WASHINGTON — A draft report from the Government Accountability Office could deal a death blow to industry efforts to pass legislation that would ease currency transaction report filing requirements.

The report, obtained by American Banker and expected to be released this month, says that law enforcement agencies find CTRs very useful, and bankers are unable to prove the cost of filing them is unnecessarily high.

"According to federal, state, and local law enforcement officials, CTRs provide unique and reliable information essential to a variety of efforts, and recent advances in technology have enhanced their ability to use CTR data by integrating it with other information," the report said. "In addition to supporting specific investigations, CTR requirements aid law enforcement by forcing criminals — who attempt to avoid reporting transactions — to act in ways that increase their chances of detection through other methods."

The GAO did agree with bankers that the Financial Crimes Enforcement Network does a poor job of providing feedback to the industry on the usefulness of CTRs. It also cited several deterrences to institutions' use of existing CTR exemptions and recommended ways to encourage institutions to use them more often.

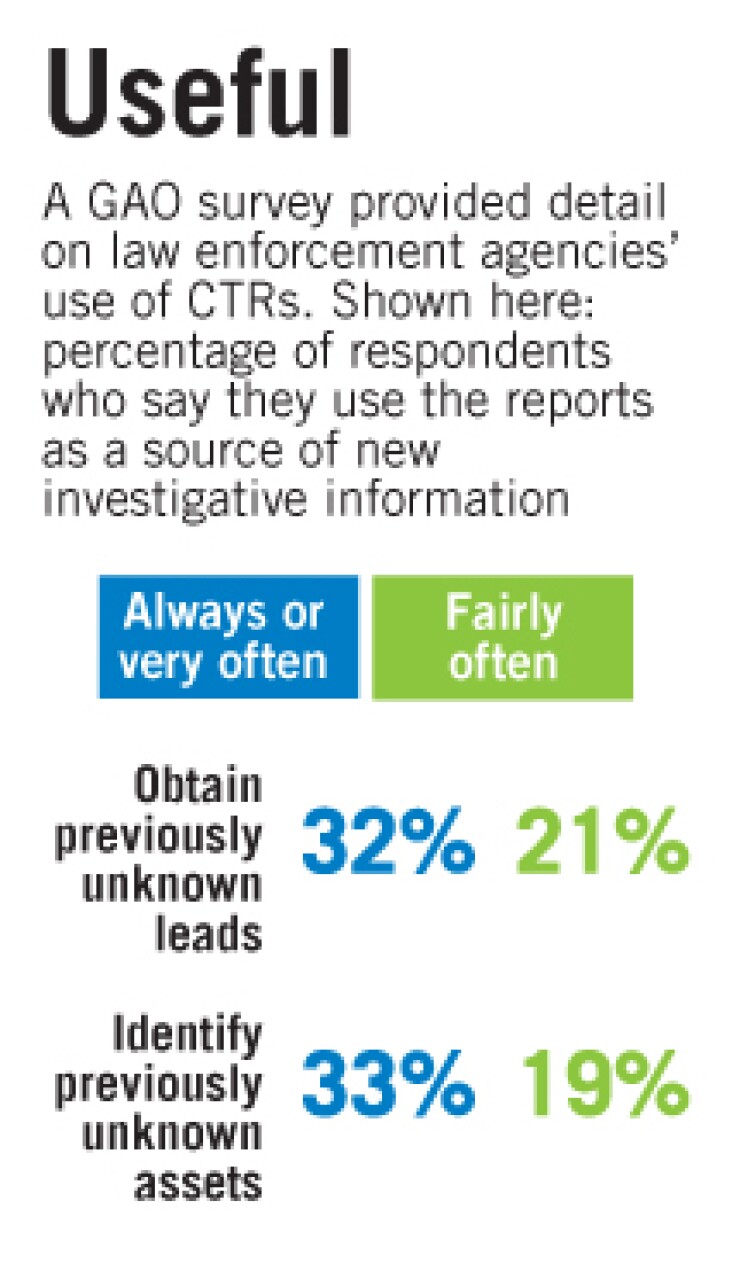

Overall, however, the report undermined what has been the industry's argument for two decades: that most CTRs go unused by law enforcement agencies and are an excessive burden to financial institutions.

