has more than 2 million.

The competition helps in the sense that it draws more attention to all the players, he said.

“There’s a bit more activity in the space in the U.S. and also more focus in the U.S. on tech from journalists, which I think is exciting because it gives more life into the neobank, challenger bank industry,” Kopp said. “That spotlight is moving to us, and you can sense that in the market, that people are really curious about us.”

With more than 325 million people in the country, there is room for another rival.

“There is still plenty of white space in the U.S. for a digital-only bank,” said Emmett Higdon, director of digital banking at Javelin Strategy & Research.

Editor at Large Penny Crosman welcomes feedback at