GreenSky, a digital consumer lender that went public just 15 months ago, announced Tuesday that its board is exploring the possibility of a sale.

David Zalik, the company’s chairman and CEO, indicated that the decision reflects a belief that GreenSky’s current market value is lower than it should be. He and other executives did not establish a timetable for the completion of the board’s review.

“The decision to explore the strategic alternatives was one that the board felt was timely and appropriate for the benefit of all shareholders,” Chief Administrative Officer and Vice Chairman Gerald Benjamin said during the company’s earnings call.

When Atlanta-based GreenSky went public in May 2018, its shares were priced at $23. They opened trading on Tuesday at $10.38 and then 34.3% to close at $6.81.

GreenSky’s quarterly earnings report on Tuesday was disappointing to investors, and the company also suspended its financial guidance, both of which may have contributed to Tuesday’s sell-off.

The review by GreenSky’s board could end with either the company’s purchase by a strategic buyer or the public shares being sold to a private equity firm, said Christopher Donat, an analyst at Sandler O’Neill.

GreenSky extends credit to consumers through partnerships with home improvement contractors, health care providers and other merchants. GreenSky doesn't make the loans directly, instead providing the technology for merchants to offer loans at the point of sale to consumers and relying on its partner banks to ultimately fund the loans. GreenSky earns money from transaction fees and from servicing the loans.

Donat mentioned Goldman Sachs and Square as potential buyers of GreenSky, which had a market capitalization of around $1.3 billion on Tuesday.

Goldman has been expanding its nascent consumer banking business, and the Wall Street bank could use its deposit franchise to fund GreenSky loans.

Square currently offers small-business loans to merchants that use its payment processing services.

“Square has talked about doing more on the lending side,” Donat noted.

A Goldman spokesman declined to comment. Square did not immediately respond to a request for comment.

GreenSky’s decision to explore a potential sale is the latest reflection of diminishing expectations in the online lending sector.

LendingClub, a digital consumer lender that held an initial public offering in December 2014, was trading Tuesday at around 17% of its IPO price. So was OnDeck Capital, an online business lender that went public at around the same time.

In another announcement Tuesday, GreenSky said that it is considering changes to how its loans get funded. The firm has traditionally relied on banks, including SunTrust Banks and Synovus, to fund its loans, but concerns have arisen about the durability of GreenSky’s bank-centric funding model since

GreenSky said Tuesday that it has been exploring the merits of entering into partnerships with insurance companies, asset managers or pension plans.

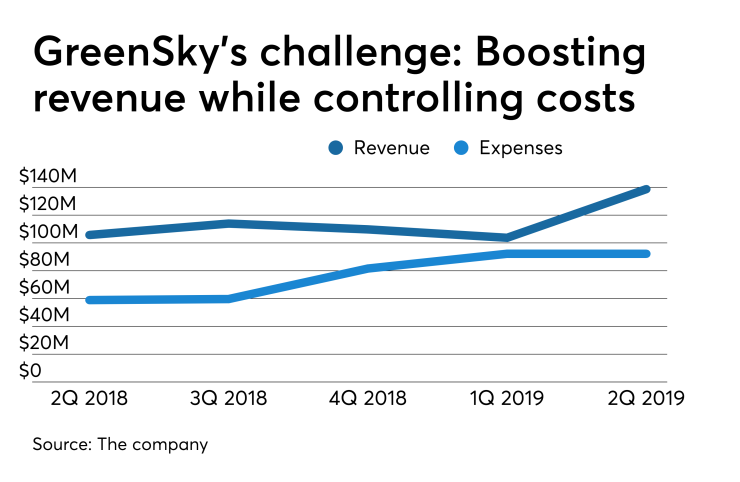

During the second quarter, GreenSky reported net income of $39.2 million, which was down slightly from $40.8 million in the same period a year earlier. A 31% increase in revenue was offset by higher costs and expenses.

Zalik said during the company’s earnings call Tuesday that the decision to suspend its financial guidance was driven by the evaluation of strategic alternatives and the potential changes to the company’s funding model.

GreenSky had previously said that it expected revenue growth of 30% to 38% for the current fiscal year.