The report said CTR data is helpful to investigate a variety of crimes, including terror financing, tax evasion, customs violations, and drug trafficking. The filings are useful both reactively to support investigations and proactively to analyze patterns to initiate investigations, the report said.

Law enforcement agencies provided the GAO with plenty of numbers to make its case. In 2006 more than 1.6 million CTRs were viewed by law enforcement agencies, most often by the Internal Revenue Service.

According to officials with the Federal Bureau of Investigation, about 40% of all FBI terrorism subjects appeared on CTRs that were filed between January 2000 and June 30, 2006, the report said. The FBI also said Fincen had identified more than 14,000 CTRs related to an investigation on the funding of al-Quaida.

More than 60% of state and local agencies the GAO interviewed said the reports were "extremely useful" for criminal investigations of money laundering, fraud, organized crime, drugs, tax investigations, counterintelligence against international terrorism, and indictments and prosecutions. Fifty-eight percent of state and local officials surveyed said that increasing the CTR threshold would result in a very great or great reduction in the usefulness of the CTR filing for their work.

Bankers, meanwhile, failed to prove that CTR filing was overly burdensome, the report said.

"Institutions we contacted were generally unable to qualify their costs for meeting CTR requirements, in large part because they used the same processes and staff for meeting other [Bank Secrecy Act] requirements or for other purposes. While we asked institutions we spoke with to provide estimates of costs based on categories such as personnel, training, and technology, not all institutions were able to do so because they do not typically account for CTR costs in this way."

The report also found that technology and automated processes had lessened the burden of filing CTRs. The report said that 78% of institutions responding to the survey had at least one part of their CTR filing process mostly or fully automated. Bankers put the cost of automated filing technology at $30,000 to $70,000, though they noted those systems are also used for other processes. Depository institutions said the CTR filing process was not complex; half of those surveyed described the process as very or somewhat simple for their institution to complete.

Still, the GAO noted that no institution reported a completely automated CTR process and said there were at least some costs associated with the process regardless of the number of filings.

Currency transaction reports were also largely concentrated at large banks, the GAO said. It found that less than 30 very large banks accounted for more than half of all new CTR filings between 2004 and 2006. Banks with assets between $1 billion and $50 billion accounted for 31%, the GAO said.

The single largest filer, Bank of America Corp., accounted for 1.7 million CTRs, or 14% of the total, in 2006.

When the GAO report was originally required by the regulatory relief bill passed in 2006, many bankers had hoped it would help build momentum for a bill that would let banks stop filing such reports for well-known business customers. Bankers have also backed a separate bill that would triple the threshold for CTR filing to $30,000.

Though the GAO declined to take a position on legislation to create a seasoned business customer exemption, which the House approved last year, it advocated leaving the current threshold for CTR filing at $10,000. It cited an argument from law enforcement agencies that large cash transactions have become more uncommon as consumers have more access to credit and electronic payment options.

The GAO report "probably means we'll stick with the status quo," said Rob Rowe, a regulatory counsel with the Independent Community Bankers of America. "It sounds like from what the GAO is coming out with, nothing is going to change."

The report did criticize Fincen for not providing enough feedback on the use of CTRs and recommended the agency routinely publish summary information on law enforcement uses of CTRs.

The GAO also recommended some changes to CTR exemption rules, which they said were too difficult to understand.

The BSA allows bankers to file an exemption for certain customers, including government agencies, public companies, certain nonpublic businesses, and payroll customers. But bankers have been reluctant to file exemptions. They cite the costs and effort involved in filing an exemption and uncertainty about qualifications for exemptions. Between 2004 and 2006, institutions filed 70,800 CTR exemptions.

To increase the number of exemptions, the GAO recommended clearer guidance from Fincen on acceptable documentation to prove a business qualifies for an exemption and urged the agency to eliminate the currently required biannual renewal of certain exemptions.

The report also said Fincen should eliminate the requirement to file a form for certain customers already mandated by law for an exemption, and suggested shortening the time period from a year for exemptions to certain businesses.